CNH Industrial N.V. (CNHI): Price and Financial Metrics

CNHI Price/Volume Stats

| Current price | $12.55 | 52-week high | $15.74 |

| Prev. close | $12.70 | 52-week low | $9.77 |

| Day low | $12.34 | Volume | 10,574,000 |

| Day high | $12.59 | Avg. volume | 11,896,763 |

| 50-day MA | $12.37 | Dividend yield | N/A |

| 200-day MA | $12.41 | Market Cap | 15.77B |

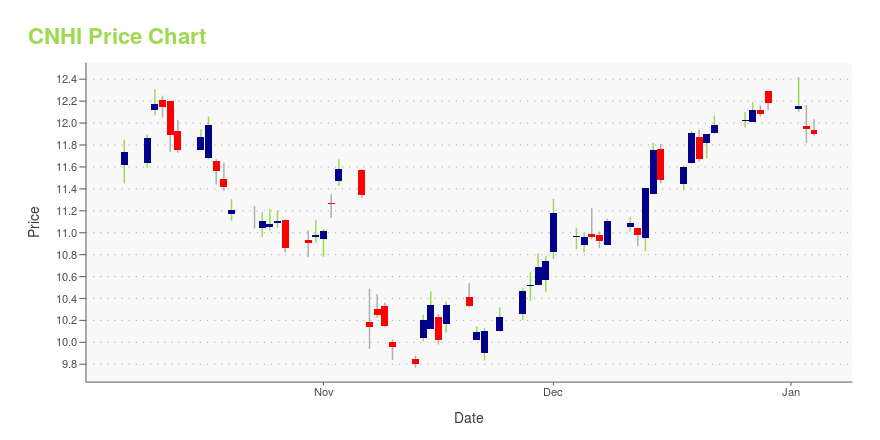

CNHI Stock Price Chart Interactive Chart >

CNH Industrial N.V. (CNHI) Company Bio

CNH Industrial N.V. is an Italian-American multinational corporation with global headquarters in Basildon, United Kingdom, but controlled and mostly owned by the multinational investment company Exor, which in turn is controlled by the Agnelli family. The company is listed on the New York Stock Exchange and on Borsa Italiana: it is a constituent of the FTSE MIB index. The company is incorporated in the Netherlands. The seat of the company is in Amsterdam, Netherlands, with a principal office in London, England.(Source:Wikipedia)

Latest CNHI News From Around the Web

Below are the latest news stories about CNH INDUSTRIAL NV that investors may wish to consider to help them evaluate CNHI as an investment opportunity.

13 Most Promising Low-Cost Stocks According to AnalystsIn this article, we will take a look at 13 most promising low-cost stocks according to analysts. To skip our analysis of the recent market activity, you can go directly to see the 5 Most Promising Low-Cost Stocks According to Analysts. For the purpose of this article, we have defined low-cost stocks as stocks that […] |

With State-of-the-Art Technology, CNH Bets on Technical EducationNORTHAMPTON, MA / ACCESSWIRE / December 21, 2023 / CNH announced its partnership with the Catholic University of Cordoba (UCC) to help educate Argentina's next generation of farmers. In Argentina, Technical Education Day was celebrated on November ... |

AE50 2024: CNH farming innovations awarded by the ASABECNH_AE50_Winners (3) CNH AE50 winners AE50 2024: CNH farming innovations awarded by the ASABE Basildon, December 21, 2023 Customer-inspired innovations from CNH’s global agriculture brands Case IH and New Holland have won six 2024 AE50 awards. These awards are determined by the American Society of Agricultural and Biological Engineers (ASABE). They honor the year’s 50 most innovative products and systems engineered for the food and agricultural industries. Winning Traits The Case IH Steiger 715 |

CNH Industrial: Periodic Report on $1 Billion Buyback ProgramCNH Industrial: Periodic Report on $1 Billion Buyback Program Basildon, December 20, 2023 CNH Industrial N.V. (NYSE: CNHI / MI: CNHI) announces that under the €400 million component (the “First Component”) of its $1 billion share buyback program the Company completed transactions in the period December 11, 2023 through December 15, 2023, reported in aggregate, as set forth in the table below. After the purchases announced today and considering those previously executed under the First Component, |

CNH introduces agriculture’s first accessible tractorAccessible Tractor Globenewswire image Farmer Fernando Dalmolin operating the accessible tractor mobile armchair device Our photo series looks at how our New Holland brand launched this world-first in Brazil. Basildon, December 20, 2023 CNH is committed to advancing the noble work of farming and prioritizes customer-inspired innovation to ensure we deliver solutions that meet the needs of ALL hardworking growers and builders. This includes serving customers who are living with disabilities. Our |

CNHI Price Returns

| 1-mo | 1.54% |

| 3-mo | 8.47% |

| 6-mo | 11.95% |

| 1-year | -15.03% |

| 3-year | -21.42% |

| 5-year | 11.75% |

| YTD | 3.04% |

| 2023 | -24.16% |

| 2022 | -17.34% |

| 2021 | 51.32% |

| 2020 | 16.73% |

| 2019 | 19.44% |

Continue Researching CNHI

Here are a few links from around the web to help you further your research on CNH Industrial NV's stock as an investment opportunity:CNH Industrial NV (CNHI) Stock Price | Nasdaq

CNH Industrial NV (CNHI) Stock Quote, History and News - Yahoo Finance

CNH Industrial NV (CNHI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...