Panhandle Oil and Gas Inc (PHX): Price and Financial Metrics

PHX Price/Volume Stats

| Current price | $3.26 | 52-week high | $3.89 |

| Prev. close | $3.30 | 52-week low | $2.51 |

| Day low | $3.25 | Volume | 17,100 |

| Day high | $3.33 | Avg. volume | 60,289 |

| 50-day MA | $3.14 | Dividend yield | 3.64% |

| 200-day MA | $3.31 | Market Cap | 122.11M |

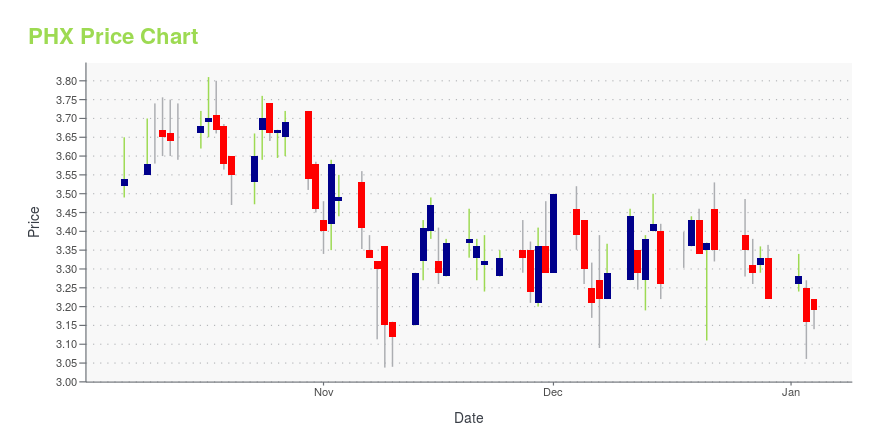

PHX Stock Price Chart Interactive Chart >

Panhandle Oil and Gas Inc (PHX) Company Bio

Panhandle Oil & Gas acquires, develops, and manages oil and natural gas properties in the United States. The company was founded in 1926 and is based in Oklahoma City, Oklahoma.

Latest PHX News From Around the Web

Below are the latest news stories about PHX MINERALS INC that investors may wish to consider to help them evaluate PHX as an investment opportunity.

7 Penny Stocks You’ll Regret Not Buying Soon: November 2023Unlock robust upside potential by wagering on these top penny stocks to buy in a volatile market at this time. |

3 Penny Stocks With Potential to 10x in 2024As the new year approaches, here is a list of potential penny stocks winners to get you started with the right foot. |

PHX Minerals Reports Results for the Quarter Ended Sept. 30, 2023; Increases Fixed Quarterly Dividend 33% and Expands Borrowing BasePHX MINERALS INC., "PHX" or the "Company" (NYSE: PHX), today reported financial and operating results for the quarter ended Sept. 30, 2023. |

PHX Minerals Inc.'s (NYSE:PHX) largest shareholders are individual investors with 41% ownership, institutions own 21%Key Insights PHX Minerals' significant individual investors ownership suggests that the key decisions are influenced by... |

PHX Minerals Inc. to Announce Quarterly Financial Results on Nov. 8 and Host Earnings Call on Nov. 9PHX MINERALS INC., "PHX," (NYSE: PHX), today announced it will release results for the quarter ended Sept. 30, 2023, following the close of market on Wednesday, Nov. 8, 2023. |

PHX Price Returns

| 1-mo | 6.89% |

| 3-mo | 5.87% |

| 6-mo | -7.20% |

| 1-year | 20.86% |

| 3-year | 67.36% |

| 5-year | -76.11% |

| YTD | 2.26% |

| 2023 | -14.60% |

| 2022 | 83.43% |

| 2021 | -4.33% |

| 2020 | -79.09% |

| 2019 | -26.79% |

PHX Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching PHX

Want to do more research on Panhandle Oil & Gas Inc's stock and its price? Try the links below:Panhandle Oil & Gas Inc (PHX) Stock Price | Nasdaq

Panhandle Oil & Gas Inc (PHX) Stock Quote, History and News - Yahoo Finance

Panhandle Oil & Gas Inc (PHX) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...