Essential Properties Realty Trust, Inc. (EPRT): Price and Financial Metrics

EPRT Price/Volume Stats

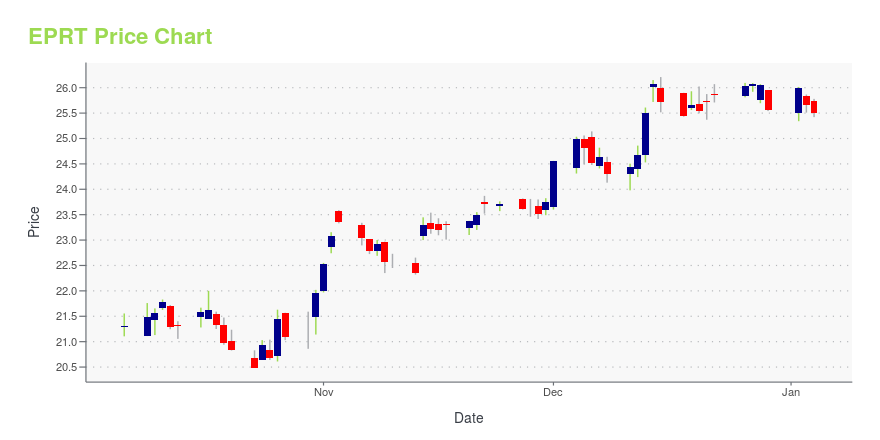

| Current price | $24.91 | 52-week high | $26.77 |

| Prev. close | $24.76 | 52-week low | $20.49 |

| Day low | $24.77 | Volume | 651,600 |

| Day high | $25.10 | Avg. volume | 1,353,676 |

| 50-day MA | $25.09 | Dividend yield | 4.48% |

| 200-day MA | $24.12 | Market Cap | 4.22B |

EPRT Stock Price Chart Interactive Chart >

Essential Properties Realty Trust, Inc. (EPRT) Company Bio

Essential Properties Realty Trust, Inc. operate as a real estate investment trust. The Company focuses on properties leased to tenants in businesses such as restaurants car washes, automotive services, medical services, convenience stores, entertainment, health & fitness and early childhood education centers. The company is based in Princeton, New Jersey.

Latest EPRT News From Around the Web

Below are the latest news stories about ESSENTIAL PROPERTIES REALTY TRUST INC that investors may wish to consider to help them evaluate EPRT as an investment opportunity.

If You Invested $10,000 In Essential Properties Realty Trust Five Years Ago, Here's How Much Money You Would Have TodayOne of the best things about investing in real estate investment trusts (REITs) is that with the right stock, an investor can gain some appreciation and procure a solid monthly or quarterly dividend for additional income. But because not all REITs will deliver solid appreciation and dividend growth, it's important to look at a REIT's five-year history to help assess possible future returns. Take a look at one popular REIT over the past five years, how much it's appreciated over that time and wha |

Insider Sell: Essential Properties Realty Trust Inc CEO Peter Mavoides Sells 39,158 SharesEssential Properties Realty Trust Inc (NYSE:EPRT) has recently witnessed a significant insider sell by its President and CEO, Peter Mavoides. |

Insider Sell Alert: CEO Peter Mavoides Sells 52,601 Shares of Essential Properties Realty Trust IncEssential Properties Realty Trust Inc (NYSE:EPRT) has recently witnessed a significant insider sell by its President and CEO, Peter Mavoides. |

Essential Properties Realty Trust, Inc. Increases Quarterly Dividend to $0.285 per Share, a 1.8% Increase Over Prior QuarterPRINCETON, N.J., December 04, 2023--Essential Properties Realty Trust, Inc. (NYSE: EPRT; the "Company") announced today that its Board of Directors declared a quarterly cash dividend of $0.285 per share of common stock for the fourth quarter of 2023. On an annualized basis the fourth quarter 2023 dividend of $0.285 equals $1.14 per share, an increase of $0.02 per share compared to the previous annualized dividend. The dividend is payable on January 12, 2024 to stockholders of record as of the cl |

Real Estate Rut: 3 REITs With Major Growth PotentialGrowth REITs to buy is the name of the game, as real estate investments have underperformed U.S. stocks since the turn of the year. |

EPRT Price Returns

| 1-mo | -0.46% |

| 3-mo | 0.58% |

| 6-mo | 22.18% |

| 1-year | 7.23% |

| 3-year | 14.41% |

| 5-year | 64.24% |

| YTD | -1.47% |

| 2023 | 14.20% |

| 2022 | -14.60% |

| 2021 | 41.19% |

| 2020 | -9.72% |

| 2019 | 86.75% |

EPRT Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching EPRT

Want to do more research on Essential Properties Realty Trust Inc's stock and its price? Try the links below:Essential Properties Realty Trust Inc (EPRT) Stock Price | Nasdaq

Essential Properties Realty Trust Inc (EPRT) Stock Quote, History and News - Yahoo Finance

Essential Properties Realty Trust Inc (EPRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...