Carolina Trust BancShares, Inc. (CART): Price and Financial Metrics

CART Price/Volume Stats

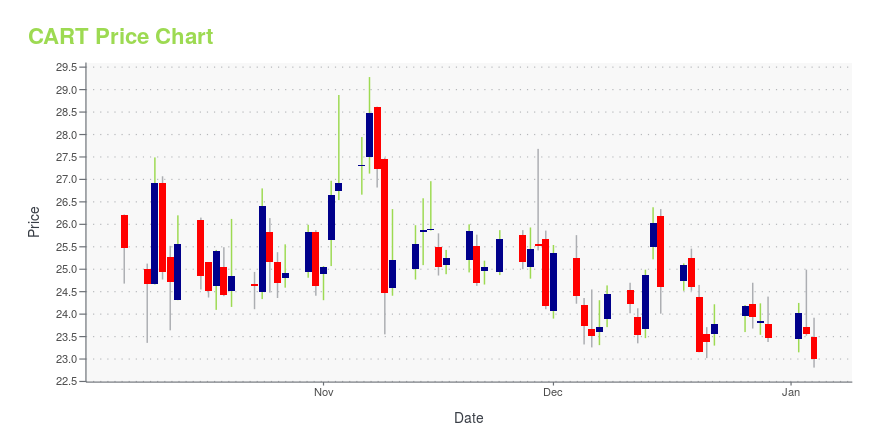

| Current price | $33.42 | 52-week high | $42.95 |

| Prev. close | $36.09 | 52-week low | $22.13 |

| Day low | $32.77 | Volume | 8,989,137 |

| Day high | $34.72 | Avg. volume | 4,092,923 |

| 50-day MA | $34.53 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | 8.89B |

CART Stock Price Chart Interactive Chart >

Latest CART News From Around the Web

Below are the latest news stories about INSTACART (MAPLEBEAR INC) that investors may wish to consider to help them evaluate CART as an investment opportunity.

3 Winning Tech Stocks for 2024 That Most Investors Won’t See ComingWith this rebounding economy, you need to buy these three top tech stocks to increase your portfolio's value in 2024. |

IPO market: Watch for Panera, Shein, Skims in 2024Arm (ARM), Cava (CAVA), Birkenstock (BIRK), and Instacart (CART) were among the companies that made their IPO debut in 2023. But these debuts did not bring about the market excitement many may have hoped for. As we move toward 2024, what should investors expect from the IPO market? Shein, Skims, and Panera Bread are some of the 2024 IPO contenders, according to Bloomberg. Yahoo Finance’s Brooke DiPalma discusses what we may see from the IPO market next year and how some of the 2023 debuts have performed so far. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live. |

Consumer brands headline 2024's IPO market, as investors remain value sensitiveSetting reasonable valuations will be key for successful 2024 retail IPOs. |

Fairway Market launches 30-minute delivery through InstacartCalled Fairway Now, the service is now available from two of the grocer’s Manhattan stores and will roll out to its remaining locations in the coming weeks. |

Fairway Market Launches 30-Minute Delivery Service Powered by InstacartInstacart (Nasdaq: CART), the leading grocery technology company in North America, and Fairway Market today announced the launch of "Fairway Now," a new fast home delivery service powered by Instacart that lets Fairway Market customers access last-minute groceries and household essentials in as fast as 30-minutes. The service is available today from the Chelsea and Upper East Side locations, and will be available from all four Fairway Market stores in Manhattan in the coming weeks. |

CART Price Returns

| 1-mo | -10.93% |

| 3-mo | 34.76% |

| 6-mo | 35.36% |

| 1-year | N/A |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 42.39% |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...