Landos Biopharma, Inc. (LABP): Price and Financial Metrics

LABP Price/Volume Stats

| Current price | $22.07 | 52-week high | $22.19 |

| Prev. close | $22.15 | 52-week low | $2.50 |

| Day low | $22.07 | Volume | 830 |

| Day high | $22.19 | Avg. volume | 21,956 |

| 50-day MA | $13.07 | Dividend yield | N/A |

| 200-day MA | $6.33 | Market Cap | 68.84M |

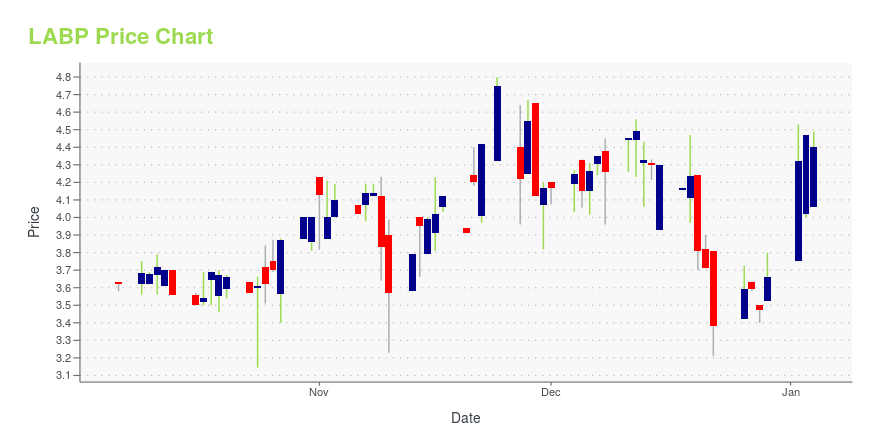

LABP Stock Price Chart Interactive Chart >

Landos Biopharma, Inc. (LABP) Company Bio

Landos Biopharma, Inc. operates as a pharmaceutical company. The Company discovers and develops oral therapeutics for patients with autoimmune diseases. Landos Biopharma serves customers worldwide.

Latest LABP News From Around the Web

Below are the latest news stories about LANDOS BIOPHARMA INC that investors may wish to consider to help them evaluate LABP as an investment opportunity.

Landos Biopharma Publishes Results of NX-13 Phase 1b Study in Ulcerative Colitis in Journal of Crohn’s and ColitisNX-13, a Novel, Oral, NLRX1 Agonist, was Observed to be Well Tolerated and Demonstrated Early Signs of Rapid Symptomatic Relief and Endoscopic Improvement in Patients with Ulcerative Colitis NEXUS Phase 2 Proof-of-Concept Study is Ongoing, with Top-Line Readout Expected in Q4 2024 NEW YORK, Nov. 21, 2023 (GLOBE NEWSWIRE) -- Landos Biopharma, Inc. (NASDAQ: LABP), a clinical-stage biopharmaceutical company developing novel, oral medicines for patients with autoimmune diseases, today announced a pe |

Landos Biopharma Provides Company Update and Reports Third Quarter 2023 ResultsNEXUS Phase 2 Clinical Trial of NX-13 for Ulcerative Colitis Remains On Track with Top-line Results Planned for Q4 2024 Sufficient Cash to Fund Planned Operations into First Half of 2025 NEW YORK, Nov. 09, 2023 (GLOBE NEWSWIRE) -- Landos Biopharma, Inc. (NASDAQ: LABP), a clinical-stage biopharmaceutical company developing novel, oral medicines for patients with autoimmune diseases, today provided a business update and announced financial results for the quarter ended September 30, 2023. “The NX- |

Landos Biopharma to Present at the American College of Gastroenterology 2023 Annual Scientific MeetingNEW YORK, Oct. 23, 2023 (GLOBE NEWSWIRE) -- Landos Biopharma, Inc. (NASDAQ: LABP), a clinical-stage biopharmaceutical company developing novel, oral medicines for patients with autoimmune diseases, today announced that it will present additional findings from its Phase 1b study of NX-13 for the treatment of ulcerative colitis (UC), including detailed results on the rapid symptomatic relief and improvement in multiple clinical biomarkers observed in the study, at the American College of Gastroent |

Landos Biopharma to Present New Data on NX-13 from Phase 1b Trial in Ulcerative Colitis at United European Gastroenterology (UEG) Week 2023 CongressNX-13 Demonstrated Rapid Symptomatic Relief and Improvement in Multiple Biomarkers that Correlated With Early Endoscopic Response in Patients With Ulcerative Colitis (UC) NEXUS Phase 2 Clinical Trial is Ongoing; Top-line Readout Expected in Q4 2024 NEW YORK, Sept. 19, 2023 (GLOBE NEWSWIRE) -- Landos Biopharma, Inc. (NASDAQ: LABP), a clinical-stage biopharmaceutical company developing novel, oral medicines for patients with autoimmune diseases, today announced presentation of new data on the rapi |

Landos Biopharma Announces Strategic Research Collaboration with KU Leuven and University Hospitals Leuven to Further Characterize the Effects of NX-13 on Epithelial CellsCollaboration Will Focus on Defining the Effects Of NX-13 in Ulcerative Colitis Patient Derived Organoid ModelsNEW YORK, Sept. 14, 2023 (GLOBE NEWSWIRE) -- Landos Biopharma, Inc. (NASDAQ: LABP), a clinical-stage biopharmaceutical company developing novel, oral medicines for patients with autoimmune diseases, today announced a strategic research collaboration to investigate the effects of NX-13 on epithelial cells with the Inflammatory Bowel Disease (IBD) Team at KU Leuven and University Hospital |

LABP Price Returns

| 1-mo | 3.13% |

| 3-mo | 361.40% |

| 6-mo | 470.28% |

| 1-year | 661.03% |

| 3-year | -78.32% |

| 5-year | N/A |

| YTD | 503.01% |

| 2023 | -26.81% |

| 2022 | -89.58% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...