Kintara Therapeutics, Inc. (KTRA): Price and Financial Metrics

KTRA Price/Volume Stats

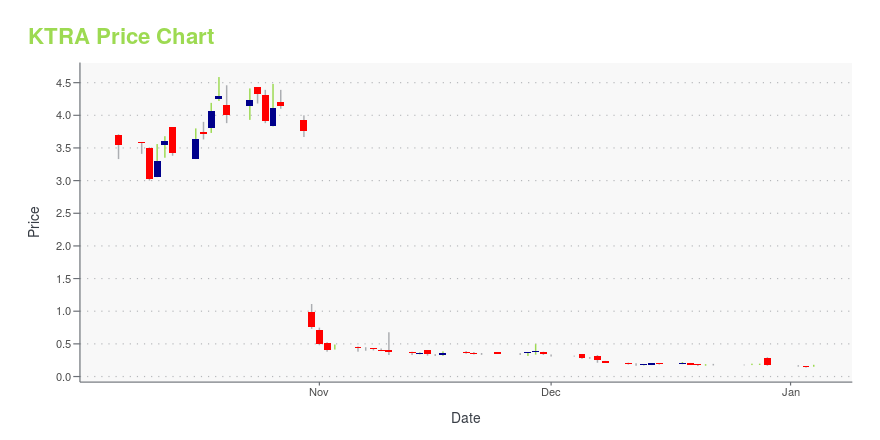

| Current price | $0.14 | 52-week high | $5.98 |

| Prev. close | $0.13 | 52-week low | $0.08 |

| Day low | $0.13 | Volume | 5,977,200 |

| Day high | $0.14 | Avg. volume | 13,265,630 |

| 50-day MA | $0.11 | Dividend yield | N/A |

| 200-day MA | $1.72 | Market Cap | 5.36M |

KTRA Stock Price Chart Interactive Chart >

Kintara Therapeutics, Inc. (KTRA) Company Bio

Kintara Therapeutics, Inc., a clinical stage drug development company, focuses on developing and commercializing anti-cancer therapies to treat cancer patients. It is developing two late-stage, Phase III-ready therapeutics, including VAL-083, a DNA-targeting agent for the treatment of drug-resistant solid tumors, such as glioblastoma multiforme, as well as other solid tumors, including ovarian cancer, non-small cell lung cancer, and diffuse intrinsic pontine glioma; and REM-001, a photodynamic therapy for the treatment of cutaneous metastatic breast cancer. The company has a strategic collaboration with Guangxi Wuzhou Pharmaceutical (Group) Co. Ltd. to manufacture and sell VAL-083 in China. The company was formerly known as DelMar Pharmaceuticals, Inc. and changed its name to Kintara Therapeutics, Inc. in August 2020. Kintara Therapeutics, Inc. was founded in 2009 and is headquartered in San Diego, California.

Latest KTRA News From Around the Web

Below are the latest news stories about KINTARA THERAPEUTICS INC that investors may wish to consider to help them evaluate KTRA as an investment opportunity.

Kintara Therapeutics Announces Review of Strategic AlternativesKintara Therapeutics, Inc. (Nasdaq: KTRA) ("Kintara" or the "Company"), a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced that its Board of Directors has initiated a process to explore and review a range of strategic alternatives focused on maximizing stockholder value. |

Kintara Therapeutics Granted Extension by Nasdaq to Regain Compliance with the Stockholders' Equity Continued Listing RequirementKintara Therapeutics, Inc. (Nasdaq: KTRA) ("Kintara" or the "Company"), a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced that it received notice from the Staff of the Listing Qualifications Department (the "Staff") of The Nasdaq Stock Market LLC ("Nasdaq") that the Staff has determined to grant the Company an extension of time to regain compliance with Listing Rule 5550(b) (the "Rule"). The Rule requires a minimum $2,500,000 stockholders |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on WednesdayIt's time to dive into the biggest pre-market stock movers as we check out all of the hottest news worth reading about on Wednesday! |

Kintara Therapeutics Announces Fiscal 2024 First Quarter Financial Results and Provides Corporate UpdateKintara Therapeutics, Inc. (Nasdaq: KTRA) ("Kintara" or the "Company"), a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced financial results for its fiscal first quarter ended September 30, 2023 and provided a corporate update. |

Kintara Therapeutics Announces Preliminary Topline Results From GBM AGILE StudyKintara Therapeutics, Inc. (Nasdaq: KTRA) ("Kintara" or the "Company"), a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced that preliminary topline results from the Glioblastoma Adaptive Global Innovative Learning Environment (GBM AGILE) study showed that VAL-083 did not perform better than the current standards of care in glioblastoma. These topline results included preliminary safety data for VAL-083 that was similar to that of the curre |

KTRA Price Returns

| 1-mo | 55.90% |

| 3-mo | 5.03% |

| 6-mo | -96.62% |

| 1-year | -95.00% |

| 3-year | -99.82% |

| 5-year | -99.92% |

| YTD | -17.45% |

| 2023 | -97.54% |

| 2022 | -72.98% |

| 2021 | -60.16% |

| 2020 | 85.59% |

| 2019 | -79.71% |

Loading social stream, please wait...