Pathfinder Bancorp, Inc. (PBHC): Price and Financial Metrics

PBHC Price/Volume Stats

| Current price | $12.19 | 52-week high | $15.90 |

| Prev. close | $12.24 | 52-week low | $11.41 |

| Day low | $12.19 | Volume | 1,000 |

| Day high | $12.19 | Avg. volume | 2,410 |

| 50-day MA | $12.16 | Dividend yield | 3.33% |

| 200-day MA | $13.33 | Market Cap | 57.54M |

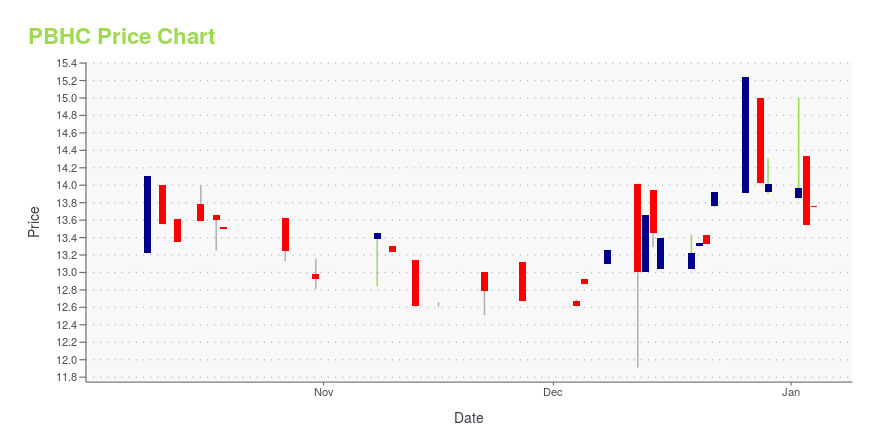

PBHC Stock Price Chart Interactive Chart >

Pathfinder Bancorp, Inc. (PBHC) Company Bio

Pathfinder Bancorp, Inc. operates as a holding company for Pathfinder Bank that provides various banking and financial products and services primarily in Oswego and Onondaga Counties, New York. The company accepts various deposits, including checking, savings, and money market deposit accounts, as well as certificates of deposit, and demand and time deposits. Its loan portfolio comprises commercial real estate loans; commercial loans; residential real estate and construction loans; tax-exempt loans; home equity loans and junior liens; municipal loans; and consumer loans comprising automobile, recreational vehicles, and unsecured personal loans, as well as unsecured lines of credit and loans secured by deposit accounts. The company is also involved in the property, casualty, and life insurance brokerage business. It primarily serves individuals, families, small to mid-size businesses, and municipalities. As of February 03, 2020, it operated through ten full-service offices located in Oswego and Onondaga Counties, as well as one limited purpose office located in Oneida County. Pathfinder Bancorp, Inc. was founded in 1859 and is headquartered in Oswego, New York.

Latest PBHC News From Around the Web

Below are the latest news stories about PATHFINDER BANCORP INC that investors may wish to consider to help them evaluate PBHC as an investment opportunity.

Pathfinder Bancorp, Inc. Declares DividendOSWEGO, N.Y., Dec. 26, 2023 (GLOBE NEWSWIRE) -- James A. Dowd, President and CEO of Pathfinder Bancorp, Inc., the bank holding company of Pathfinder Bank (NASDAQ: PBHC) (listing: PathBcp), has announced that the Company has declared a cash dividend of $0.09 per share on the Company's voting common and non-voting common stock, and a cash dividend of $0.09 per notional share for the issued warrant relating to the fiscal quarter ending December 31, 2023. The fourth quarter 2023 dividend will be pay |

Pathfinder Bancorp (NASDAQ:PBHC) shareholders have endured a 23% loss from investing in the stock a year agoPassive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While... |

Pathfinder Bancorp Inc (PBHC) Reports Q3 2023 Earnings: Net Income Drops to $2.2 MillionDespite challenges, the company sees a 32.0% increase in interest and dividend income |

Pathfinder Bancorp, Inc. Announces Third Quarter 2023 Net Income of $2.2 MillionHighlights Include Continued Deposit Base and Net Interest Margin StabilityOSWEGO, N.Y., Nov. 01, 2023 (GLOBE NEWSWIRE) -- Pathfinder Bancorp, Inc. ("Company") (NASDAQ: PBHC), the holding Company for Pathfinder Bank ("Bank"), announced third quarter 2023 net income available to common shareholders of $2.2 million or $0.35 per basic and diluted share. This reflects a decrease of $1.0 million compared to the $3.2 million or $0.52 per basic and diluted share, earned in the third quarter of 2022. Th |

Pathfinder Bancorp (NASDAQ:PBHC) Is Paying Out A Dividend Of $0.09The board of Pathfinder Bancorp, Inc. ( NASDAQ:PBHC ) has announced that it will pay a dividend on the 10th of... |

PBHC Price Returns

| 1-mo | -1.52% |

| 3-mo | N/A |

| 6-mo | -7.51% |

| 1-year | -19.98% |

| 3-year | -13.88% |

| 5-year | -5.38% |

| YTD | -11.68% |

| 2023 | -25.09% |

| 2022 | 13.48% |

| 2021 | 52.29% |

| 2020 | -15.54% |

| 2019 | -9.70% |

PBHC Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PBHC

Here are a few links from around the web to help you further your research on Pathfinder Bancorp Inc's stock as an investment opportunity:Pathfinder Bancorp Inc (PBHC) Stock Price | Nasdaq

Pathfinder Bancorp Inc (PBHC) Stock Quote, History and News - Yahoo Finance

Pathfinder Bancorp Inc (PBHC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...