Southside Bancshares, Inc. (SBSI): Price and Financial Metrics

SBSI Price/Volume Stats

| Current price | $27.51 | 52-week high | $34.40 |

| Prev. close | $28.38 | 52-week low | $25.38 |

| Day low | $27.02 | Volume | 13,286 |

| Day high | $29.01 | Avg. volume | 128,257 |

| 50-day MA | $28.33 | Dividend yield | 5.11% |

| 200-day MA | $29.46 | Market Cap | 833.09M |

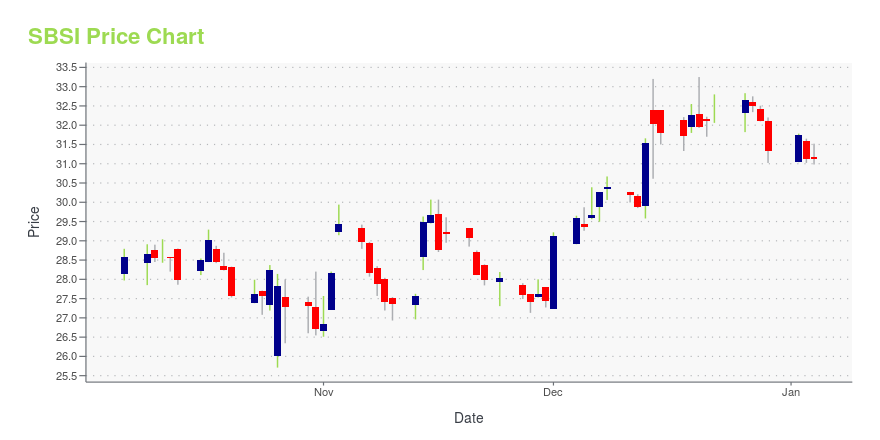

SBSI Stock Price Chart Interactive Chart >

Southside Bancshares, Inc. (SBSI) Company Bio

Southside Bancshares, Inc. provides financial products and services to individuals, businesses, municipal entities, and nonprofit organizations in Texas. The company was founded in 1960 and is based in Tyler, Texas.

Latest SBSI News From Around the Web

Below are the latest news stories about SOUTHSIDE BANCSHARES INC that investors may wish to consider to help them evaluate SBSI as an investment opportunity.

With 57% ownership, Southside Bancshares, Inc. (NASDAQ:SBSI) boasts of strong institutional backingKey Insights Given the large stake in the stock by institutions, Southside Bancshares' stock price might be vulnerable... |

New Strong Sell Stocks for December 15thARREF, SBSI and KW have been added to the Zacks Rank #5 (Strong Sell) List on December 15, 2023. |

Dividend Champions List Ranked By Yield: Top 30In this article, we discuss top 30 dividend champions according to dividend yields. You can skip our detailed analysis of dividend stocks and their performance over the years, and go directly to read Dividend Champions List Ranked By Yield: Top 10. Dividend champions are companies that have increased their dividends for 25 years or more. […] |

Should You Buy Southside Bancshares, Inc. (NASDAQ:SBSI) For Its Upcoming Dividend?Readers hoping to buy Southside Bancshares, Inc. ( NASDAQ:SBSI ) for its dividend will need to make their move shortly... |

Southside Bancshares, Inc. Declares Fourth Quarter And Special Cash DividendsTYLER, Texas, Nov. 02, 2023 (GLOBE NEWSWIRE) -- The Board of Directors of Southside Bancshares, Inc., (NASDAQ:SBSI), parent company of Southside Bank declared a regular quarterly cash dividend of $0.35 per common share. In a separate action, the Board declared a special cash dividend of $0.02 per common share. The combined cash dividend of $0.37 is scheduled for payment on December 7, 2023, to common stock shareholders of record on November 22, 2023. “We are pleased to announce our regular quart |

SBSI Price Returns

| 1-mo | -2.03% |

| 3-mo | -10.10% |

| 6-mo | 3.44% |

| 1-year | -9.54% |

| 3-year | -23.70% |

| 5-year | -3.57% |

| YTD | -11.08% |

| 2023 | -8.90% |

| 2022 | -10.84% |

| 2021 | 39.55% |

| 2020 | -12.74% |

| 2019 | 21.32% |

SBSI Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching SBSI

Want to see what other sources are saying about Southside Bancshares Inc's financials and stock price? Try the links below:Southside Bancshares Inc (SBSI) Stock Price | Nasdaq

Southside Bancshares Inc (SBSI) Stock Quote, History and News - Yahoo Finance

Southside Bancshares Inc (SBSI) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...