One Stop Systems, Inc. (OSS): Price and Financial Metrics

OSS Price/Volume Stats

| Current price | $2.78 | 52-week high | $4.57 |

| Prev. close | $2.98 | 52-week low | $1.56 |

| Day low | $2.77 | Volume | 79,600 |

| Day high | $2.99 | Avg. volume | 112,828 |

| 50-day MA | $3.22 | Dividend yield | N/A |

| 200-day MA | $2.40 | Market Cap | 57.73M |

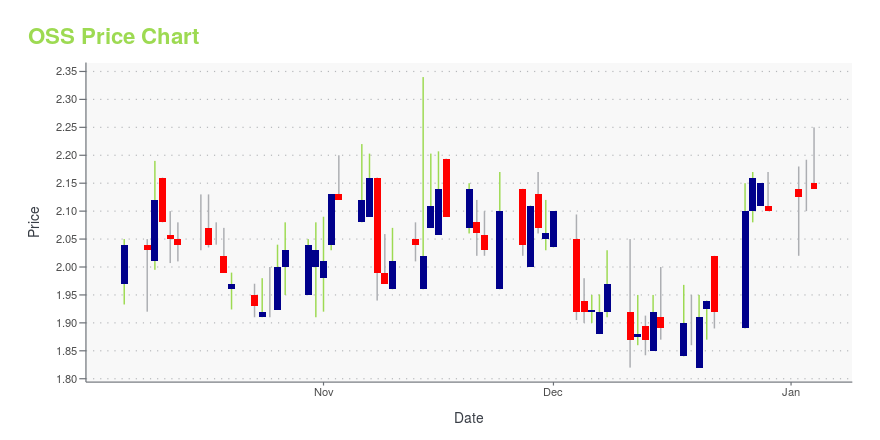

OSS Stock Price Chart Interactive Chart >

One Stop Systems, Inc. (OSS) Company Bio

One Stop Systems, Inc. designs, manufactures, and markets industrial grade computer systems and components that are based on industry standard computer architectures worldwide. The company offers custom built servers; graphical processing unit compute accelerators; flash arrays; peripheral component interconnect expansion products and adaptors; storage management software; and infrastructure as a service solutions. It serves manufacturers of automated equipment used for telecommunication, industrial, and military applications. The company was founded in 1998 and is based in Escondido, California.

Latest OSS News From Around the Web

Below are the latest news stories about ONE STOP SYSTEMS INC that investors may wish to consider to help them evaluate OSS as an investment opportunity.

7 Nano-Cap Stocks That Pack a Serious Punch for Their WeightPlaying in the field of nano-cap stocks is similar to the concept of stealing bases. |

OSS Appoints Technology and Defense Industry Executive, Mitchell H. Herbets, to Board of DirectorsESCONDIDO, Calif., Nov. 30, 2023 (GLOBE NEWSWIRE) -- One Stop Systems, Inc. (Nasdaq: OSS), a leader in rugged high performance compute (HPC) for artificial intelligence (AI), machine learning (ML) and sensor processing at the edge, has appointed Mitchell H. Herbets as a member of its board of directors. Concurrent with the appointment, OSS’ board of directors adopted a resolution to temporarily increase the size of the board from eight members to nine members, effective immediately, and to subse |

OSS to Present at Noble Capital Markets Emerging Growth Equity Conference, December 4, 2023ESCONDIDO, Calif., Nov. 28, 2023 (GLOBE NEWSWIRE) -- One Stop Systems, Inc. (Nasdaq: OSS), a leader in rugged High Performance Compute (HPC) for Artificial Intelligence (AI), Machine Learning and sensor processing at the edge, has been invited to present at the Noble Capital Markets 19th Emerging Growth Equity Conference at the Florida Atlantic University's Executive Education Complex in Boca Raton, Florida on December 4, 2023. OSS CEO Mike Knowles is scheduled to present on Monday, December 4 a |

OSS Wins U.S. Government Program for AI Compute and Storage SolutionOSS AI Edge Solution to Enable Mobile AI Signal Collection AI Compute and Storage Solution OSS Gen 5 PCle® SDS-3U GPU-accelerated Server ESCONDIDO, Calif., Nov. 14, 2023 (GLOBE NEWSWIRE) -- One Stop Systems, Inc. (Nasdaq: OSS), a leader rugged High Performance Compute (HPC) for Artificial Intelligence (AI), Machine Learning and sensor processing at the edge, has won a multi-million-dollar program with Leidos’ Dynetics, a provider of mission-critical solutions for the U.S. government. Under this |

OSS Unveils New Gen 5 AI Transportable Compute ServerOSS Gen 5 Server Doubles Performance -- Powering the Most Demanding Intelligent Edge Applications Gen 5 Short-Depth Server (SDS) OSS new Gen 5 AI Transportable compute server doubles the performance over previous generation for powering the most demanding intelligent edge applications. ESCONDIDO, Calif., Nov. 13, 2023 (GLOBE NEWSWIRE) -- One Stop Systems, Inc. (Nasdaq: OSS), a leader in rugged High Performance Compute (HPC) for Artificial Intelligence (AI), Machine Learning and sensor processing |

OSS Price Returns

| 1-mo | -16.52% |

| 3-mo | 43.30% |

| 6-mo | 44.04% |

| 1-year | 14.64% |

| 3-year | -45.06% |

| 5-year | 15.88% |

| YTD | 32.38% |

| 2023 | -30.23% |

| 2022 | -39.19% |

| 2021 | 23.75% |

| 2020 | 98.02% |

| 2019 | 4.12% |

Continue Researching OSS

Want to see what other sources are saying about One Stop Systems Inc's financials and stock price? Try the links below:One Stop Systems Inc (OSS) Stock Price | Nasdaq

One Stop Systems Inc (OSS) Stock Quote, History and News - Yahoo Finance

One Stop Systems Inc (OSS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...