Party City Holdco Inc. (PRTY): Price and Financial Metrics

PRTY Price/Volume Stats

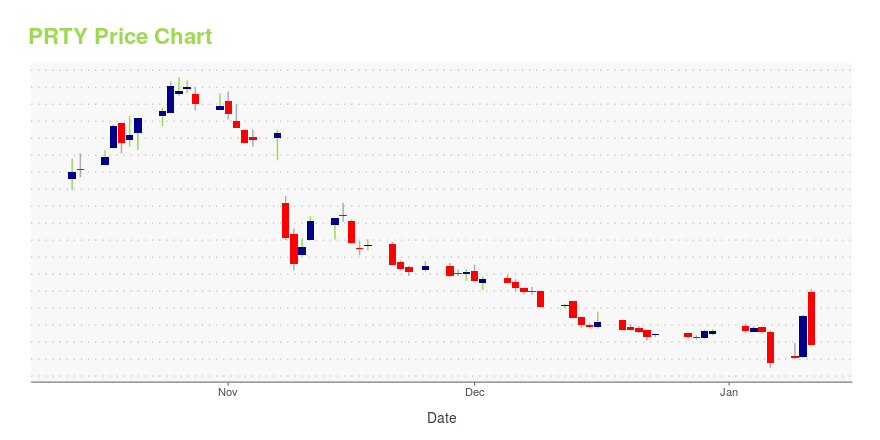

| Current price | $0.41 | 52-week high | $5.52 |

| Prev. close | $0.37 | 52-week low | $0.15 |

| Day low | $0.41 | Volume | 886,349 |

| Day high | $0.41 | Avg. volume | 57,838,367 |

| 50-day MA | $0.59 | Dividend yield | N/A |

| 200-day MA | $1.56 | Market Cap | 46.73M |

PRTY Stock Price Chart Interactive Chart >

Party City Holdco Inc. (PRTY) Company Bio

Party City retails and wholesales paper and plastic tableware, metallic and latex balloons, Halloween and other costumes, accessories, novelties, gifts, and stationery. The company was founded in 1947 and is based in Elmsford, New York.

Latest PRTY News From Around the Web

Below are the latest news stories about PARTY CITY HOLDCO INC that investors may wish to consider to help them evaluate PRTY as an investment opportunity.

Stocks Aim For Weekly Wins Despite Bank Sector PullbackStocks are trading on both sides of the aisle today after JPMorgan Chase warned that a recession is the best-case scenario this year. |

Is a Giant Short Squeeze Brewing in Virgin Galactic (SPCE) Stock?SPCE stock is soaring after reiterating its previous guidance regarding the initiation of its space flights. |

PRTY… BBBY… MULN… There’s a Meme Stocks Investor in All of UsEveryone is looking to get rich, so investing in meme stocks is logical. |

5 Retail Stocks to Put on Your 2023 Death WatchSurvival for any of these retail stocks to sell would mean big profits for investors who buy now, but that's not the way to bet. |

Is a Giant Short Squeeze Brewing in Arrival (ARVL) Stock?Today's incredibly bullish price action in the market has led to impressive gains for EV startup Arrival and ARVL stock. |

PRTY Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | N/A |

| 3-year | -93.83% |

| 5-year | -94.25% |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -93.44% |

| 2021 | -9.43% |

| 2020 | 162.82% |

| 2019 | -76.55% |

Continue Researching PRTY

Want to do more research on Party City Holdco Inc's stock and its price? Try the links below:Party City Holdco Inc (PRTY) Stock Price | Nasdaq

Party City Holdco Inc (PRTY) Stock Quote, History and News - Yahoo Finance

Party City Holdco Inc (PRTY) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...