Delek US Holdings, Inc. (DK): Price and Financial Metrics

DK Price/Volume Stats

| Current price | $29.45 | 52-week high | $33.60 |

| Prev. close | $30.10 | 52-week low | $19.39 |

| Day low | $29.31 | Volume | 720,710 |

| Day high | $30.22 | Avg. volume | 1,038,683 |

| 50-day MA | $28.93 | Dividend yield | 3.17% |

| 200-day MA | $27.17 | Market Cap | 1.89B |

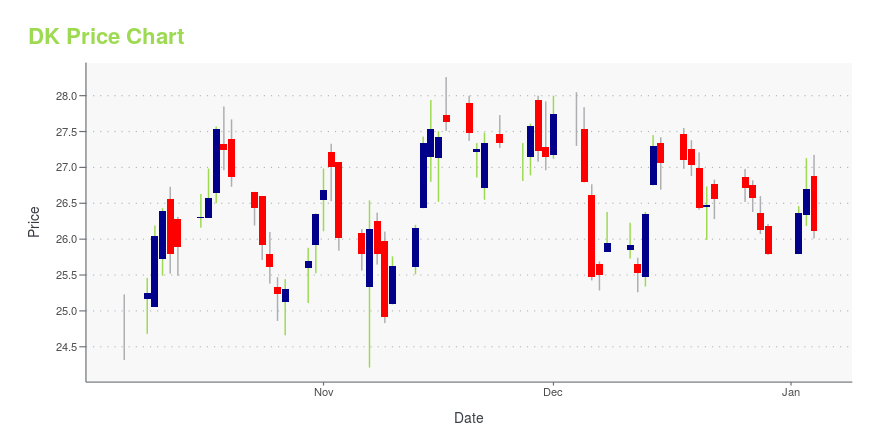

DK Stock Price Chart Interactive Chart >

Delek US Holdings, Inc. (DK) Company Bio

Delek US Holdings operates as an integrated downstream energy company that operates in petroleum refining, wholesale distribution, and convenience store retailing businesses. The company was founded in 2001 and is based in Brentwood, Tennessee.

Latest DK News From Around the Web

Below are the latest news stories about DELEK US HOLDINGS INC that investors may wish to consider to help them evaluate DK as an investment opportunity.

Delek US Holdings (NYSE:DK) rallies 7.1% this week, taking three-year gains to 87%One simple way to benefit from the stock market is to buy an index fund. But if you buy good businesses at attractive... |

Why Is Delek US Holdings (DK) Down 1.3% Since Last Earnings Report?Delek US Holdings (DK) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Oil Price Tick Lower on Inventory Gain, OPEC SpeculationWith oil trading below $80, we advise investors to buy stocks like Delek US Holdings (DK), EOG Resources (EOG) and Murphy Oil (MUR) at bargain prices. |

Oil Price Tumbles Below $75 With Production at Record LevelsWith oil prices plunging, we advise investors to buy stocks like Delek US Holdings (DK), EOG Resources (EOG) and Civitas Resources (CIV)) at bargain prices. |

Diamondback (FANG) Q3 Earnings Beat Estimates on Higher OutputFor 2023, Diamondback Energy (FANG) forecasts a capital spending budget between $2.66 billion and $2.7 billion and looks to pump around 447,000 BOE/d of hydrocarbon. |

DK Price Returns

| 1-mo | -2.58% |

| 3-mo | 21.86% |

| 6-mo | 11.78% |

| 1-year | 37.01% |

| 3-year | 47.38% |

| 5-year | -9.47% |

| YTD | 15.29% |

| 2023 | -0.78% |

| 2022 | 82.48% |

| 2021 | -6.72% |

| 2020 | -49.56% |

| 2019 | 6.57% |

DK Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching DK

Want to see what other sources are saying about Delek US Holdings Inc's financials and stock price? Try the links below:Delek US Holdings Inc (DK) Stock Price | Nasdaq

Delek US Holdings Inc (DK) Stock Quote, History and News - Yahoo Finance

Delek US Holdings Inc (DK) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...