HAPPINESS BIOTECH GROUP LTD (HAPP): Price and Financial Metrics

HAPP Price/Volume Stats

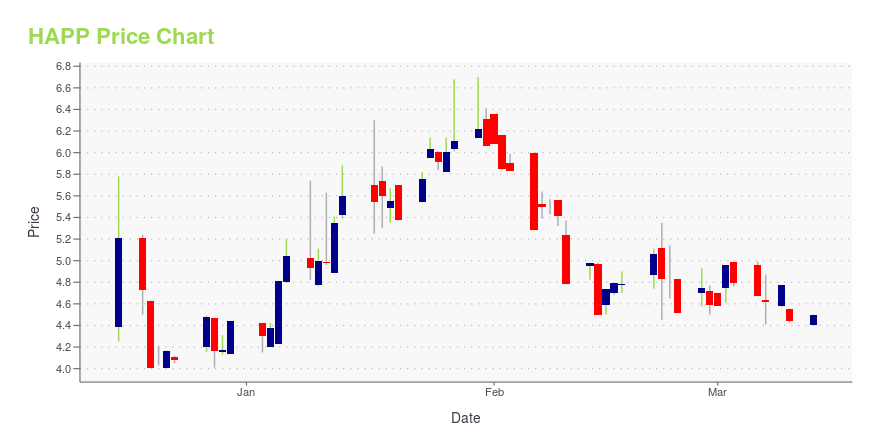

| Current price | $4.50 | 52-week high | $7.40 |

| Prev. close | $4.44 | 52-week low | $2.08 |

| Day low | $4.40 | Volume | 1,500 |

| Day high | $4.50 | Avg. volume | 14,340 |

| 50-day MA | $5.10 | Dividend yield | N/A |

| 200-day MA | $3.99 | Market Cap | 31.30M |

HAPP Stock Price Chart Interactive Chart >

HAPPINESS BIOTECH GROUP LTD (HAPP) Company Bio

Happiness Biotech Group Ltd. is a nutraceutical and dietary supplements producer, which engages in the research, development, manufacturing, marketing, and sales of a variety of products made from herbal and animal extracts. The firm's products include lucidum spore powder; cordyceps mycelia; ijiao solution; and American ginseng. It operates under the brand name Happiness. The company was founded on February 9, 2018 and is headquartered in Nanping City, China.

Latest HAPP News From Around the Web

Below are the latest news stories about HAPPINESS DEVELOPMENT GROUP LTD that investors may wish to consider to help them evaluate HAPP as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayWe're starting off the week with a look at the biggest pre-market stock movers traders need to know about on Monday morning! |

Happiness Development Group Limited Regains Compliance with Nasdaq Minimum Bid Price RequirementHappiness Development Group Limited ("HAPP" or the "Company"), (NASDAQ: HAPP) announced today that on October 25, 2022, the Company received a notification letter from the Nasdaq Listing Qualifications Staff of The NASDAQ Stock Market LLC ("Nasdaq") notifying the Company that it has regained compliance with the Nasdaq's minimum bid price requirement and the matter is closed. |

Happiness Development Group Limited Announces 1 for 20 Reverse Share SplitHappiness Development Group Limited ("HAPP" or the "Company"), (NASDAQ: HAPP) an emerging and diversified company engaging in the business of production and sale of nutraceutical and dietary supplements, providing e-commerce sales and marketing solutions, and the sales of automobile today announced that an 1 for 20 reverse split of its ordinary shares, par value $0.0005 each, was approved by the Company's shareholders on October 7, 2022 and became effective on October 10, 2022. In connection wit |

Happiness Development Entered into Agreement for Sales up to 2000 Electric VehiclesHappiness Development Group Limited ("HAPP" or the "Company"), (NASDAQ: HAPP) an emerging and diversified company engaging in the business of production and sale of nutraceutical and dietary supplements, providing e-commerce sales and marketing solutions, and the sales of automobile today announced that its automobile sales subsidiary 'Taochejun" has entered into a strategic cooperation agreement with Fujian Yiluba Automobile Service Consulting Co., Ltd. ("168"). According to the cooperation agr |

Happiness Development Granted Extension to Meet Nasdaq Minimum Bid Price RequirementHappiness Development Group Limited ("HAPP" or the "Company"), (NASDAQ: HAPP) an emerging and diversified company engaging in the business of production and sale of nutraceutical and dietary supplements, of e-commerce and providing marketing solutions, and of the sales of automobile, today announced that on May 11, 2022, the Company received a written notification from the Nasdaq's Listing Qualifications Department, granting the Company another 180 calendar days extension, or until November 7, 2 |

HAPP Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -86.99% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -61.05% |

| 2021 | -69.03% |

| 2020 | -59.60% |

| 2019 | N/A |

Loading social stream, please wait...