Daily Journal Corp. (S.C.) (DJCO): Price and Financial Metrics

DJCO Price/Volume Stats

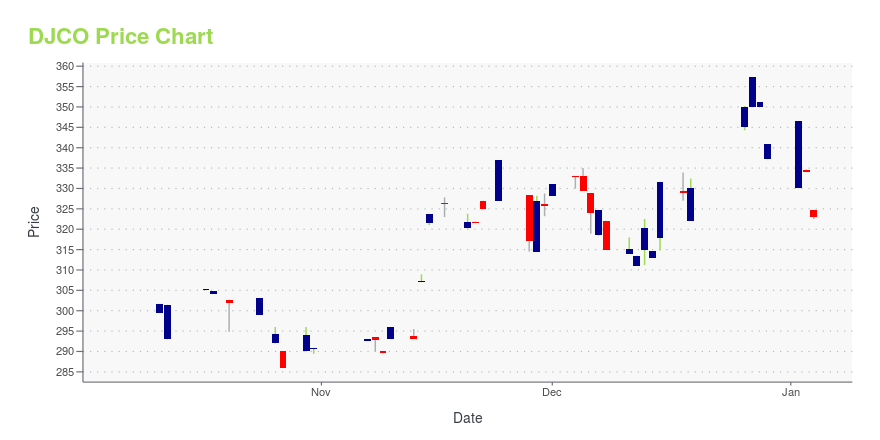

| Current price | $353.55 | 52-week high | $402.95 |

| Prev. close | $356.90 | 52-week low | $270.51 |

| Day low | $349.95 | Volume | 5,901 |

| Day high | $356.06 | Avg. volume | 8,432 |

| 50-day MA | $354.60 | Dividend yield | N/A |

| 200-day MA | $320.00 | Market Cap | 486.84M |

DJCO Stock Price Chart Interactive Chart >

Daily Journal Corp. (S.C.) (DJCO) Company Bio

Daily Journal Corporation publishes newspapers and Web sites in California, Arizona, and Utah. It operates through two segments, Traditional Business and Journal Technologies. The company was founded in 1987 and is based in Los Angeles, California.

Latest DJCO News From Around the Web

Below are the latest news stories about DAILY JOURNAL CORP that investors may wish to consider to help them evaluate DJCO as an investment opportunity.

Daily Journal Corporation Announces Financial Results for Fiscal Year ended September 30, 2023LOS ANGELES, Dec. 27, 2023 (GLOBE NEWSWIRE) -- During fiscal 2023, Daily Journal Corporation (NASDAQ:DJCO) had consolidated revenues of $67,709,000 as compared to $54,009,000 in the prior year. This increase of $13,700,000 was primarily from increases in (i) Journal Technologies’ consulting fees of $7,911,000, license and maintenance fees of $4,311,000 and other public service fees of $1,147,000, and (ii) the Traditional Business’ advertising revenues of $364,000, partially offset by a decrease |

Charlie Munger Discusses Daily JournalThe late investor discusses the Los Angeles-based newspaper company |

In Memory of a Legend: 7 Stocks That Charlie Munger LovedCharlie Munger stock picks stand as a masterclass in value-based investment strategies, and offer lessons for traders of all levels. |

Column: Is it time to sell my Berkshire?Many people have written and talked about how Munger, whom I knew and liked for more than 40 years, had a dry wit and convinced Buffett, a fellow Omaha native, to start buying good companies at reasonable prices rather than making cheap purchases of “cigar butt” remnant companies that had only a few puffs left. But I had a totally different reaction: did Munger’s death mean that I should bail out of my Berkshire Class B stock, which I bought in early 2016? |

Remembering Charlie MungerThe investment legend's legacy will live on forever. |

DJCO Price Returns

| 1-mo | -0.69% |

| 3-mo | 5.92% |

| 6-mo | 23.60% |

| 1-year | 30.70% |

| 3-year | 14.14% |

| 5-year | N/A |

| YTD | 3.74% |

| 2023 | 36.05% |

| 2022 | -29.78% |

| 2021 | -11.70% |

| 2020 | 39.11% |

| 2019 | 24.11% |

Continue Researching DJCO

Want to do more research on Daily Journal Corp's stock and its price? Try the links below:Daily Journal Corp (DJCO) Stock Price | Nasdaq

Daily Journal Corp (DJCO) Stock Quote, History and News - Yahoo Finance

Daily Journal Corp (DJCO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...