GigaMedia Limited - Ordinary Shares (GIGM): Price and Financial Metrics

GIGM Price/Volume Stats

| Current price | $1.36 | 52-week high | $1.62 |

| Prev. close | $1.31 | 52-week low | $1.23 |

| Day low | $1.31 | Volume | 12,154 |

| Day high | $1.36 | Avg. volume | 9,711 |

| 50-day MA | $1.30 | Dividend yield | N/A |

| 200-day MA | $1.38 | Market Cap | 15.03M |

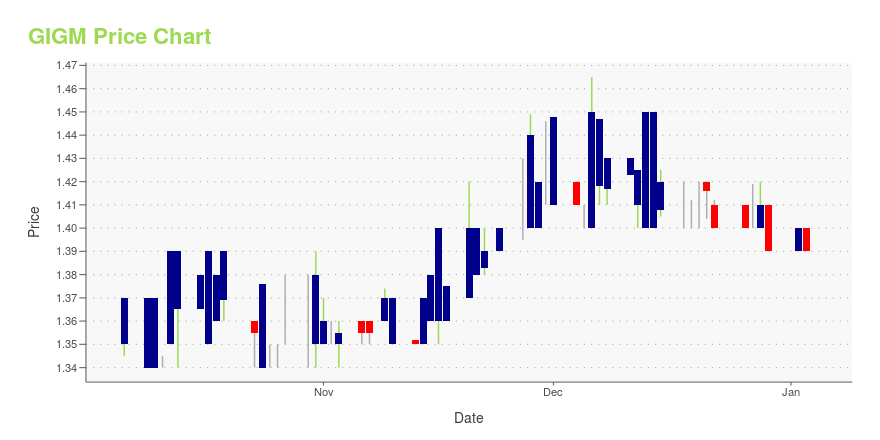

GIGM Stock Price Chart Interactive Chart >

GigaMedia Limited - Ordinary Shares (GIGM) Company Bio

GigaMedia Limited provides digital entertainment services in Taiwan and Hong Kong. The company operates FunTown, a digital entertainment portal that offers mobile and browser-based casual games through -branded platform. It offers MahJong, a traditional Chinese tile based game; casual card and table games; online card games; and chance-based games, including bingo, lotto, horse racing, Sic-Bo, slots, and various casual games. The company also provides sports games and role-playing games, such as Tales Runner, a multi-player online obstacle running game; Yume 100, a story -based game that targets female players; Akaseka, a female-oriented game; and Shinobi Master New Link, a male-oriented game. GigaMedia Limited was founded in 1998 and is headquartered in Taipei, Taiwan.

Latest GIGM News From Around the Web

Below are the latest news stories about GIGAMEDIA LTD that investors may wish to consider to help them evaluate GIGM as an investment opportunity.

Chih-Hong Tsai and Wan-Wan Lin Appointed Independent Non-Executive Directors of GigaMediaGigaMedia Limited (NASDAQ: GIGM) today announced that its Board of Directors has appointed Chih-Hong Tsai (a.k.a. John J.H. Tsai) and Wan-Wan Lin as new independent non-executive directors upon the departure of Casey Kuo-Chong Tung and Billy Bing-Yuan Huang, who have resigned and retired from the Board. The resignations of Mr. Tung and Mr. Huang were accepted by the Board of Directors and effective on November 23, 2023. |

GigaMedia Announces Third-Quarter 2023 Financial ResultsGigaMedia Limited (NASDAQ: GIGM) today announced its third-quarter 2023 unaudited financial results. |

GigaMedia Announces Partial Extension of Aeolus Convertible NoteGigaMedia Limited (NASDAQ: GIGM) today announced that the Company has entered into and executed with Aeolus Robotics Corporation ("Aeolus") an agreement of amendment to the Aeolus convertible promissory note previously purchased by GigaMedia on August 31, 2020 (the "Note"). The amendment is to extend the due date of the Note for the outstanding US$7 million principal, with advantageous terms and conditions. |

GigaMedia Announces Second-Quarter 2023 Financial ResultsGigaMedia Limited (NASDAQ: GIGM) today announced its second-quarter 2023 unaudited financial results. |

RESULT OF ANNUAL GENERAL MEETING HELD ON 29 JUNE 2023GigaMedia Limited (NASDAQ: GIGM), a digital entertainment services provider, wishes to announce that at the Annual General Meeting ("AGM") of the Company held on 29 June 2023, all resolutions relating to the matters set out in the Notice of AGM dated 17 May 2023 were duly passed. |

GIGM Price Returns

| 1-mo | 1.49% |

| 3-mo | -4.36% |

| 6-mo | 0.74% |

| 1-year | -2.16% |

| 3-year | -54.82% |

| 5-year | -47.49% |

| YTD | -2.17% |

| 2023 | 14.88% |

| 2022 | -46.22% |

| 2021 | -29.69% |

| 2020 | 32.78% |

| 2019 | -19.67% |

Continue Researching GIGM

Want to do more research on GIGAMEDIA Ltd's stock and its price? Try the links below:GIGAMEDIA Ltd (GIGM) Stock Price | Nasdaq

GIGAMEDIA Ltd (GIGM) Stock Quote, History and News - Yahoo Finance

GIGAMEDIA Ltd (GIGM) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...