Sabra Health Care REIT, Inc. (SBRA): Price and Financial Metrics

SBRA Price/Volume Stats

| Current price | $13.57 | 52-week high | $14.91 |

| Prev. close | $13.43 | 52-week low | $10.30 |

| Day low | $13.40 | Volume | 873,453 |

| Day high | $13.64 | Avg. volume | 2,028,096 |

| 50-day MA | $14.03 | Dividend yield | 8.82% |

| 200-day MA | $13.66 | Market Cap | 3.14B |

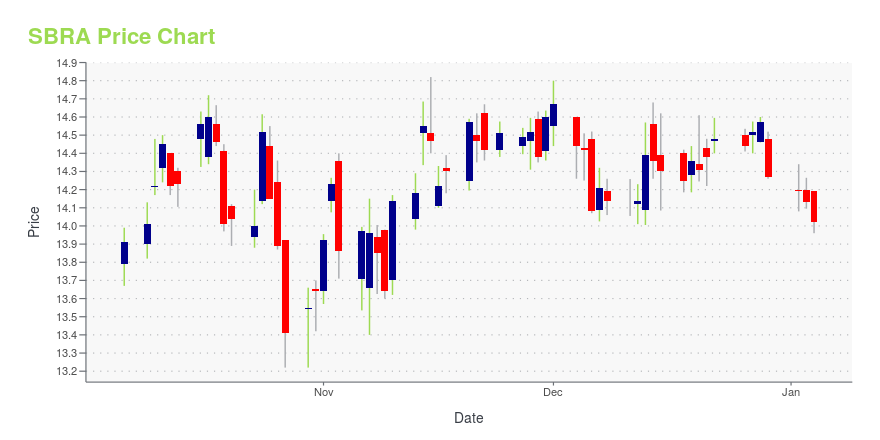

SBRA Stock Price Chart Interactive Chart >

Sabra Health Care REIT, Inc. (SBRA) Company Bio

Sabra Health Care REIT owns and invests in real estate serving the healthcare industry, including nursing facilities, assisted living, independent living facilities, and mental health facilities. The company was founded in 2010 and is based in Irvine, California.

Latest SBRA News From Around the Web

Below are the latest news stories about SABRA HEALTH CARE REIT INC that investors may wish to consider to help them evaluate SBRA as an investment opportunity.

Sabra Health Care REIT, Inc. (NASDAQ:SBRA) Q3 2023 Earnings Call TranscriptSabra Health Care REIT, Inc. (NASDAQ:SBRA) Q3 2023 Earnings Call Transcript November 7, 2023 Operator: Good day, everyone. My name is Briana and I will be your conference operator today. At this time, I would like to welcome everyone to the Sabra’s Third Quarter 2023 Earnings Call. [Operator Instructions] I would now like to turn […] |

Q3 2023 Sabra Health Care REIT Inc Earnings CallQ3 2023 Sabra Health Care REIT Inc Earnings Call |

Sabra Health Care REIT Inc (SBRA) Reports Q3 2023 EarningsNet Loss of $0.07 Per Share, FFO of $0.33 Per Share, and Dividend of $0.30 Per Share |

Sabra Reports Third Quarter 2023 ResultsIRVINE, Calif., November 06, 2023--Sabra Health Care REIT, Inc. ("Sabra," the "Company" or "we") (Nasdaq: SBRA) today announced its results of operations for the third quarter of 2023. |

Sabra Health Care REIT, Inc. Announces Third Quarter 2023 Earnings Release Date and Conference CallIRVINE, Calif., October 23, 2023--Sabra Health Care REIT, Inc. (Nasdaq: SBRA) announced today that it will issue its 2023 third quarter earnings release on November 6, 2023, after the close of trading. |

SBRA Price Returns

| 1-mo | -6.99% |

| 3-mo | 2.51% |

| 6-mo | 0.88% |

| 1-year | 33.39% |

| 3-year | 0.12% |

| 5-year | 8.81% |

| YTD | -2.80% |

| 2023 | 26.26% |

| 2022 | 0.38% |

| 2021 | -16.16% |

| 2020 | -11.33% |

| 2019 | 41.14% |

SBRA Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SBRA

Want to see what other sources are saying about Sabra Health Care REIT Inc's financials and stock price? Try the links below:Sabra Health Care REIT Inc (SBRA) Stock Price | Nasdaq

Sabra Health Care REIT Inc (SBRA) Stock Quote, History and News - Yahoo Finance

Sabra Health Care REIT Inc (SBRA) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...