Can-Fite Biopharma Ltd Sponsored ADR (Israel) (CANF): Price and Financial Metrics

CANF Price/Volume Stats

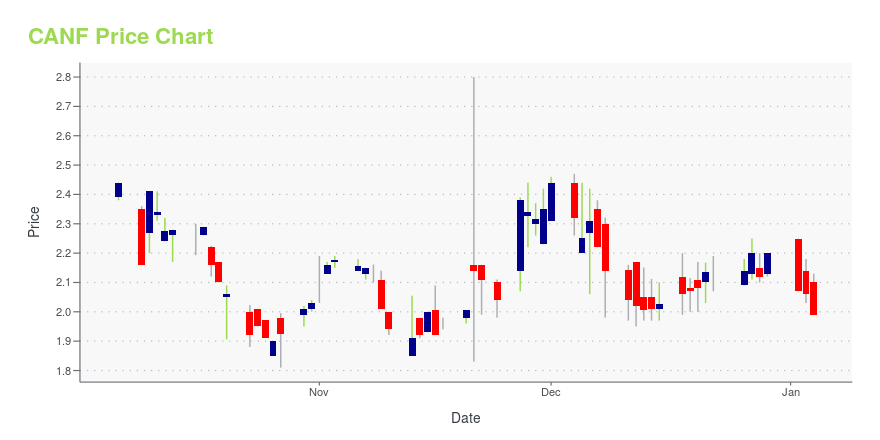

| Current price | $1.98 | 52-week high | $3.33 |

| Prev. close | $1.97 | 52-week low | $1.66 |

| Day low | $1.96 | Volume | 7,817 |

| Day high | $2.07 | Avg. volume | 19,783 |

| 50-day MA | $2.15 | Dividend yield | N/A |

| 200-day MA | $2.34 | Market Cap | 7.01M |

CANF Stock Price Chart Interactive Chart >

Can-Fite Biopharma Ltd Sponsored ADR (Israel) (CANF) Company Bio

Can-Fite BioPharma Ltd., a clinical-stage biopharmaceutical company, develops small molecule therapeutic products for the treatment of cancer, liver and inflammatory disease, and sexual dysfunction. The company's lead drug candidate CF101 (Piclidenoson), which is in Phase III clinical trial for the treatment of rheumatoid arthritis and psoriasis. It also develops CF102 (Namodenoson) that is completed Phase II clinical trial for the treatment of hepatocellular carcinoma, as well as in Phase II trial for the treatment of non-alcoholic steatohepatitis; and CF602, which is in pre-clinical trial for the treatment of erectile dysfunction. Can-Fite BioPharma Ltd. has collaboration agreement with CMS Medical to develop, manufacture, and commercialize Piclidenoson and Namodenoson; and Univo Pharmaceuticals to identify and co-develop specific formulations of cannabis components for the treatment of cancer, inflammatory, autoimmune, and metabolic diseases. The company was formerly known as Can-Fite Technologies Ltd. and changed its name to Can-Fite BioPharma Ltd. in January 2001. Can-Fite BioPharma Ltd. was founded in 1994 and is headquartered in Petah-Tikva, Israel.

Latest CANF News From Around the Web

Below are the latest news stories about CAN-FITE BIOPHARMA LTD that investors may wish to consider to help them evaluate CANF as an investment opportunity.

The Anti-Obesity Effect of Can-Fite’s Namodenoson: Molecular Mechanism of Action in Pre-clinical and Human StudiesPETACH TIKVA, Israel, December 20, 2023--Can-Fite BioPharma Ltd. (NYSE American: CANF) (TASE: CANF), a biotechnology company advancing a pipeline of proprietary small molecule drugs that address oncological and inflammatory diseases, today reported new data on Namodenoson’s anti-obesity mechanism of action. |

Can-Fite Received FDA Positive Response to Psoriasis Pediatric PlanPETACH TIKVA, Israel, December 18, 2023--Can-Fite Received FDA Positive Response to Psoriasis Pediatric Plan |

Can-Fite’s Namodenoson for the Treatment of Pancreatic Cancer Patients: Progress in Clinical DevelopmentPETACH TIKVA, Israel, December 04, 2023--Can-Fite BioPharma Ltd. (NYSE American: CANF) (TASE: CANF), a biotechnology company advancing a pipeline of proprietary small molecule drugs that address oncological and inflammatory diseases, today announced that it completed the design of a Phase IIa study protocol for the treatment of patients with pancreatic cancer and plans to submit the protocol shortly to ethical committees for approval. |

Can-Fite Reports Third Quarter 2023 Financial Results and Clinical UpdatePETACH TIKVA, Israel, November 30, 2023--Can-Fite BioPharma Ltd. (NYSE American: CANF) (TASE: CANF), a biotechnology company advancing a pipeline of proprietary small molecule drugs that address oncological and inflammatory diseases, today announced financial results for the nine months ended September 30, 2023. |

Can-Fite (CANF) Up on Liver Cancer Study Update of NamodenosonCan-Fite (CANF) stock up 7% as the liver cancer patient achieves a complete response and overall survival of 6.9 years upon continued treatment with namodenoson in a phase II study. |

CANF Price Returns

| 1-mo | -11.21% |

| 3-mo | 2.59% |

| 6-mo | -3.88% |

| 1-year | 14.45% |

| 3-year | -90.92% |

| 5-year | -97.33% |

| YTD | -10.00% |

| 2023 | -64.11% |

| 2022 | -52.48% |

| 2021 | -27.53% |

| 2020 | -46.06% |

| 2019 | -82.54% |

Continue Researching CANF

Want to see what other sources are saying about Can-Fite BioPharma Ltd's financials and stock price? Try the links below:Can-Fite BioPharma Ltd (CANF) Stock Price | Nasdaq

Can-Fite BioPharma Ltd (CANF) Stock Quote, History and News - Yahoo Finance

Can-Fite BioPharma Ltd (CANF) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...