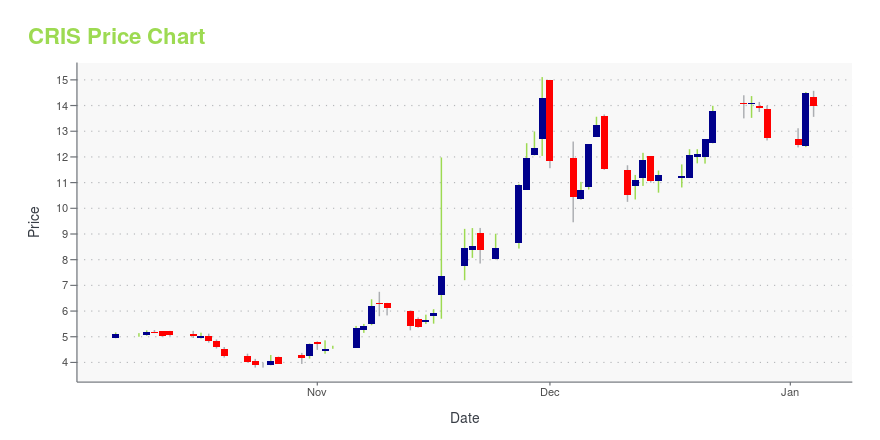

Curis, Inc. (CRIS): Price and Financial Metrics

CRIS Price/Volume Stats

| Current price | $14.77 | 52-week high | $19.60 |

| Prev. close | $15.01 | 52-week low | $3.80 |

| Day low | $14.77 | Volume | 1,105 |

| Day high | $15.07 | Avg. volume | 35,389 |

| 50-day MA | $11.93 | Dividend yield | N/A |

| 200-day MA | $10.78 | Market Cap | 87.05M |

CRIS Stock Price Chart Interactive Chart >

Curis, Inc. (CRIS) Company Bio

Curis, Inc. engages in the discovery and development of drug candidates for the treatment of human cancers. The company was founded in 2000 and is based in Lexington, Massachusetts.

Latest CRIS News From Around the Web

Below are the latest news stories about CURIS INC that investors may wish to consider to help them evaluate CRIS as an investment opportunity.

Curis, Inc. (NASDAQ:CRIS) Surges 54% Yet Its Low P/S Is No Reason For ExcitementCuris, Inc. ( NASDAQ:CRIS ) shareholders would be excited to see that the share price has had a great month, posting a... |

Curis Announces Initial Combination Study Data from its TakeAim Lymphoma StudyCuris, Inc. (NASDAQ: CRIS), a biotechnology company focused on the development of emavusertib (CA-4948), an orally available, small molecule IRAK4 inhibitor, today announced initial combination study data from its TakeAim Lymphoma trial including 5 primary CNS lymphoma (PCNSL) patients. |

Curis Presented Clinical Data from the TakeAim Leukemia Study at the 2023 ASH ConferenceCuris, Inc. (NASDAQ: CRIS), a biotechnology company focused on the development of emavusertib (CA-4948), an orally available, small molecule IRAK4 inhibitor, last night presented clinical data from its TakeAim Leukemia Study at the 2023 ASH Conference. |

Curis Announces Three Presentations at ASHCuris, Inc. (NASDAQ: CRIS), a biotechnology company focused on the development of emavusertib (CA-4948), an orally available, small molecule IRAK4 inhibitor, today announced that the Company along with its collaborative partners will be presenting three posters at the upcoming 65th ASH Annual Meeting and Exposition (ASH 2025) being held in San Diego, California and online from December 9th to December 12th. |

Curis Enters into Agreement for Emavusertib / Pembrolizumab Combination Study in MelanomaCuris, Inc. (NASDAQ: CRIS), a biotechnology company focused on the development of emavusertib (CA-4948), an orally available, small molecule IRAK4 inhibitor, today announced that it has entered into an investigator-initiated clinical trial agreement with the University of Florida to study the combination of emavusertib and pembrolizumab in patients with metastatic melanoma. |

CRIS Price Returns

| 1-mo | 36.38% |

| 3-mo | 53.22% |

| 6-mo | 274.87% |

| 1-year | -5.83% |

| 3-year | -93.03% |

| 5-year | -58.51% |

| YTD | 15.84% |

| 2023 | 15.91% |

| 2022 | -88.45% |

| 2021 | -41.88% |

| 2020 | 381.76% |

| 2019 | 146.38% |

Continue Researching CRIS

Want to do more research on Curis Inc's stock and its price? Try the links below:Curis Inc (CRIS) Stock Price | Nasdaq

Curis Inc (CRIS) Stock Quote, History and News - Yahoo Finance

Curis Inc (CRIS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...