Carver Bancorp, Inc. (CARV): Price and Financial Metrics

CARV Price/Volume Stats

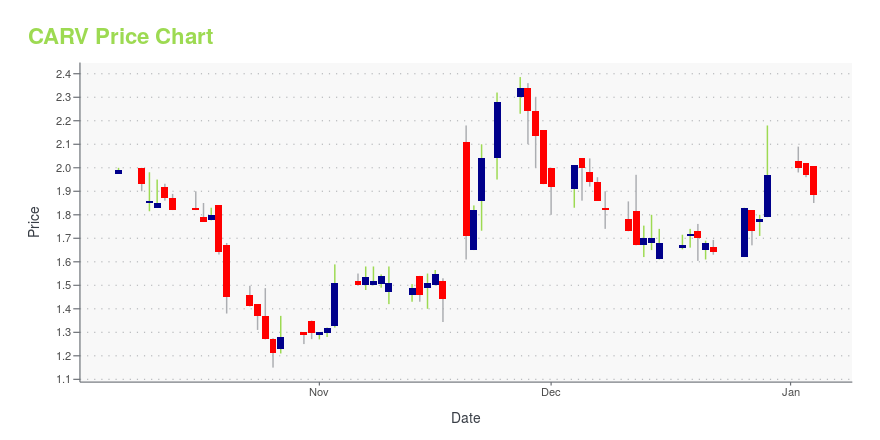

| Current price | $1.57 | 52-week high | $5.13 |

| Prev. close | $1.66 | 52-week low | $1.15 |

| Day low | $1.56 | Volume | 9,900 |

| Day high | $1.63 | Avg. volume | 22,891 |

| 50-day MA | $1.60 | Dividend yield | N/A |

| 200-day MA | $1.95 | Market Cap | 7.83M |

CARV Stock Price Chart Interactive Chart >

Carver Bancorp, Inc. (CARV) Company Bio

Carver Bancorp, Inc. operates as the holding company for Carver Federal Savings Bank, a federally chartered savings bank that provides consumer and commercial banking services for consumers, businesses, and governmental and quasi-governmental agencies primarily in New York. It accepts various deposit products, including demand, savings, and time deposits; passbook and statement accounts, and certificates of deposit; and individual retirement accounts. The company also provides lending products, such as one-to-four family residential, multifamily real estate, and commercial real estate; and construction, business and small business administration, and consumer and other loans. In addition, it offers other consumer and commercial banking products and services, including debit card, online account opening and banking, online bill pay, and telephone banking, as well as check cashing, wire transfer, bill payment, reloadable prepaid card, and money order services. The company operates through one administrative office, seven branches, and four ATM locations. Carver Bancorp, Inc. was founded in 1948 and is headquartered in New York, New York.

Latest CARV News From Around the Web

Below are the latest news stories about CARVER BANCORP INC that investors may wish to consider to help them evaluate CARV as an investment opportunity.

Carver Bancorp, Inc. Interim CEO Craig C. MacKay Comments on the Bank's Recent PerformanceCarver Bancorp, Inc. (Nasdaq: CARV), the holding company for Carver Federal Savings Bank, today released a letter from its Interim CEO Craig C. MacKay on the Bank's recent performance: |

Activist group boosts its offer to buy New York-based CarverDream Chasers upped its bid for Carver, one of the nation's largest and highest-profile Black banks, by a quarter, to $3.25 per share, dismissing the growth strategy interim CEO Craig MacKay outlined in a recent shareholder letter. |

Dream Chasers raises its offer to $3.25 per share for 35% of Nasdaq listed Carver Bancorp symbol: CARVDream Chasers Capital, Carver Bancorp's largest minority shareholder, encourage investors to call and email the bank to accept its improved $3.25 per share offer-an over 100% premium to the current stock price. |

Carver Bancorp, Inc. Interim CEO Craig C. MacKay Provides Strategic Update on the Bank's Progress and Impact on the Communities it ServesCarver Bancorp, Inc. (Nasdaq: CARV) ("Carver"), the holding company for Carver Federal Savings Bank (the "Bank") today released a letter to shareholders from its Interim CEO Craig C. MacKay that provides an update on the Bank's strategic progress and impact on the communities it serves. |

TruFund Financial Services, Inc. Secures Additional $11.5 Million in Capital to Bolster Historically Under-Resourced Affordable Housing DevelopersNEW YORK, September 29, 2023--TruFund Financial Services, Inc. is proud to announce the expansion of the Impact Developers Fund (IDF). The additional $11.5 million includes commitments from three new investors, in addition to increased commitments from the Ford Foundation and Tru-Capital Investment Fund, the general partner of the fund. This results in a >40% increase in the fund's size to a total of $37.5 million. |

CARV Price Returns

| 1-mo | -7.10% |

| 3-mo | -21.11% |

| 6-mo | 29.77% |

| 1-year | -67.29% |

| 3-year | -81.57% |

| 5-year | N/A |

| YTD | -20.30% |

| 2023 | -52.07% |

| 2022 | -51.87% |

| 2021 | 31.59% |

| 2020 | 166.97% |

| 2019 | -18.42% |

Continue Researching CARV

Here are a few links from around the web to help you further your research on Carver Bancorp Inc's stock as an investment opportunity:Carver Bancorp Inc (CARV) Stock Price | Nasdaq

Carver Bancorp Inc (CARV) Stock Quote, History and News - Yahoo Finance

Carver Bancorp Inc (CARV) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...