Restaurant Brands International Limited Partnership (RSTRF): Price and Financial Metrics

RSTRF Price/Volume Stats

| Current price | $75.72 | 52-week high | $81.74 |

| Prev. close | $79.00 | 52-week low | $66.26 |

| Day low | $73.62 | Volume | 1,300 |

| Day high | $75.72 | Avg. volume | 367 |

| 50-day MA | $70.20 | Dividend yield | N/A |

| 200-day MA | $0.00 | Market Cap | N/A |

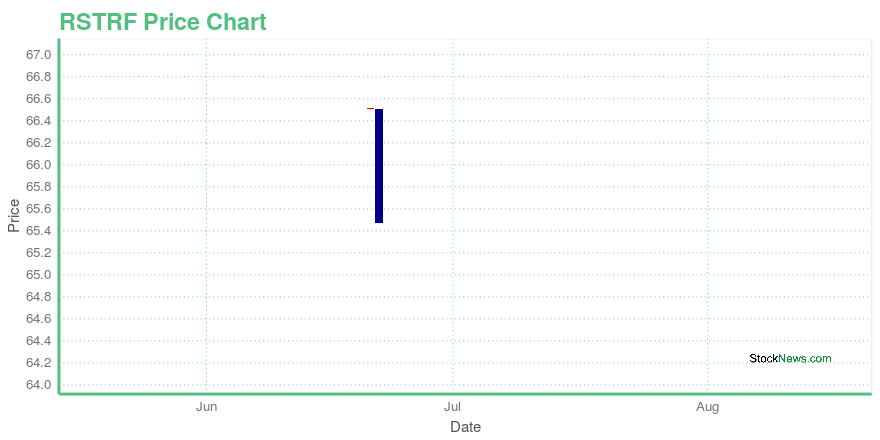

RSTRF Stock Price Chart Interactive Chart >

Restaurant Brands International Limited Partnership (RSTRF) Company Bio

Restaurant Brands International Limited Partnership represents units of the newly formed Restaurants Brands International Inc which is an unlimited liability holding company for Burger King Worldwide and Tim Hortons Inc.

Latest RSTRF News From Around the Web

Below are the latest news stories about Restaurant Brands International Limited Partnership that investors may wish to consider to help them evaluate RSTRF as an investment opportunity.

Restaurant Brands International Inc. Reports Second Quarter 2021 ResultsRestaurant Brands International Inc. (TSX: QSR) (NYSE: QSR) (TSX: QSP) today reported financial results for the second quarter ended June 30, 2021. |

Slowing Rates Of Return At Restaurant Brands International Limited Partnership (TSE:QSP.UN) Leave Little Room For ExcitementWhat trends should we look for it we want to identify stocks that can multiply in value over the long term? Amongst... |

Restaurant Brands International Inc. Announces Pricing of First Lien Senior Secured Notes OfferingRestaurant Brands International Inc. ("RBI") (TSX: QSR) (NYSE: QSR) (TSX: QSP), 1011778 B.C. Unlimited Liability Company (the "Issuer") and New Red Finance, Inc. (the "Co-Issuer" and, together with the Issuer, the "Issuers") announced today that the Issuers priced an offering of $800 million in aggregate principal amount of 3.875% First Lien Senior Secured Notes due 2028 (the "Notes"). The Notes will be issued as additional notes under the Indenture, dated as of September 24, 2019, pursuant to w |

Did You Participate In Any Of Restaurant Brands International Limited Partnership's (TSE:QSP.UN) Respectable 69% Return?Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the... |

Restaurant Brands International Inc. Reports First Quarter 2021 ResultsRestaurant Brands International Inc. (TSX: QSR) (NYSE: QSR) (TSX: QSP) today reported financial results for the first quarter ended March 31, 2021. |

RSTRF Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | 12.93% |

| 3-year | N/A |

| 5-year | 11.85% |

| YTD | N/A |

| 2023 | N/A |

| 2022 | N/A |

| 2021 | N/A |

| 2020 | 0.00% |

| 2019 | N/A |

Loading social stream, please wait...