Matinas Biopharma Holdings, Inc. (MTNB): Price and Financial Metrics

MTNB Price/Volume Stats

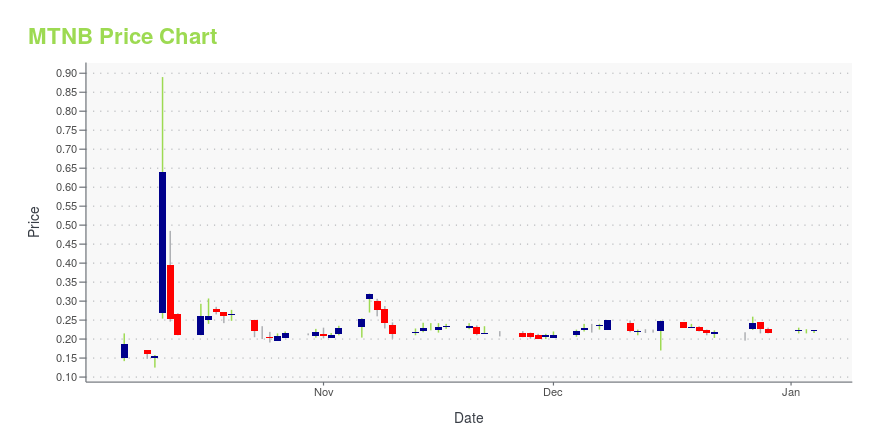

| Current price | $0.18 | 52-week high | $0.89 |

| Prev. close | $0.18 | 52-week low | $0.11 |

| Day low | $0.18 | Volume | 60,476 |

| Day high | $0.19 | Avg. volume | 1,388,768 |

| 50-day MA | $0.25 | Dividend yield | N/A |

| 200-day MA | $0.23 | Market Cap | 39.52M |

MTNB Stock Price Chart Interactive Chart >

Matinas Biopharma Holdings, Inc. (MTNB) Company Bio

Matinas BioPharma Holdings, Inc., a clinical-stage biopharmaceutical company, focuses on identifying and developing therapeutics for the treatment of fungal and bacterial infections.

Latest MTNB News From Around the Web

Below are the latest news stories about MATINAS BIOPHARMA HOLDINGS INC that investors may wish to consider to help them evaluate MTNB as an investment opportunity.

Matinas BioPharma Demonstrates in vivo Biological Activity and Disease Improvement in Two Inflammatory Disease Models with Oral LNC-Delivered Small OligonucleotidesIn an acute colitis model, data show statistically significant knockdown of elevated levels of serum TNFα, reductions in tissue TNFα mRNA and improvement in disease activity scores In an acute psoriasis model, data show reductions in tissue IL-17A mRNA and improvement in clinical disease markers including skin lesions BEDMINSTER, N.J, Dec. 27, 2023 (GLOBE NEWSWIRE) -- Matinas BioPharma Holdings, Inc. (NYSE American: MTNB), a clinical-stage biopharmaceutical company focused on delivering groundbr |

Matinas BioPharma Provides Update to MAT2203 Regulatory and Development Pathway Following Feedback from FDAWritten Preliminary Comments on the Phase 3 Registration Trial for MAT2203 Move Company Closer to Full Alignment with FDA Matinas to Meet with FDA Early in the First Quarter of 2024 to Finalize Phase 3 Study Design Partnership Discussions Remain Ongoing for MAT2203 BEDMINSTER, N.J., Dec. 21, 2023 (GLOBE NEWSWIRE) -- Matinas BioPharma Holdings, Inc. (NYSE American: MTNB), a clinical-stage biopharmaceutical company focused on delivering groundbreaking therapies using its lipid nanocrystal (LNC) pl |

Matinas BioPharma Holdings, Inc. (AMEX:MTNB) Q3 2023 Earnings Call TranscriptMatinas BioPharma Holdings, Inc. (AMEX:MTNB) Q3 2023 Earnings Call Transcript November 8, 2023 Matinas BioPharma Holdings, Inc. reports earnings inline with expectations. Reported EPS is $-0.03 EPS, expectations were $-0.03. Operator: Welcome to the Matinas BioPharma Third Quarter 2023 Financial Results Conference Call. Currently, all participants are in a listen-only mode. Following management’s prepared remarks, […] |

12 Best Day Trading Stocks To BuyIn this article, we discuss the 12 best day trading stocks to buy. If you want to read about some more day trading stocks, go directly to 5 Best Day Trading Stocks To Buy. Over the past few years, the rise of a new generation of stock traders that like to engage in risky bets, […] |

Q3 2023 Matinas BioPharma Holdings Inc Earnings CallQ3 2023 Matinas BioPharma Holdings Inc Earnings Call |

MTNB Price Returns

| 1-mo | -37.97% |

| 3-mo | -5.11% |

| 6-mo | -16.28% |

| 1-year | -72.73% |

| 3-year | -79.65% |

| 5-year | -82.69% |

| YTD | -16.74% |

| 2023 | -56.76% |

| 2022 | -50.50% |

| 2021 | -25.74% |

| 2020 | -40.09% |

| 2019 | 281.51% |

Loading social stream, please wait...