Codere Online Luxembourg, S.A. (CDRO): Price and Financial Metrics

CDRO Price/Volume Stats

| Current price | $6.94 | 52-week high | $8.09 |

| Prev. close | $6.85 | 52-week low | $2.15 |

| Day low | $6.76 | Volume | 19,200 |

| Day high | $7.18 | Avg. volume | 37,606 |

| 50-day MA | $6.69 | Dividend yield | N/A |

| 200-day MA | $4.11 | Market Cap | 314.37M |

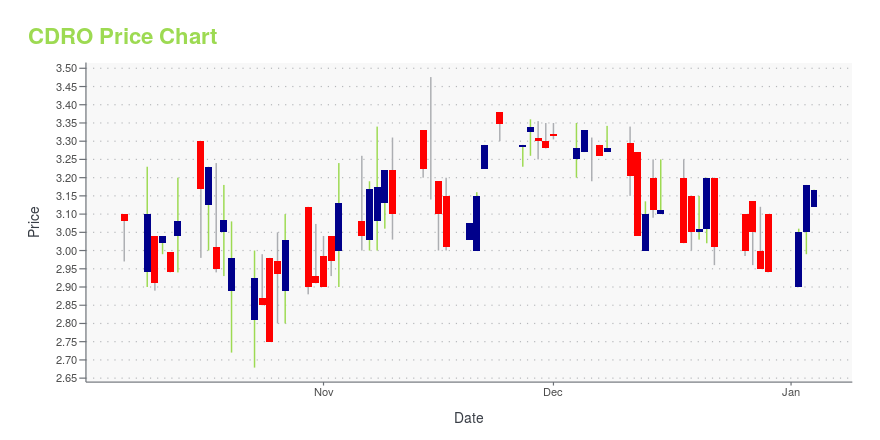

CDRO Stock Price Chart Interactive Chart >

Codere Online Luxembourg, S.A. (CDRO) Company Bio

Codere Online Luxembourg, S.A. operates as an online gaming and sports betting operator in Latin America. The company offers online sports betting and casino services through its website and a mobile application. It operates in Spain, Italy, Mexico, Colombia, and Panama. The company is based in Luxembourg, Luxembourg.

Latest CDRO News From Around the Web

Below are the latest news stories about CODERE ONLINE LUXEMBOURG SA that investors may wish to consider to help them evaluate CDRO as an investment opportunity.

Investors in Codere Online Luxembourg (NASDAQ:CDRO) have unfortunately lost 77% over the last yearEven the best investor on earth makes unsuccessful investments. But it should be a priority to avoid stomach churning... |

CDRO Price Returns

| 1-mo | -1.84% |

| 3-mo | 75.70% |

| 6-mo | 136.46% |

| 1-year | 191.60% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 136.05% |

| 2023 | 13.95% |

| 2022 | -57.14% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...