Pop Culture Group Co., Ltd (CPOP): Price and Financial Metrics

CPOP Price/Volume Stats

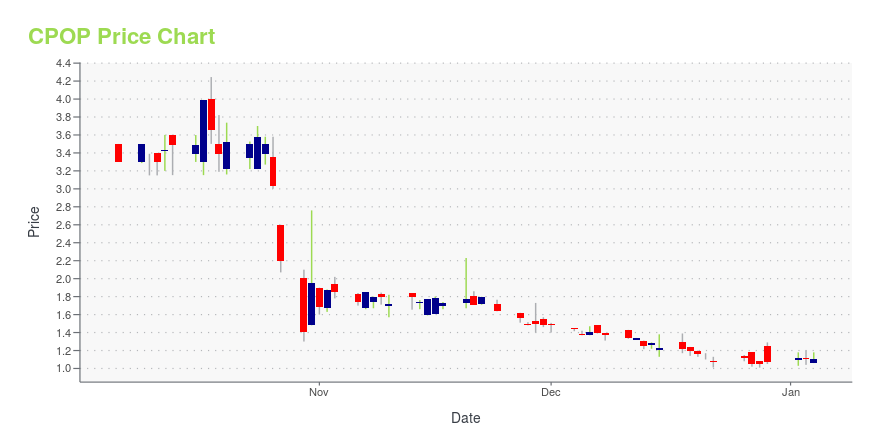

| Current price | $1.84 | 52-week high | $10.90 |

| Prev. close | $1.76 | 52-week low | $0.91 |

| Day low | $1.78 | Volume | 3,395 |

| Day high | $1.84 | Avg. volume | 2,085,839 |

| 50-day MA | $2.74 | Dividend yield | N/A |

| 200-day MA | $2.63 | Market Cap | 7.25M |

CPOP Stock Price Chart Interactive Chart >

Pop Culture Group Co., Ltd (CPOP) Company Bio

Pop Culture Group Co., Ltd hosts entertainment events to corporate clients in China. The company hosts concerts and hip-hop related events, including stage plays, dance competitions, cultural and musical festivals, and promotional parties, as well as creates hip-hop related online programs; and provides event planning and execution services comprising communication, planning, design, production, reception, execution, and analysis services to advertising and media service providers and industry associations, as well as companies in a range of industries, such as consumer goods, real estate, tourism, entertainment, technology, e-commerce, education, and sports. It also offers marketing services, including brand promotion services, such as trademark and logo design, visual identity system design, brand positioning, brand personality design, and digital solutions; and advertisement distribution services to corporate clients. The company was founded in 2007 and is headquartered in Xiamen, China.

Latest CPOP News From Around the Web

Below are the latest news stories about POP CULTURE GROUP CO LTD that investors may wish to consider to help them evaluate CPOP as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayWe're starting off the day with a breakdown of all the biggest pre-market stock movers worth reading about on Thursday morning! |

Pop Culture Group First Half 2023 Earnings: US$0.20 loss per share (vs US$0.021 profit in 1H 2022)Pop Culture Group ( NASDAQ:CPOP ) First Half 2023 Results Key Financial Results Revenue: US$11.3m (down 44% from 1H... |

Pop Culture has Applied AIGC to Its Business SystemPop Culture Group Co., Ltd (hereinafter referred to as "Pop Culture" or the "Company") (Nasdaq: CPOP) announced that it has achieved milestones in the field of artificial intelligence such as AIGC (AI Generated Content) and ChatGPT. The application of ChatGPT is under continuous development in the Company's Shenzhen Technology Center while AIGC has been integrated into some of its business segments. |

Pop Culture Group announces subsidiary's plan to accelerate digitization through ChatGPTPop Culture Group (CPOP) announced today that its subsidiary, Shenzhen Pupu Digital Industry Development Cooperation, will dedicate itself to developing programs where ChatGPT (Natural language processing) technology empowers metaverse and NFT digital collections, with the main purpose of lowering labor costs, improving innovation efficiency and achieving full digitization in a faster manner. |

CPOP Price Returns

| 1-mo | -40.26% |

| 3-mo | 76.92% |

| 6-mo | -47.83% |

| 1-year | -76.28% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | 71.96% |

| 2023 | -86.29% |

| 2022 | -78.50% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...