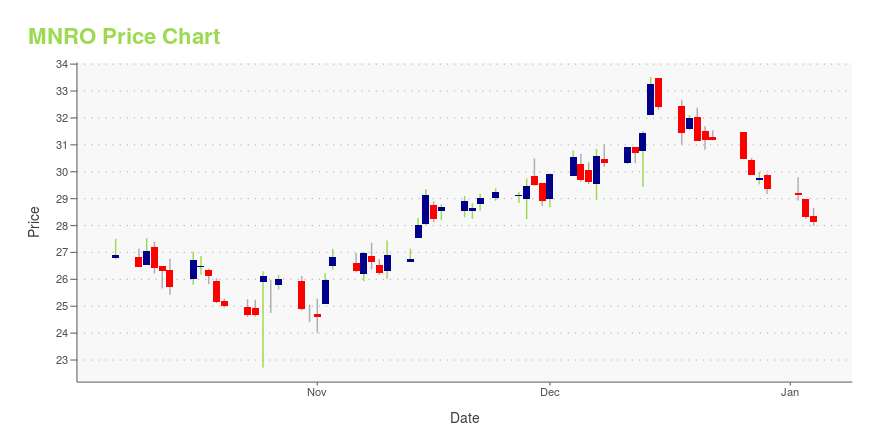

Monro, Inc. (MNRO): Price and Financial Metrics

MNRO Price/Volume Stats

| Current price | $29.58 | 52-week high | $50.20 |

| Prev. close | $29.74 | 52-week low | $22.72 |

| Day low | $29.38 | Volume | 217,000 |

| Day high | $29.98 | Avg. volume | 403,812 |

| 50-day MA | $31.20 | Dividend yield | 3.75% |

| 200-day MA | $31.01 | Market Cap | 884.50M |

MNRO Stock Price Chart Interactive Chart >

Monro, Inc. (MNRO) Company Bio

Monro Muffler Brake Inc. operates a chain of stores providing automotive undercar repair and tire services in the United States. The company was founded in 1957 and is based in Rochester, New York.

Latest MNRO News From Around the Web

Below are the latest news stories about MONRO INC that investors may wish to consider to help them evaluate MNRO as an investment opportunity.

MNRO vs. MCW: Which Stock Is the Better Value Option?MNRO vs. MCW: Which Stock Is the Better Value Option? |

What Makes Monro (MNRO) a New Buy StockMonro (MNRO) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term. |

Monro's (NASDAQ:MNRO) Returns On Capital Not Reflecting Well On The BusinessIf you're looking at a mature business that's past the growth phase, what are some of the underlying trends that pop... |

Do These 3 Checks Before Buying Monro, Inc. (NASDAQ:MNRO) For Its Upcoming DividendMonro, Inc. ( NASDAQ:MNRO ) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs one day... |

Monro, Inc. Declares Quarterly Cash DividendROCHESTER, N.Y., November 29, 2023--Monro, Inc. (Nasdaq: MNRO), a leading provider of automotive undercar repair and tire services, today announced that its Board of Directors has declared a quarterly cash dividend of $.28 per share on the Company’s outstanding shares of common stock, including the shares of common stock to which the holders of the Company’s Class C Convertible Preferred Stock are entitled. The dividend is payable on December 19, 2023 to shareholders at the close of business on |

MNRO Price Returns

| 1-mo | -2.50% |

| 3-mo | 1.60% |

| 6-mo | 20.49% |

| 1-year | -36.52% |

| 3-year | -51.62% |

| 5-year | -59.64% |

| YTD | 1.70% |

| 2023 | -33.10% |

| 2022 | -20.59% |

| 2021 | 11.13% |

| 2020 | -30.65% |

| 2019 | 15.00% |

MNRO Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MNRO

Want to do more research on Monro Inc's stock and its price? Try the links below:Monro Inc (MNRO) Stock Price | Nasdaq

Monro Inc (MNRO) Stock Quote, History and News - Yahoo Finance

Monro Inc (MNRO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...