IMPEL NEUROPHARMA INC (IMPL): Price and Financial Metrics

IMPL Price/Volume Stats

| Current price | $0.04 | 52-week high | $4.20 |

| Prev. close | $0.06 | 52-week low | $0.02 |

| Day low | $0.02 | Volume | 720,000 |

| Day high | $0.05 | Avg. volume | 682,655 |

| 50-day MA | $0.34 | Dividend yield | N/A |

| 200-day MA | $0.97 | Market Cap | 956.00K |

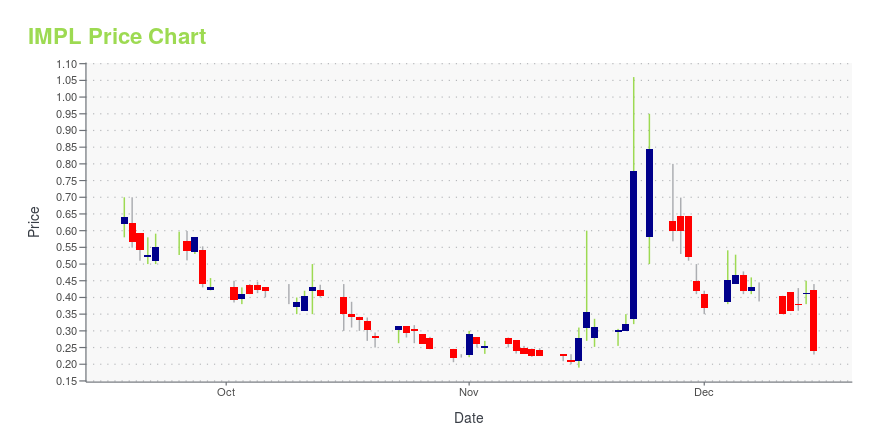

IMPL Stock Price Chart Interactive Chart >

IMPEL NEUROPHARMA INC (IMPL) Company Bio

Impel NeuroPharma, Inc., a late-stage pharmaceutical company, focuses on the development and commercialization of therapies for patients suffering from central nervous system disease in the United States. Its lead product candidate is TRUDHESA, an upper nasal formulation of dihydroergotamine for the acute treatment of migraine. The company is also developing INP105, an upper nasal formulation of olanzapine for the acute treatment of agitation and aggression in autism spectrum disorder; and INP107, an upper nasal formulation of carbidopa/levodopa for the treatment of OFF episodes in Parkinson's disease. Impel NeuroPharma, Inc. was incorporated in 2008 and is headquartered in Seattle, Washington.

Latest IMPL News From Around the Web

Below are the latest news stories about IMPEL PHARMACEUTICALS INC that investors may wish to consider to help them evaluate IMPL as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the week with a breakdown of the biggest pre-market stock movers that are worth watching on Monday morning! |

Billionaire Marc Lasry’s Top 10 Stock PicksIn this piece, we will take a look at billionaire Marc Lasry’s top ten stock picks. If you want to skip our introduction to the billionaire hedge fund boss and the general investing climate, then take a look at Billionaire Marc Lasry’s Top 5 Stock Picks. Marc Lasry is a hedge fund billionaire who started […] |

Impel Pharmaceuticals Announces Exploration of Strategic AlternativesSEATTLE, Oct. 05, 2023 (GLOBE NEWSWIRE) -- Impel Pharmaceuticals Inc. (NASDAQ: IMPL) (“Impel” or “the Company”), a commercial-stage biopharmaceutical company with a mission to develop transformative therapies for people suffering from diseases with high unmet medical needs, today announced that it has initiated an exploration of strategic alternatives. As part of this process, the Company plans to consider a wide range of options with a focus on maximizing shareholder value, including a potentia |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time for another dive into the biggest pre-market stock movers as we check out all the shares worth watching on Wednesday! |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayWe're starting off the workweek right with a breakdown of the biggest pre-market stock movers worth watching on Monday morning! |

IMPL Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | -85.72% |

| 1-year | -97.81% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -56.55% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...