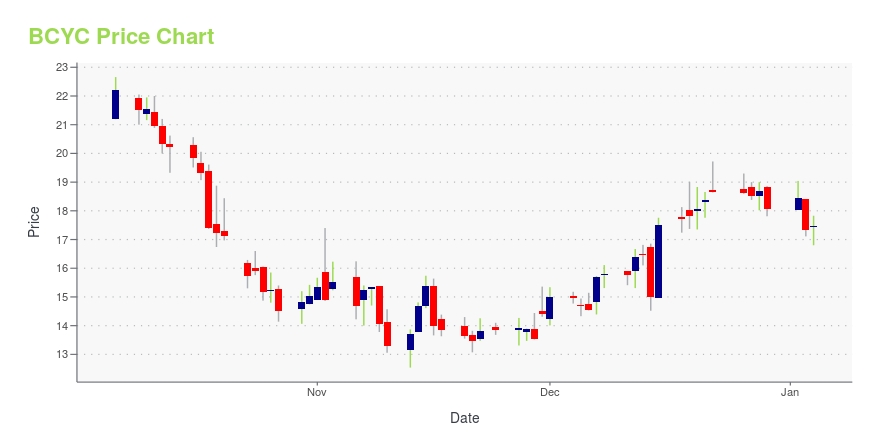

Bicycle Therapeutics plc (BCYC): Price and Financial Metrics

BCYC Price/Volume Stats

| Current price | $22.57 | 52-week high | $28.91 |

| Prev. close | $23.45 | 52-week low | $12.54 |

| Day low | $22.48 | Volume | 395,100 |

| Day high | $23.65 | Avg. volume | 382,764 |

| 50-day MA | $23.65 | Dividend yield | N/A |

| 200-day MA | $20.35 | Market Cap | 678.07M |

BCYC Stock Price Chart Interactive Chart >

Bicycle Therapeutics plc (BCYC) Company Bio

Bicycle Therapeutics Plc is a holding company, which engages in the development of biopharmaceuticals. It focuses on developing a novel class of medicines, which the company refers to as bicycles, for diseases that are underserved by existing therapeutics. The firm utilizes its novel and proprietary phage display screening platform to identify bicycles. Its portfolio includes internal product candidates that are directed to oncology applications. The company was founded by Gregory Winter, John Tite, and Christian Heinis in 2009 and is headquartered in Cambridge, the United Kingdom.

Latest BCYC News From Around the Web

Below are the latest news stories about BICYCLE THERAPEUTICS PLC that investors may wish to consider to help them evaluate BCYC as an investment opportunity.

Bicycle Therapeutics Provides Data Updates for Three Clinical Programs and Strategy Overview at First R&D DayCAMBRIDGE, England & BOSTON, December 14, 2023--Bicycle Therapeutics (Nasdaq: BCYC), a biotechnology company pioneering a new and differentiated class of therapeutics based on its proprietary bicyclic peptide (Bicycle®) technology, is today hosting a Research & Development (R&D) Day for investors and analysts in New York to provide clinical updates for BT8009, BT7480 and BT5528, and an overview of the company’s strategy and pipeline opportunities. The company will also highlight the broad capabi |

Bicycle Therapeutics to Host R&D Day on December 14CAMBRIDGE, England & BOSTON, November 30, 2023--Bicycle Therapeutics plc (NASDAQ:BCYC), a biotechnology company pioneering a new and differentiated class of therapeutics based on its proprietary bicyclic peptide (Bicycle®) technology, today announced that the company will host its first Research and Development (R&D) Day on Thursday, December 14. The event will take place in New York City from 8 a.m. to 12 p.m. Eastern Time and will be simultaneously webcast. |

Bicycle Therapeutics plc (NASDAQ:BCYC) Analysts Just Trimmed Their Revenue Forecasts By 13%One thing we could say about the analysts on Bicycle Therapeutics plc ( NASDAQ:BCYC ) - they aren't optimistic, having... |

Bicycle Therapeutics PLC (BCYC) Reports Q3 2023 Financial Results and Upcoming R&D DayCompany's cash and cash equivalents stand at $572.1 million as of September 30, 2023 |

Bicycle Therapeutics Reports Recent Business Progress and Third Quarter 2023 Financial Results and Announces Upcoming R&D DayCAMBRIDGE, England & BOSTON, November 02, 2023--Bicycle Therapeutics plc (NASDAQ: BCYC), a biotechnology company pioneering a new and differentiated class of therapeutics based on its proprietary bicyclic peptide (Bicycle®) technology, today reported financial results for the third quarter ended September 30, 2023, and provided recent corporate updates. |

BCYC Price Returns

| 1-mo | -11.46% |

| 3-mo | 28.97% |

| 6-mo | 48.00% |

| 1-year | 11.79% |

| 3-year | -27.15% |

| 5-year | N/A |

| YTD | 24.83% |

| 2023 | -38.92% |

| 2022 | -51.37% |

| 2021 | 239.11% |

| 2020 | 90.35% |

| 2019 | N/A |

Loading social stream, please wait...