Equinox Gold Corp. (EQX): Price and Financial Metrics

EQX Price/Volume Stats

| Current price | $5.23 | 52-week high | $6.50 |

| Prev. close | $5.72 | 52-week low | $3.95 |

| Day low | $5.18 | Volume | 20,468,600 |

| Day high | $5.32 | Avg. volume | 2,592,006 |

| 50-day MA | $5.21 | Dividend yield | N/A |

| 200-day MA | $4.85 | Market Cap | 1.72B |

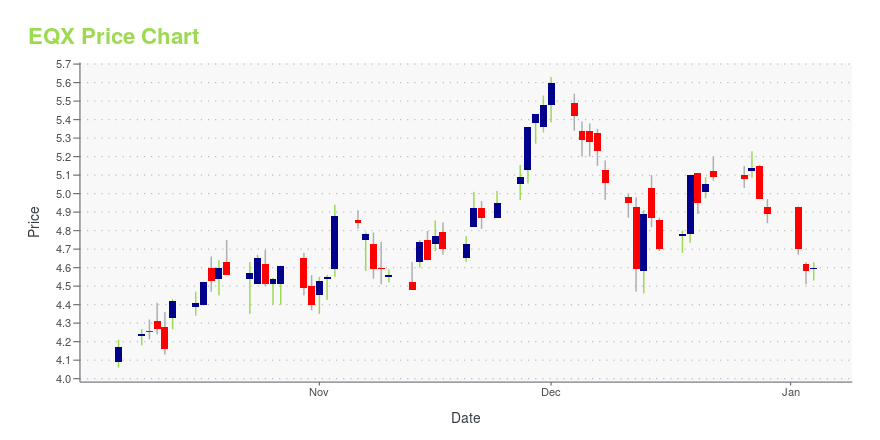

EQX Stock Price Chart Interactive Chart >

Equinox Gold Corp. (EQX) Company Bio

Equinox Gold Corp. engages in the exploration of gold mining properties. Its projects include mesquite gold mine, aurizona gold mine, castle mountain, and copper projects. The company was founded by Marc Pais on March 23, 2007 and is headquartered in Vancouver, Canada.

Latest EQX News From Around the Web

Below are the latest news stories about EQUINOX GOLD CORP that investors may wish to consider to help them evaluate EQX as an investment opportunity.

Equinox Gold's Greenstone Project: 96% Complete, Commissioning UnderwayAll dollar amounts shown in United States dollars unless otherwise notedVancouver, British Columbia--(Newsfile Corp. - November 20, 2023) - Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) is pleased to provide an update on construction and commissioning progress at its Greenstone Project in Ontario, Canada. The Greenstone Project is being developed as a 60/40 partnership, respectively, by Equinox Gold and Orion Mine Finance Group, and will be one of the largest gold mines in ... |

Equinox Gold Reports Third Quarter 2023 Financial and Operating ResultsDelivers Strongest Third Quarter on Record for Production, Revenue and EBITDA All financial figures are in US dollars, unless otherwise indicated.Vancouver, British Columbia--(Newsfile Corp. - October 31, 2023) - Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) ("Equinox Gold" or the "Company") is pleased to announce its third quarter 2023 summary financial and operating results. The Company's unaudited condensed consolidated interim financial statements and related management's discussion and |

Equinox Gold Completes $172.5 Million Convertible Senior Notes Bought Deal OfferingAll dollar amounts shown in United States dollars, unless otherwise indicated.Vancouver, British Columbia--(Newsfile Corp. - September 21, 2023) - Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) ("Equinox Gold" or the "Company") has closed its previously announced bought deal offering of $172.5 million aggregate principal amount of 4.75% unsecured convertible senior notes due 2028 (the "2028 Notes"), which includes exercise of the full amount of the option to purchase an additional $22.5 mill |

Equinox Gold Corp (EQX): A Deep Dive into Its Performance MetricsUnraveling the Factors That May Limit the Company's Future Outperformance |

Equinox Gold Announces Bought Deal Offering of Convertible Senior NotesAll dollar amounts shown in United States dollars, unless otherwise indicated.This is a "designated news release" for the purposes of the Company's prospectus supplement dated November 21, 2022, to its short form base shelf prospectus dated November 21, 2022.Vancouver, British Columbia--(Newsfile Corp. - September 18, 2023) - Equinox Gold Corp. (TSX: EQX) (NYSE American: EQX) ("Equinox Gold" or the "Company") announces that it has entered into an agreement with BMO Capital Markets, on behalf ... |

EQX Price Returns

| 1-mo | -3.15% |

| 3-mo | 18.86% |

| 6-mo | 13.45% |

| 1-year | 5.87% |

| 3-year | -38.62% |

| 5-year | 27.56% |

| YTD | 6.95% |

| 2023 | 49.09% |

| 2022 | -51.48% |

| 2021 | -34.62% |

| 2020 | 34.29% |

| 2019 | 106.43% |

Loading social stream, please wait...