JanOne Inc. (JAN): Price and Financial Metrics

JAN Price/Volume Stats

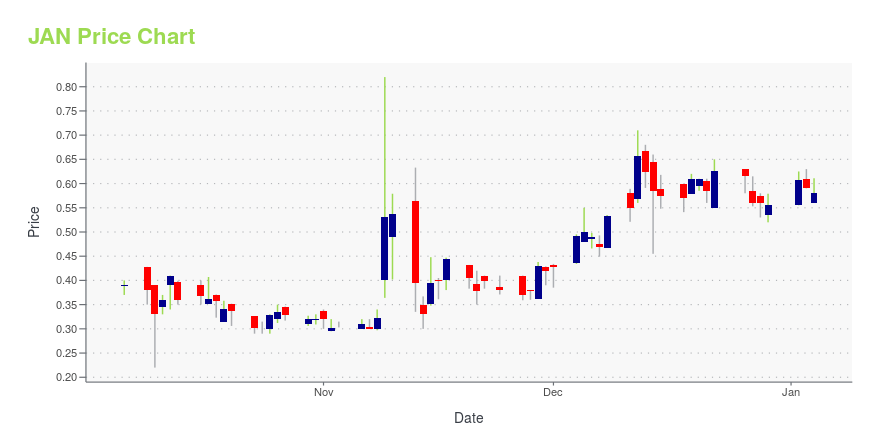

| Current price | $3.82 | 52-week high | $4.08 |

| Prev. close | $3.08 | 52-week low | $0.22 |

| Day low | $3.11 | Volume | 631,547 |

| Day high | $4.08 | Avg. volume | 263,039 |

| 50-day MA | $2.01 | Dividend yield | N/A |

| 200-day MA | $0.94 | Market Cap | 32.83M |

JAN Stock Price Chart Interactive Chart >

JanOne Inc. (JAN) Company Bio

JanOne Inc. develops treatments for conditions that cause severe pain. The company, through its non-addictive pain-relieving drugs, focuses on reduction for need of opioid prescriptions to treat disease associated pain that can lead to opioid abuse. Its lead candidate JAN101 provides slow-release formulation of sodium nitrite therapeutic for treatment of peripheral artery disease (PAD). The company was formerly known as Appliance Recycling Centers of America, Inc. and changed its name to JanOne Inc. in September 2019. JanOne Inc. was founded in 1976 and is headquartered in Las Vegas, Nevada.

Latest JAN News From Around the Web

Below are the latest news stories about JANONE INC that investors may wish to consider to help them evaluate JAN as an investment opportunity.

Why Is Assertio (ASRT) Stock Down 39% Today?Assertio stock is dropping on Thursday as investors in ASRT react to the company's poor earnings results for the third quarter of 2023. |

Why Is Atara Biotherapeutics (ATRA) Stock Down 50% Today?Atara Biotherapeutics stock is falling on Thursday as investors in ATRA react to the company's latest Phase 2 clinical trial data. |

Why Is JanOne (JAN) Stock Up 40% Today?JanOne stock is climbing higher on Thursday with heavy trading of JAN shares despite a lack of news from the biopharmaceutical company. |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start the day with a breakdown of the biggest pre-market stock movers worth keeping tabs on for Thursday morning! |

JanOne to Present at the Dawson James 8th Annual Investment ConferenceJanOne (Nasdaq: JAN), the biopharmaceutical company focused on developing non-addicting painkillers and novel treatments for the causes of pain, will participate in investor sessions at the Dawson James Securities 8th Annual Investment Conference in Jupiter, Florida. JanOne's Chief Medical Officer, Dr. Amol Soin, will attend the October 12, day-long conference and present JanOne's mission and progress. |

JAN Price Returns

| 1-mo | 32.64% |

| 3-mo | 664.00% |

| 6-mo | 1,023.53% |

| 1-year | 257.01% |

| 3-year | -55.37% |

| 5-year | 17.72% |

| YTD | 588.29% |

| 2023 | -59.49% |

| 2022 | -66.50% |

| 2021 | -16.36% |

| 2020 | 65.20% |

| 2019 | 34.55% |

Loading social stream, please wait...