Shattuck Labs Inc. (STTK): Price and Financial Metrics

STTK Price/Volume Stats

| Current price | $9.58 | 52-week high | $11.11 |

| Prev. close | $10.13 | 52-week low | $1.33 |

| Day low | $9.50 | Volume | 417,100 |

| Day high | $10.28 | Avg. volume | 365,882 |

| 50-day MA | $9.16 | Dividend yield | N/A |

| 200-day MA | $5.04 | Market Cap | 454.81M |

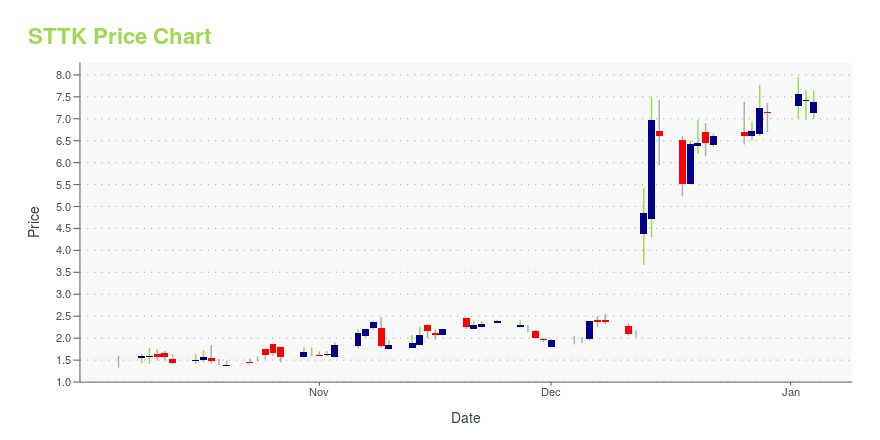

STTK Stock Price Chart Interactive Chart >

Shattuck Labs Inc. (STTK) Company Bio

Shattuck is a clinical-stage biotechnology company advancing its proprietary Agonist Redirected Checkpoint (ARC) platform, a novel class of dual-function fusion proteins with applications in oncology and autoimmune disease. The company’s lead program, SL-279252 (PD1-Fc-OX40L), is being studied in a Phase I trial in collaboration with Takeda Pharmaceuticals. Its technology focuses on immuno-oncology research targeted towards patients with many cancer types, including melanoma, lung, and bladder, by endowing one molecule with multiple functions, with applicability across the entire spectrum of human disease that enables medical researchers to find a quick and painless detection of malignancy for later-stage cancer patients.

Latest STTK News From Around the Web

Below are the latest news stories about SHATTUCK LABS INC that investors may wish to consider to help them evaluate STTK as an investment opportunity.

Shattuck Labs Announces $50 Million Public Offering of Common Stock and Concurrent Private Placement of Pre-Funded WarrantsAUSTIN, TX and DURHAM, NC, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Shattuck Labs, Inc. (“Shattuck” or the “company”) (NASDAQ: STTK), a clinical-stage biotechnology company pioneering the development of bi-functional fusion proteins as a new class of biologic medicine for the treatment of patients with cancer and autoimmune disease, today announced the pricing of a registered offering of 4,651,163 shares of common stock, par value $0.0001 (the “common stock”), at a price of $6.45 per share, which is pr |

We're Keeping An Eye On Shattuck Labs' (NASDAQ:STTK) Cash Burn RateThere's no doubt that money can be made by owning shares of unprofitable businesses. Indeed, Shattuck Labs... |

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on ThursdayIt's time to start the day off right with a look at the biggest pre-market stock movers to watch for Thursday morning! |

EY Layoffs 2023: What to Know About the Latest EY Job CutsEY layoffs have been announced and this has the accounting firm cutting 130 jobs to adjust for slowing demand after the pandemic. |

Why Is Shattuck Labs (STTK) Stock Up 93% Today?Shattuck Labs stock is rising on Wednesday after the company provided positive initial results from a Phase 1 clinical trial. |

STTK Price Returns

| 1-mo | -3.43% |

| 3-mo | 6.21% |

| 6-mo | 569.93% |

| 1-year | 226.96% |

| 3-year | -68.79% |

| 5-year | N/A |

| YTD | 34.36% |

| 2023 | 210.00% |

| 2022 | -72.97% |

| 2021 | -83.76% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...