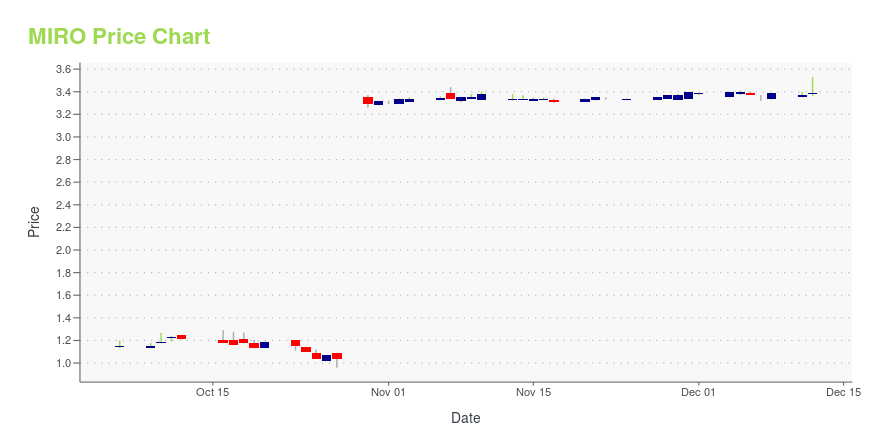

Miromatrix Medical Inc. (MIRO): Price and Financial Metrics

MIRO Price/Volume Stats

| Current price | $3.39 | 52-week high | $4.35 |

| Prev. close | $3.37 | 52-week low | $0.91 |

| Day low | $3.36 | Volume | 632,100 |

| Day high | $3.53 | Avg. volume | 80,095 |

| 50-day MA | $2.52 | Dividend yield | N/A |

| 200-day MA | $1.72 | Market Cap | 92.95M |

MIRO Stock Price Chart Interactive Chart >

Miromatrix Medical Inc. (MIRO) Company Bio

Miromatrix Medical Inc. engages in the development of biological human organs to solve the chronic shortage of transplantable organs. The company also develops organ-derived biological products for various applications, such as soft tissue reinforcement and wound care. It uses its perfusion decellularization/recellularization technology to engineer transplantable organs for the people who need them. Miromatrix Medical Inc. has strategical partnerships with The Mayo Clinic, Mount Sinai Hospital, and The Texas Heart Institute. Miromatrix Medical Inc. was formerly known as TayTech, Inc. The company was incorporated in 2009 and is headquartered in Eden Prairie, Minnesota.

Latest MIRO News From Around the Web

Below are the latest news stories about MIROMATRIX MEDICAL INC that investors may wish to consider to help them evaluate MIRO as an investment opportunity.

United Therapeutics and Miromatrix Medical Announce Completion of Tender Offer and MergerSILVER SPRING, Md. & RESEARCH TRIANGLE PARK, N.C. & EDEN PRAIRIE, Minn., December 13, 2023--United Therapeutics Corporation (Nasdaq: UTHR) and Miromatrix Medical Inc. (Nasdaq: MIRO) announced today that United Therapeutics, through its wholly owned subsidiary Morpheus Subsidiary Inc. ("Merger Sub"), has successfully completed the previously announced tender offer to acquire all outstanding shares of Miromatrix for a purchase price of $3.25 per share in cash at closing and an additional $1.75 per |

United Therapeutics and Miromatrix Medical Announce Successful Tender OfferSILVER SPRING, Md. & RESEARCH TRIANGLE PARK, N.C. & EDEN PRAIRIE, Minn., December 12, 2023--United Therapeutics Corporation (Nasdaq: UTHR) and Miromatrix Medical Inc. (Nasdaq: MIRO) announced today the results of the previously announced tender offer by Morpheus Subsidiary Inc. ("Merger Sub"), a wholly owned subsidiary of United Therapeutics, to acquire all outstanding shares of Miromatrix for a purchase price of $3.25 per share in cash at closing and an additional $1.75 per share in cash upon t |

Miromatrix Reports Third Quarter 2023 ResultsEDEN PRAIRIE, Minn., Nov. 14, 2023 (GLOBE NEWSWIRE) -- Miromatrix Medical Inc. (Nasdaq: MIRO) (the “Company”), a life sciences company pioneering a novel technology for bioengineering fully transplantable organs to help save and improve patients' lives, today reported third quarter 2023 financial results. Due to the Company’s pending proposed transaction with United Therapeutics Corporation (Nasdaq: UTHR) (“United Therapeutics”), the Company’s management has suspended guidance for 2023 and will |

Six Flags' pact with Cedar Fair; Disney's Hulu buy: 4 big deal reportsHere is your Pro Recap of 4 head-turning deal dispatches you may have missed last week: Disney to buy the remaining stake in Hulu from Comcast's NBCUniversal, and deals at Six Flags Entertainment/Cedar Fair, Realty Income/Spirit Realty Capital, and United Therapeutics/Miromatrix Medical. On Thursday, in line with recent speculation, the amusement park companies Cedar Fair (NYSE:FUN) and Six Flags Entertainment (NYSE:SIX) disclosed their agreement to merge in an all-stock transaction. Upon completion of the merger, Cedar Fair's unitholders will hold a majority stake of 51.2%, while Six Flags' shareholders will possess around 48.8% in the newly formed entity, which is projected to have a pro forma enterprise value close to $8 billion. |

Why Is Conduit Pharmaceuticals (CDT) Stock Up 66% Today?Conduit Pharmaceuticals stock is rising higher on Monday with heavy trading of CDT shares despite a lack of news from the company. |

MIRO Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | 200.00% |

| 1-year | 151.11% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -36.25% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...