Dakota Gold Corp. (DC): Price and Financial Metrics

DC Price/Volume Stats

| Current price | $2.52 | 52-week high | $3.94 |

| Prev. close | $2.50 | 52-week low | $1.95 |

| Day low | $2.46 | Volume | 253,700 |

| Day high | $2.53 | Avg. volume | 198,558 |

| 50-day MA | $2.26 | Dividend yield | N/A |

| 200-day MA | $2.57 | Market Cap | 221.01M |

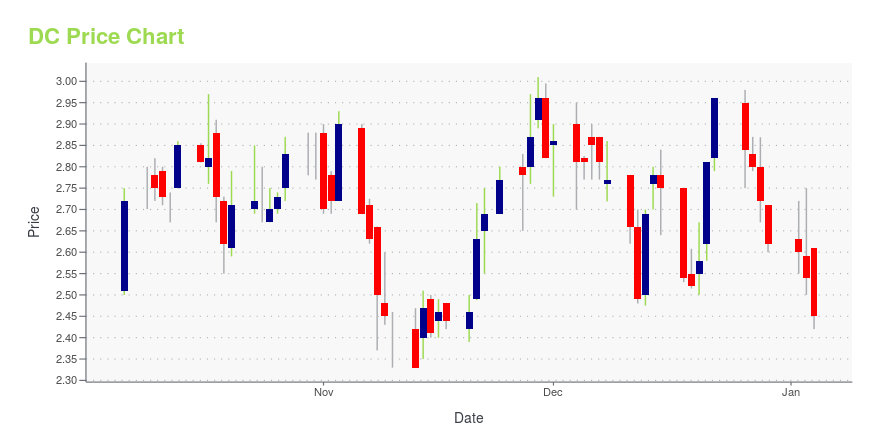

DC Stock Price Chart Interactive Chart >

Dakota Gold Corp. (DC) Company Bio

Dakota Gold Corp. operates as a gold exploration and development company. It has gold mineral properties covering approximately 40 thousand acres surrounding the Homestake Mine. The company holds an interest in the Maitland Gold property located in South Dakota. Dakota Gold Corp. was incorporated in 2017 and is based in Vancouver, Canada.

Latest DC News From Around the Web

Below are the latest news stories about DAKOTA GOLD CORP that investors may wish to consider to help them evaluate DC as an investment opportunity.

Dakota Gold Corp. Issues Correction to November 21, 2023 News Release Announced Earlier TodayLead, South Dakota--(Newsfile Corp. - November 21, 2023) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") wishes to correct an error in reporting the gold assay in drill hole RH23C-059 announced on November 21, 2023 at 5:30am EST. The November 21, 2023 news release reported an interval of 1.809 oz/ton Au over 7.3 feet (62.02 grams/tonne over 2.2 meters) within a larger interval of 0.711 oz/ton Au over 19.5 feet ... |

Dakota Gold Corp. Returns Best Intercept to Date with RH23C-059 Intersecting 1.809 oz/ton Au over 7.3 feet (62.02 grams/tonne over 2.2 meters) Within a Larger Interval of 19.5 feet at 0.711 oz/ton Au (24.38 grams/tonne over 5.9 meters) from the Richmond Hill ProjectLead, South Dakota--(Newsfile Corp. - November 21, 2023) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to report assays from an additional six drill holes from the Richmond Hill Gold Project ("Richmond Hill") in South Dakota. RH23C-059 returned an exceptionally high-grade intercept, 1.809 oz/ton Au over 7.3 feet (62.02 grams/tonne over 2.2 meters) within a larger interval of 0.711 oz/ton Au over 19.5 feet (24.38 grams/tonne over 5.9 ... |

Dakota Gold Corp. Announces Extension of the Option Covering Certain Surface Rights of the Homestake Mine Property with Barrick Gold Corporation to 2026Lead, South Dakota--(Newsfile Corp. - November 20, 2023) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to announce that it has extended the option term from September 7, 2024 to March 7, 2026 of its option agreement with Homestake Mining Company of California ("Homestake"), a wholly owned subsidiary of Barrick Gold Corporation ("Barrick"), over certain of Homestake's surface rights and residual facilities in the Homestake District in South ... |

Dakota Gold Corp. Announces Closing of $17 Million Orion Mine Finance InvestmentLead, South Dakota--(Newsfile Corp. - October 20, 2023) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to announce the closing of the previously announced investment of $17 million by OMF Fund IV SPV C LLC, an entity managed by Orion Mine Finance ("Orion").Orion purchased 6,666,667 shares of common stock of Dakota Gold (each a "Share") at a price of $2.55 per Share for aggregate gross proceeds of $17 ... |

Dakota Gold Corp. Announces Strategic Partnership with Orion Mine Finance for $17 MillionLead, South Dakota--(Newsfile Corp. - October 12, 2023) - Dakota Gold Corp. (NYSE American: DC) ("Dakota Gold" or the "Company") is pleased to announce it has entered into a binding agreement with OMF Fund IV SPV C LLC, an entity managed by Orion Mine Finance ("Orion"), for an investment of $17 million in Dakota Gold and a commitment from Orion for future financing support.Jonathan Awde, President, CEO and a Director of the Company commented: ... |

DC Price Returns

| 1-mo | 17.21% |

| 3-mo | 14.55% |

| 6-mo | -7.01% |

| 1-year | -23.17% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -3.82% |

| 2023 | -14.10% |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...