Capital Bancorp, Inc. (CBNK): Price and Financial Metrics

CBNK Price/Volume Stats

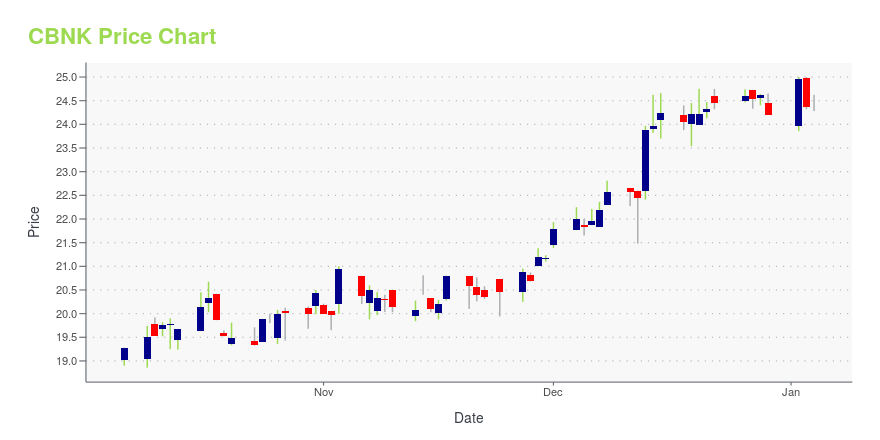

| Current price | $19.20 | 52-week high | $25.00 |

| Prev. close | $19.29 | 52-week low | $15.36 |

| Day low | $19.09 | Volume | 22,200 |

| Day high | $19.39 | Avg. volume | 21,580 |

| 50-day MA | $20.31 | Dividend yield | 1.64% |

| 200-day MA | $20.61 | Market Cap | 266.69M |

CBNK Stock Price Chart Interactive Chart >

Capital Bancorp, Inc. (CBNK) Company Bio

Capital Bancorp, Inc. operates as a bank holding company of Capital Bank N.A., which offers personal and commercial banking services. The company was formerly known as Hcnb Bancorp, Inc. and changed its name to Capital Bancorp, Inc. in May 2004. The company was founded in 1998 and is based in Rockville, Maryland.

Latest CBNK News From Around the Web

Below are the latest news stories about CAPITAL BANCORP INC that investors may wish to consider to help them evaluate CBNK as an investment opportunity.

Should Value Investors Buy Capital Bancorp (CBNK) Stock?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Do Options Traders Know Something About Capital Bancorp (CBNK) Stock We Don't?Investors need to pay close attention to Capital Bancorp (CBNK) stock based on the movements in the options market lately. |

Are Investors Undervaluing Capital Bancorp (CBNK) Right Now?Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks. |

Capital Bancorp, Inc. (NASDAQ:CBNK) boasts of bullish insider sentiment with 36% ownership and they have been buying latelyKey Insights Capital Bancorp's significant insider ownership suggests inherent interests in company's expansion The top... |

Earnings Estimates Moving Higher for Capital Bancorp (CBNK): Time to Buy?Capital Bancorp (CBNK) shares have started gaining and might continue moving higher in the near term, as indicated by solid earnings estimate revisions. |

CBNK Price Returns

| 1-mo | -6.07% |

| 3-mo | -15.53% |

| 6-mo | -0.65% |

| 1-year | 17.08% |

| 3-year | -4.66% |

| 5-year | 70.72% |

| YTD | -20.35% |

| 2023 | 4.31% |

| 2022 | -9.31% |

| 2021 | 88.84% |

| 2020 | -6.45% |

| 2019 | 30.50% |

CBNK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching CBNK

Here are a few links from around the web to help you further your research on Capital Bancorp Inc's stock as an investment opportunity:Capital Bancorp Inc (CBNK) Stock Price | Nasdaq

Capital Bancorp Inc (CBNK) Stock Quote, History and News - Yahoo Finance

Capital Bancorp Inc (CBNK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...