SQZ Biotechnologies Co. (SQZ): Price and Financial Metrics

SQZ Price/Volume Stats

| Current price | $0.44 | 52-week high | $3.56 |

| Prev. close | $0.27 | 52-week low | $0.25 |

| Day low | $0.38 | Volume | 30,210,700 |

| Day high | $0.57 | Avg. volume | 455,220 |

| 50-day MA | $0.55 | Dividend yield | N/A |

| 200-day MA | $1.24 | Market Cap | 12.83M |

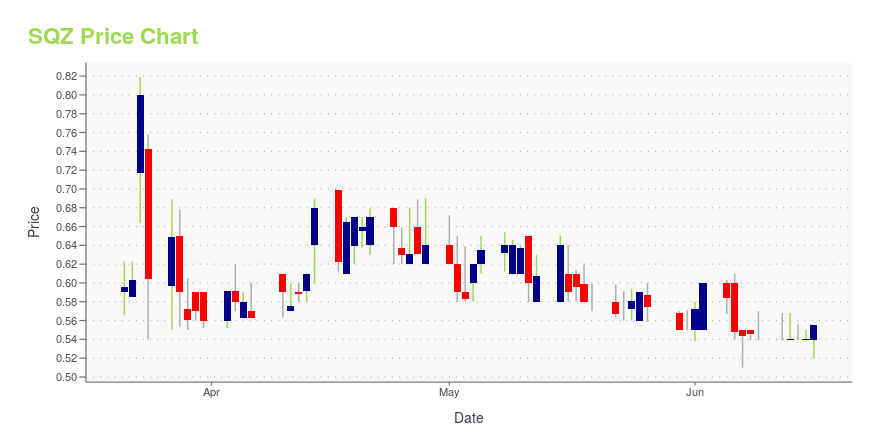

SQZ Stock Price Chart Interactive Chart >

SQZ Biotechnologies Co. (SQZ) Company Bio

SQZ Biotechnologies Co. is a clinical-stage biotechnology company, which engages in developing cell therapies for patients with cancer, infectious diseases, and other serious conditions. It operates through SQZ Cell Therapy Platform, which uses membrane disruption to deliver material into cells. The company was founded by Robert S. Langer Jr., Klavis F. Jensen, Agustin Lopez Marquez, and Armon Sharei in March 2013 and is headquartered in Watertown, MA.

Latest SQZ News From Around the Web

Below are the latest news stories about SQZ BIOTECHNOLOGIES CO that investors may wish to consider to help them evaluate SQZ as an investment opportunity.

SQZ Biotechnologies to effect 1-for-10 reverse stock split

|

SQZ Biotechnologies to Consolidate Shares with 1-for-10 Reverse Stock SplitWATERTOWN, Mass., June 15, 2023--SQZ Biotechnologies Company (NYSE: SQZ) (the "Company" or "SQZ"), focused on unlocking the full potential of cell therapies, today announced that its Board of Directors (the "Board") has approved a 1-for-10 reverse stock split ("reverse split") of its common stock, par value $0.001 per share ("Common Stock"), that is expected to become effective on Thursday, July 6, 2023 at 5:00 p.m. Eastern Time (the "Effective Date"). The Company’s common stock is expected to b |

SQZ Biotechnologies Company (SQZ) Reports Q1 Loss, Misses Revenue EstimatesSQZ Biotechnologies Company (SQZ) delivered earnings and revenue surprises of -11.11% and 100%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock? |

SQZ Biotechnologies Reports First Quarter 2023 Financial Results and Recent Portfolio UpdatesWATERTOWN, Mass., May 10, 2023--SQZ Biotechnologies Company (NYSE: SQZ), focused on unlocking the full potential of cell therapies, today reported first quarter 2023 financial results and recent portfolio updates. |

Denali Therapeutics Inc. (DNLI) Reports Q1 Loss, Tops Revenue EstimatesDenali Therapeutics Inc. (DNLI) delivered earnings and revenue surprises of -12.68% and 15.13%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock? |

SQZ Price Returns

| 1-mo | N/A |

| 3-mo | N/A |

| 6-mo | N/A |

| 1-year | -30.29% |

| 3-year | -96.58% |

| 5-year | N/A |

| YTD | N/A |

| 2023 | 0.00% |

| 2022 | -91.71% |

| 2021 | -69.19% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...