Berkeley Lights Inc. (BLI): Price and Financial Metrics

BLI Price/Volume Stats

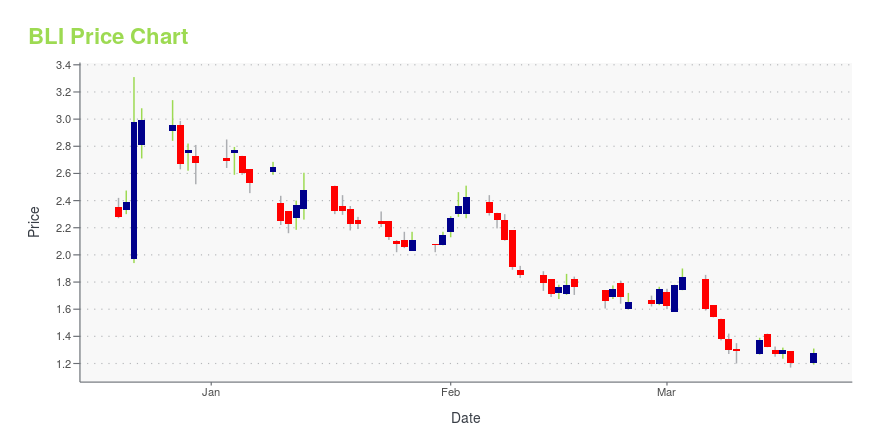

| Current price | $1.20 | 52-week high | $7.79 |

| Prev. close | $1.28 | 52-week low | $1.14 |

| Day low | $1.14 | Volume | 2,289,600 |

| Day high | $1.30 | Avg. volume | 845,024 |

| 50-day MA | $1.87 | Dividend yield | N/A |

| 200-day MA | $3.18 | Market Cap | 86.61M |

BLI Stock Price Chart Interactive Chart >

Berkeley Lights Inc. (BLI) Company Bio

Berkeley Lights, Inc. develops and commercializes platforms for the acceleration of discovery, development, and delivery of cell-based products and therapies. Its platforms automate the manipulation, analysis, and selection of individual cells, creating scalability and deep cell insights. The company was founded by Igor Y. Khandros, William H. Davidow, Michael E. Marks, and Ming C. Wu on April 5, 2011 and is headquartered in Emeryville, CA.

Latest BLI News From Around the Web

Below are the latest news stories about BERKELEY LIGHTS INC that investors may wish to consider to help them evaluate BLI as an investment opportunity.

Berkeley Lights Full Year 2022 Earnings: Misses ExpectationsBerkeley Lights ( NASDAQ:BLI ) Full Year 2022 Results Key Financial Results Revenue: US$78.6m (down 8.0% from FY 2021... |

Q4 2022 Berkeley Lights Inc Earnings CallQ4 2022 Berkeley Lights Inc Earnings Call |

Berkeley Lights Reports Fourth Quarter and Full Year 2022 Financial ResultsBerkeley Lights, Inc. (Nasdaq: BLI), a life sciences tools company, today reported financial results for the fourth quarter and full year ended December 31, 2022. |

Berkeley Lights to Report Fourth Quarter and Full Year 2022 Financial Results on February 23, 2023Berkeley Lights, Inc. (Nasdaq: BLI), a life sciences tools company, today announced that the Company will be reporting financial results for the fourth quarter and full year 2022 after market on Thursday, February 23, 2023. Company management will be webcasting a corresponding conference call beginning at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time. |

15 Worst Stock Picks of Cathie Wood in 2022In this piece, we will take a look at the 15 worst stock picks of Cathie Wood in 2022. For her top five worst stock picks, head on over to 5 Worst Stock Picks of Cathie Wood in 2022. Cathie Wood is one of the more popular hedge fund investors when it comes to the […] |

BLI Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -97.74% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -85.26% |

| 2021 | -79.67% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...