Vail Resorts Inc. (MTN): Price and Financial Metrics

MTN Price/Volume Stats

| Current price | $223.55 | 52-week high | $258.13 |

| Prev. close | $226.51 | 52-week low | $204.88 |

| Day low | $222.97 | Volume | 473,300 |

| Day high | $226.78 | Avg. volume | 469,371 |

| 50-day MA | $225.41 | Dividend yield | 3.91% |

| 200-day MA | $226.48 | Market Cap | 8.49B |

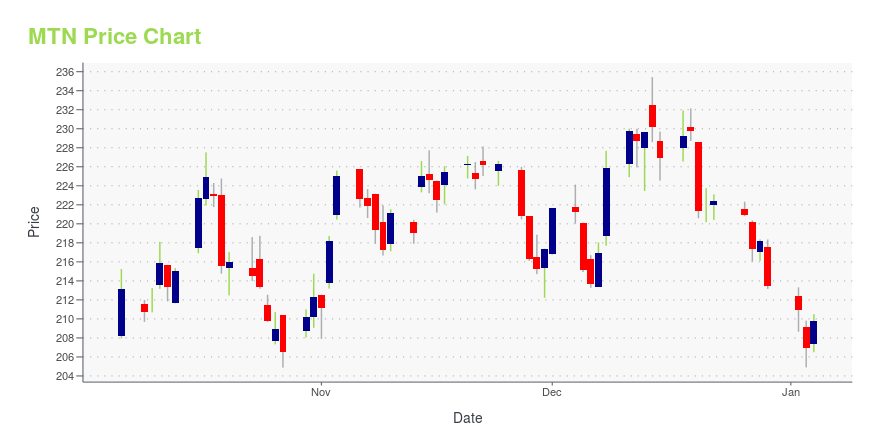

MTN Stock Price Chart Interactive Chart >

Vail Resorts Inc. (MTN) Company Bio

Vail Resorts, Inc. is an American mountain resort company headquartered in Broomfield, Colorado. The company is divided into three divisions. The mountain segment owns and operates 40 mountain resorts in four countries, Vail Resorts Hospitality owns or manages hotels, lodging, condominiums and golf courses, and the Vail Resorts Development Company oversees property development and real estate holdings. (Source:Wikipedia)

Latest MTN News From Around the Web

Below are the latest news stories about VAIL RESORTS INC that investors may wish to consider to help them evaluate MTN as an investment opportunity.

Warmer Weather Is Wreaking Havoc on Natural-Gas Prices and Your Next Ski TripNatural gas is on pace for its largest one year percentage decline since 2006, according to Dow Jones Market Data. |

Vail Resorts Inc Director Hilary Schneider Sells 2,565 SharesOn December 20, 2023, Director Hilary Schneider sold 2,565 shares of Vail Resorts Inc (NYSE:MTN), as reported in a recent SEC filing. |

Vail Resorts (MTN) Stock Down 6% YTD: Can It Revive in 2024?Vail Resorts (MTN) performance in 2024 is likely to benefit from its extensive Epic Pass offerings and digital initiatives. |

Vail Resorts Inc's Dividend AnalysisVail Resorts Inc (NYSE:MTN) recently announced a dividend of $2.06 per share, payable on 2024-01-09, with the ex-dividend date set for 2023-12-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Vail Resorts Inc's dividend performance and assess its sustainability. |

Do These 3 Checks Before Buying Vail Resorts, Inc. (NYSE:MTN) For Its Upcoming DividendVail Resorts, Inc. ( NYSE:MTN ) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs one day... |

MTN Price Returns

| 1-mo | 1.17% |

| 3-mo | 1.69% |

| 6-mo | 5.52% |

| 1-year | -7.46% |

| 3-year | -23.88% |

| 5-year | 20.35% |

| YTD | 5.80% |

| 2023 | -7.06% |

| 2022 | -24.89% |

| 2021 | 18.15% |

| 2020 | 17.77% |

| 2019 | 17.34% |

MTN Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching MTN

Want to do more research on Vail Resorts Inc's stock and its price? Try the links below:Vail Resorts Inc (MTN) Stock Price | Nasdaq

Vail Resorts Inc (MTN) Stock Quote, History and News - Yahoo Finance

Vail Resorts Inc (MTN) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...