Norwood Financial Corp. (NWFL): Price and Financial Metrics

NWFL Price/Volume Stats

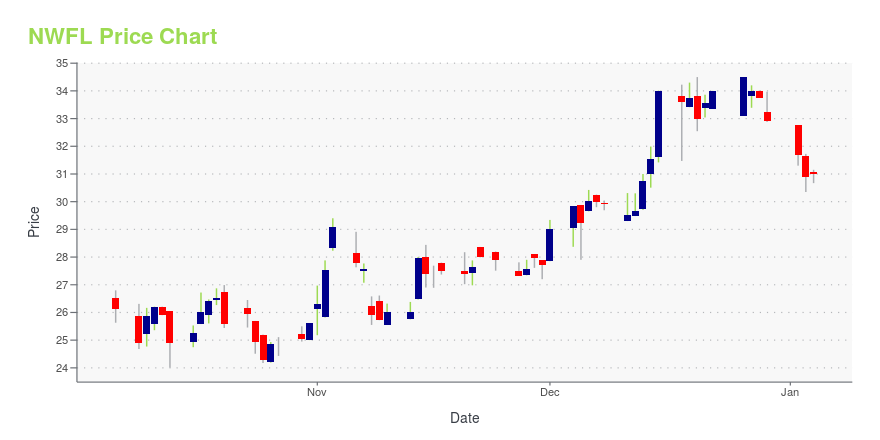

| Current price | $24.29 | 52-week high | $34.50 |

| Prev. close | $23.55 | 52-week low | $23.50 |

| Day low | $23.50 | Volume | 6,947 |

| Day high | $24.29 | Avg. volume | 11,283 |

| 50-day MA | $26.07 | Dividend yield | 5.09% |

| 200-day MA | $27.91 | Market Cap | 196.99M |

NWFL Stock Price Chart Interactive Chart >

Norwood Financial Corp. (NWFL) Company Bio

Norwood Financial Corp. operates as the bank holding company for Wayne Bank that provides various banking products and services in Pennsylvania. The company was founded in 1870 and is based in Honesdale, Pennsylvania.

Latest NWFL News From Around the Web

Below are the latest news stories about NORWOOD FINANCIAL CORP that investors may wish to consider to help them evaluate NWFL as an investment opportunity.

Norwood Financial's (NASDAQ:NWFL) Shareholders Will Receive A Bigger Dividend Than Last YearNorwood Financial Corp. ( NASDAQ:NWFL ) has announced that it will be increasing its periodic dividend on the 1st of... |

Norwood Financial Corp Increases Cash DividendHONESDALE, Pa., Dec. 14, 2023 (GLOBE NEWSWIRE) -- James O. Donnelly, President and Chief Executive Officer of Norwood Financial Corp (NASDAQ Global Market - NWFL), and its subsidiary Wayne Bank, announced that the Board of Directors declared a $0.30 per share quarterly dividend, payable February 1, 2024, to shareholders of record as of January 12, 2024. The $0.30 per share represents an increase of 3.5% over the cash dividend declared in the third quarter of this year and the fourth quarter of 2 |

Investors in Norwood Financial (NASDAQ:NWFL) have unfortunately lost 8.3% over the last yearNorwood Financial Corp. ( NASDAQ:NWFL ) shareholders should be happy to see the share price up 14% in the last month... |

Dividend Champions List Ranked By Yield: Top 30In this article, we discuss top 30 dividend champions according to dividend yields. You can skip our detailed analysis of dividend stocks and their performance over the years, and go directly to read Dividend Champions List Ranked By Yield: Top 10. Dividend champions are companies that have increased their dividends for 25 years or more. […] |

Norwood Financial Corp (NWFL) Announces Q3 2023 EarningsDecrease in Earnings and Net Interest Income Amid Rising Interest Rates |

NWFL Price Returns

| 1-mo | -7.93% |

| 3-mo | -15.03% |

| 6-mo | -2.93% |

| 1-year | -7.72% |

| 3-year | 11.12% |

| 5-year | -7.85% |

| YTD | -24.52% |

| 2023 | 2.42% |

| 2022 | 34.10% |

| 2021 | 3.36% |

| 2020 | -30.30% |

| 2019 | 21.46% |

NWFL Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching NWFL

Want to do more research on Norwood Financial Corp's stock and its price? Try the links below:Norwood Financial Corp (NWFL) Stock Price | Nasdaq

Norwood Financial Corp (NWFL) Stock Quote, History and News - Yahoo Finance

Norwood Financial Corp (NWFL) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...