Kazia Therapeutics Limited (KZIA): Price and Financial Metrics

KZIA Price/Volume Stats

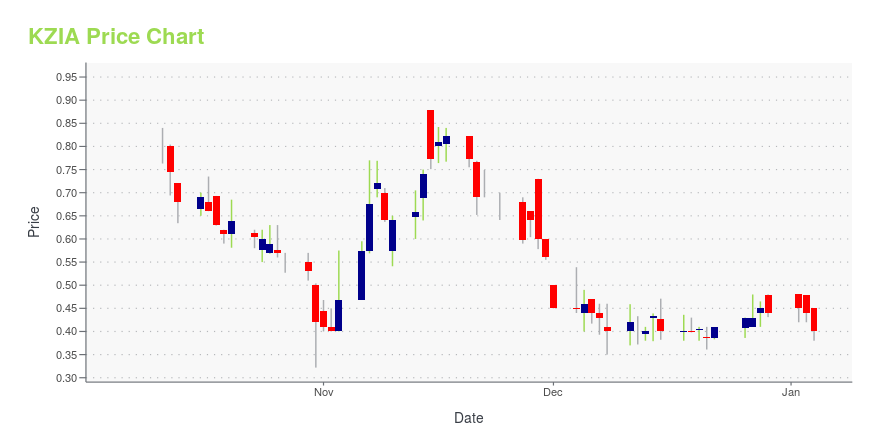

| Current price | $0.38 | 52-week high | $1.43 |

| Prev. close | $0.40 | 52-week low | $0.19 |

| Day low | $0.37 | Volume | 34,225 |

| Day high | $0.39 | Avg. volume | 740,507 |

| 50-day MA | $0.30 | Dividend yield | N/A |

| 200-day MA | $0.60 | Market Cap | 6.21M |

KZIA Stock Price Chart Interactive Chart >

Kazia Therapeutics Limited (KZIA) Company Bio

Kazia Therapeutics Limited, an oncology-focused biotechnology company, develops anti-cancer drugs. Its lead development candidate is GDC-0084, a small molecule, brain-penetrant inhibitor of the PI3K/Akt/mTor pathway, which is developed as a potential therapy for glioblastoma. The company is also developing Cantrixil, which is being developed for the treatment of ovarian cancer and is in hospitals across Australia and the United States under an Investigational New Drug application. Kazia Therapeutics Limited has collaboration agreements with St Jude Childrens Hospital; Dana-Farber Cancer Institute; Alliance for Clinical Trials in Oncology; Memorial Sloan Kettering Cancer Centre; and University of Newcastle. Kazia Therapeutics Limited has collaboration with Dana-Farber Cancer Institute to investigate the use of Kazia's investigational new drug, paxalisib, in primary central nervous system lymphoma; and Kintara Therapeutics, Inc. for the activation of paxalisib and VAL-083. The company was formerly known as Novogen Limited and changed its name to Kazia Therapeutics Limited in November 2017. Kazia Therapeutics Limited was founded in 1994 and is based in Sydney, Australia.

Latest KZIA News From Around the Web

Below are the latest news stories about KAZIA THERAPEUTICS LTD that investors may wish to consider to help them evaluate KZIA as an investment opportunity.

Kazia Therapeutics files to sell 591,697 ADSs for holdersMore on Kazia |

Kazia Therapeutics Announces Closing of $2 Million Registered Direct OfferingKazia Therapeutics Limited (NASDAQ: KZIA) ("Kazia" or the "Company"), an oncology-focused drug development company, today announced the closing of its previously announced purchase and sale of up to an aggregate of 4,444,445 of the Company's American Depositary Shares ("ADSs") (or ADS equivalents in lieu thereof), each ADS representing ten (10) ordinary shares of the Company, at a purchase price of $0.45 per ADS (or ADS equivalent in lieu thereof), in a registered direct offering. The Company al |

Kazia Therapeutics Announces $2 Million Registered Direct OfferingKazia Therapeutics Limited (NASDAQ: KZIA) ("Kazia" or the "Company"), an oncology-focused drug development company, today announced that it has entered into a definitive agreement for the purchase and sale of up to an aggregate of 4,444,445 of the Company's American Depositary Shares ("ADSs") (or ADS equivalents in lieu thereof), each ADS representing ten (10) ordinary shares of the Company, at a purchase price of $0.45 per ADS (or ADS equivalent in lieu thereof), in a registered direct offering |

KAZIA ANNOUNCES NON-BINDING LETTER OF INTENT FOR THE PROPOSED GRANTING OF RIGHTS TO DEVELOP AND COMMERCIALIZE PAXALISIB OUTSIDE OF ONCOLOGYKazia Therapeutics Limited (NASDAQ: KZIA), an oncology-focused drug development company, is pleased to announce that it has signed a non-binding Letter of Intent (LOI) with an undisclosed biotechnology company for the license of worldwide rights, other than mainland China, Hong Kong, Macao and Taiwan, to develop and commercialize pharmaceutical product containing paxalisib in an indication outside of cancer. |

KAZIA PROVIDES OVERVIEW OF PAXALISIB RELATED PRESENTATIONS FROM THE SOCIETY OF NEURO-ONCOLOGY 2023 ANNUAL MEETINGKazia Therapeutics Limited (NASDAQ: KZIA), an oncology-focused drug development company, is pleased to provide key highlights of the clinical and preclinical paxalisib related presentations given by key thought leaders at the Society of Neuro-Oncology 2023 Annual Meeting. "The 2023 SNO Annual Meeting was another successful event with the latest advances in clinical trials, diagnosis and treatment of pediatric and adult patients with CNS malignancies," stated Dr. John Friend, CEO Kazia. "We are h |

KZIA Price Returns

| 1-mo | 41.79% |

| 3-mo | 2.84% |

| 6-mo | -33.33% |

| 1-year | -71.34% |

| 3-year | -96.59% |

| 5-year | -89.14% |

| YTD | -13.54% |

| 2023 | -28.52% |

| 2022 | -92.70% |

| 2021 | -2.55% |

| 2020 | 99.08% |

| 2019 | 78.60% |

Continue Researching KZIA

Want to see what other sources are saying about Kazia Therapeutics Ltd's financials and stock price? Try the links below:Kazia Therapeutics Ltd (KZIA) Stock Price | Nasdaq

Kazia Therapeutics Ltd (KZIA) Stock Quote, History and News - Yahoo Finance

Kazia Therapeutics Ltd (KZIA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...