Immatics N.V. (IMTX): Price and Financial Metrics

IMTX Price/Volume Stats

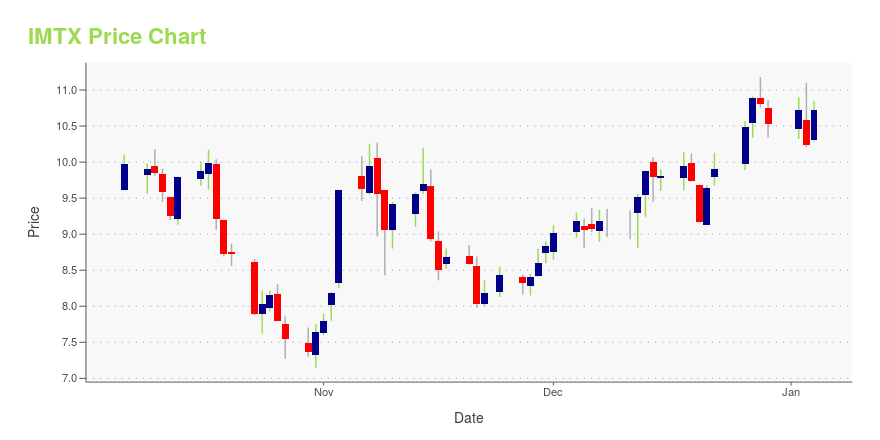

| Current price | $10.23 | 52-week high | $13.16 |

| Prev. close | $10.38 | 52-week low | $6.46 |

| Day low | $10.19 | Volume | 484,800 |

| Day high | $10.65 | Avg. volume | 499,204 |

| 50-day MA | $11.51 | Dividend yield | N/A |

| 200-day MA | $10.91 | Market Cap | 866.05M |

IMTX Stock Price Chart Interactive Chart >

Immatics N.V. (IMTX) Company Bio

Immatics N.V., a clinical-stage biopharmaceutical company, focuses on the discovery and development of T cell receptor (TCR) based immunotherapies for the treatment of cancer in the United States. The company is developing targeted immunotherapies with a focus on treating solid tumors through two distinct therapeutic modalities, such as adoptive cell therapies (ACT) and antibody-like TCR Bispecifics. Its ACTengine product candidates include IMA201 that targets melanoma-associated antigen 4 or 8 in patients with solid tumors; IMA202 that targets melanoma-associated antigen 1 in patients with various solid tumors, including squamous non-small cell lung carcinoma and hepatocellular carcinoma; IMA203 that targets preferentially expressed antigen in melanoma in adult patients with relapsed and/or refractory solid tumors; and IMA204, an anti-tumor therapy that targets the malignant tumor cell. Its TCR Bispecifics product candidates include IMA401, a cancer testis antigen for the treatment of solid tumor; and IMA402 for the treatment of solid and hematological malignancies. The company also develops IMA101, a multi-target precision immunotherapy; and IMA301, an off-the-shelf ACT. It has a strategic collaboration agreement with GlaxoSmithKline plc to develop novel adoptive cell therapies targeting multiple cancer indications; MD Anderson Cancer Center to develop multiple T cell and TCR-based adoptive cellular therapies; Celgene Switzerland LLC to develop novel adoptive cell therapies targeting multiple cancers; Genmab A/S to develop T cell engaging bispecific immunotherapies targeting multiple cancer indications; Amgen Inc.; and MorphoSys to develop novel antibody-based therapies against various cancer antigens that are recognized by T cells. Immatics N.V. is headquartered in Tübingen, Germany.

Latest IMTX News From Around the Web

Below are the latest news stories about IMMATICS NV that investors may wish to consider to help them evaluate IMTX as an investment opportunity.

Levicept Appoints Eliot Forster as CEOLeadership Team Strengthened as Clinical Development of LEVI-04 a Novel Neurotrophin Modulator for Osteoarthritis and Chronic Pain Advances SANDWICH, United Kingdom, Nov. 30, 2023 (GLOBE NEWSWIRE) -- Levicept Ltd, a biotechnology company focused on the development of LEVI-04, a first-in-class treatment for chronic pain indications, today announces the appointment of Eliot Forster as CEO. Founder and inventor of LEVI-04, Simon Westbrook, is to take the role of CSO. Eliot brings more than thirty y |

Immatics Announces Third Quarter 2023 Financial Results and Business UpdateACTengine® IMA203 GEN1 TCR-T targeting PRAME showed 50% (6/12) confirmed ORR in melanoma patients with median duration of response (mDOR) not reached at median follow-up of 14.4 months including responses ongoing at >15 months after infusion; IMA203 GEN1 continues to be well tolerated; company is targeting registration-enabling Phase 2 trial in melanoma to commence in 2024; update on the clinical development plan in 1Q 2024First clinical data on ACTengine® IMA203CD8 GEN2 TCR-T targeting PRAME de |

Immatics Reports Interim Clinical Data from ACTengine® IMA203 and IMA203CD8 TCR-T Monotherapies Targeting PRAME in an Ongoing Phase 1 TrialCompany to host conference call and webcast today, November 8, at 8:30 am EST/2:30 pm CET IMA203 data with focus on melanoma patients presented at the International Congress of the Society for Melanoma Research today, November 8 IMA203 GEN1 TCR cell therapy targeting PRAME – update on Phase 1a and Cohort A Continues to be well tolerated50% confirmed objective response rate (cORR) in melanoma patients treated at recommended Phase 2 dose; durability with some ongoing responses at >15 months and me |

Immatics (NASDAQ:IMTX) Is In A Good Position To Deliver On Growth PlansJust because a business does not make any money, does not mean that the stock will go down. For example, biotech and... |

Immatics Receives FDA Regenerative Medicine Advanced Therapy (RMAT) Designation for ACTengine® IMA203 TCR-T MonotherapyRMAT designation granted by FDA CBER for IMA203 cell therapy in multiple PRAME-expressing tumors including cutaneous and uveal melanoma, ovarian cancer and other cancer typesRegulatory activities underway with an initial focus on a registration-directed trial in melanoma as step one to leverage the full breadth of PRAME Houston, Texas and Tuebingen, Germany, October 24, 2023 – Immatics N.V. (NASDAQ: IMTX, “Immatics”), a clinical-stage biopharmaceutical company active in the discovery and develop |

IMTX Price Returns

| 1-mo | -12.26% |

| 3-mo | -10.66% |

| 6-mo | 17.32% |

| 1-year | 42.08% |

| 3-year | -15.24% |

| 5-year | N/A |

| YTD | -2.85% |

| 2023 | 20.90% |

| 2022 | -35.19% |

| 2021 | 24.56% |

| 2020 | N/A |

| 2019 | 0.00% |

Loading social stream, please wait...