CalAmp Corp. (CAMP): Price and Financial Metrics

CAMP Price/Volume Stats

| Current price | $3.33 | 52-week high | $68.54 |

| Prev. close | $3.37 | 52-week low | $2.29 |

| Day low | $3.18 | Volume | 9,800 |

| Day high | $3.37 | Avg. volume | 122,117 |

| 50-day MA | $3.04 | Dividend yield | N/A |

| 200-day MA | $8.30 | Market Cap | 5.50M |

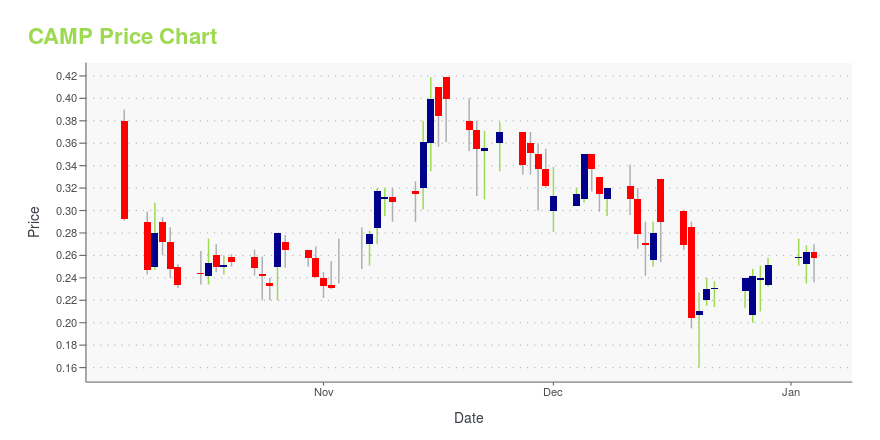

CAMP Stock Price Chart Interactive Chart >

CalAmp Corp. (CAMP) Company Bio

Calamp Corporation provides wireless communications solutions for various applications worldwide. It operates in two segments, Wireless DataCom and Satellite. The company was founded in 1981 and is based in Oxnard, California.

Latest CAMP News From Around the Web

Below are the latest news stories about CALAMP CORP that investors may wish to consider to help them evaluate CAMP as an investment opportunity.

CalAmp Announces Date for Fiscal 2024 Third Quarter Earnings Conference CallIRVINE, Calif., Dec. 26, 2023 (GLOBE NEWSWIRE) -- CalAmp (Nasdaq: CAMP), a leading telematics solution provider that helps organizations improve operational performance, today announced that it will release its fiscal 2024 third quarter financial results after market close on Tuesday, January 9, 2024. In addition, the Company will host a conference call at 5:00 p.m. Eastern (2:00 p.m. Pacific) on January 9, 2024, to discuss its financial results. The call may be accessed via webcast by visiting |

CalAmp Announces Completion of Strategic Financing with Lynrock LakeThe company reports closing a $45 million term loan in support of its business transformationIRVINE, Calif., Dec. 18, 2023 (GLOBE NEWSWIRE) -- CalAmp (Nasdaq: CAMP), a connected intelligence company helping people and organizations improve operational performance with telematics solutions, today announced the closing of a $45 million strategic financing with Lynrock Lake Master Fund LP (“Lynrock”) in the form of a term loan maturing in November 2027. Lynrock is an existing holder of a large majo |

Should You Exit CalAmp Corp. (CAMP)?Aristotle Capital Boston, LLC, an investment advisor, released its “Small Cap Equity Strategy” third quarter 2023 investor letter. A copy of the same can be downloaded here. In the third quarter, the fund delivered a return of -5.77% net of fees (-5.57% gross of fees), trailing the Russell 2000 Index’s -5.13% total return. Both security selection and […] |

CalAmp Reports Inducement Awards Under Nasdaq Listing Rule 5635(c)(4)IRVINE, Calif., Oct. 06, 2023 (GLOBE NEWSWIRE) -- CalAmp (Nasdaq: CAMP), a connected intelligence company helping people and organizations improve operational performance with a data-driven solutions ecosystem, today announced that on October 5, 2023, the Human Capital Committee of CalAmp’s Board of Directors granted inducement restricted stock unit awards covering 252,240 shares of CalAmp common stock to four new non-executive employees. The awards were granted under CalAmp’s 2023 Employment In |

CalAmp Corp. (NASDAQ:CAMP) Q2 2024 Earnings Call TranscriptCalAmp Corp. (NASDAQ:CAMP) Q2 2024 Earnings Call Transcript October 5, 2023 CalAmp Corp. misses on earnings expectations. Reported EPS is $-0.01 EPS, expectations were $0.02. Operator: Welcome to CalAmp’s Second Quarter 2024 Financial Results Conference Call. My name is Cole, and I’ll be the moderator for today’s call. All lines will be muted during the […] |

CAMP Price Returns

| 1-mo | 5.71% |

| 3-mo | -20.54% |

| 6-mo | -45.26% |

| 1-year | -93.65% |

| 3-year | -98.92% |

| 5-year | -98.93% |

| YTD | -42.32% |

| 2023 | -94.40% |

| 2022 | -36.54% |

| 2021 | -28.83% |

| 2020 | 3.55% |

| 2019 | -26.36% |

Continue Researching CAMP

Here are a few links from around the web to help you further your research on CalAmp Corp's stock as an investment opportunity:CalAmp Corp (CAMP) Stock Price | Nasdaq

CalAmp Corp (CAMP) Stock Quote, History and News - Yahoo Finance

CalAmp Corp (CAMP) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...