Hesai Group ADR (HSAI): Price and Financial Metrics

HSAI Price/Volume Stats

| Current price | $4.18 | 52-week high | $13.98 |

| Prev. close | $4.28 | 52-week low | $3.28 |

| Day low | $4.08 | Volume | 139,685 |

| Day high | $4.21 | Avg. volume | 809,660 |

| 50-day MA | $4.58 | Dividend yield | N/A |

| 200-day MA | $8.25 | Market Cap | 524.74M |

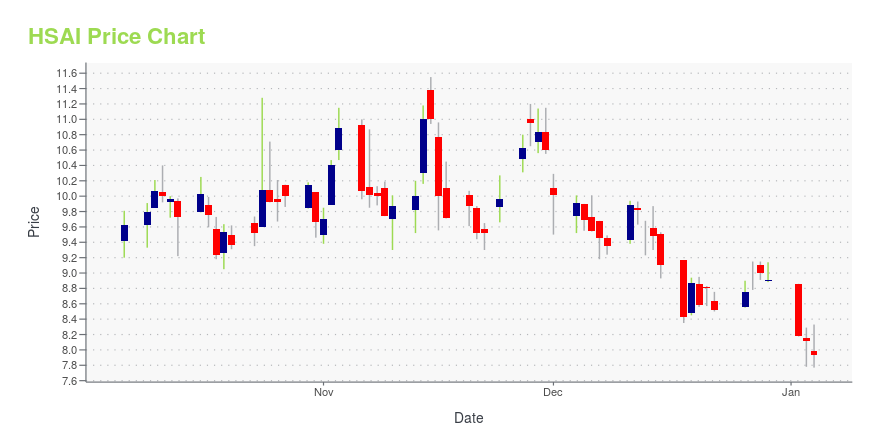

HSAI Stock Price Chart Interactive Chart >

Latest HSAI News From Around the Web

Below are the latest news stories about HESAI GROUP that investors may wish to consider to help them evaluate HSAI as an investment opportunity.

The Automotive Industry’s Best Option for Reducing Accidents and Saving Lives is Under Political Attack≈ By Exec Edge Editorial Staff A small safety sensor most people have never heard of has been in the news lately: lidar. LiDAR stands for light detection and ranging, and these hardware devices come in various shapes and sizes depending on the application. Lidar are one of the most important new safety technologies being […] |

Hesai Group (NASDAQ:HSAI): When Will It Breakeven?We feel now is a pretty good time to analyse Hesai Group's ( NASDAQ:HSAI ) business as it appears the company may be on... |

Hesai Responds to False Allegations Raised by Members of CongressPoint-cloud Image Taken by Hesai Lidar Point-cloud Image Taken by Hesai Lidar PALO ALTO, Calif., Nov. 29, 2023 (GLOBE NEWSWIRE) -- Hesai Technology, the global leader in lidar sensor technology for both automotive and industrial applications, responded to numerous false allegations made about the company and its technology in a letter from the House of Representatives Select Committee on the Chinese Communist Party released on November 28, 2023. Hesai Lidars Do Not Store or Wirelessly Transmit D |

Hesai's Ultra-Thin Long-Range LiDAR, ET25, Wins CES 2024 Innovation AwardHesai Technology (NASDAQ: HSAI), the global leader in lidar sensor technology for both automotive and industrial applications, is proud to announce that its ultra-thin long-range LiDAR, the ET25, has been named a CES 2024 Innovation Awards Honoree. This prestigious award recognizes outstanding design and engineering in cutting-edge technology products. |

Getting In Cheap On Hesai Group (NASDAQ:HSAI) Might Be DifficultHesai Group's ( NASDAQ:HSAI ) price-to-sales (or "P/S") ratio of 5.8x may look like a poor investment opportunity when... |

HSAI Price Returns

| 1-mo | -9.72% |

| 3-mo | -33.55% |

| 6-mo | -58.20% |

| 1-year | -51.11% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -53.09% |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...