Tarsus Pharmaceuticals Inc. (TARS): Price and Financial Metrics

TARS Price/Volume Stats

| Current price | $34.94 | 52-week high | $40.40 |

| Prev. close | $36.17 | 52-week low | $11.33 |

| Day low | $34.75 | Volume | 328,100 |

| Day high | $36.73 | Avg. volume | 761,253 |

| 50-day MA | $33.37 | Dividend yield | N/A |

| 200-day MA | $21.95 | Market Cap | 1.20B |

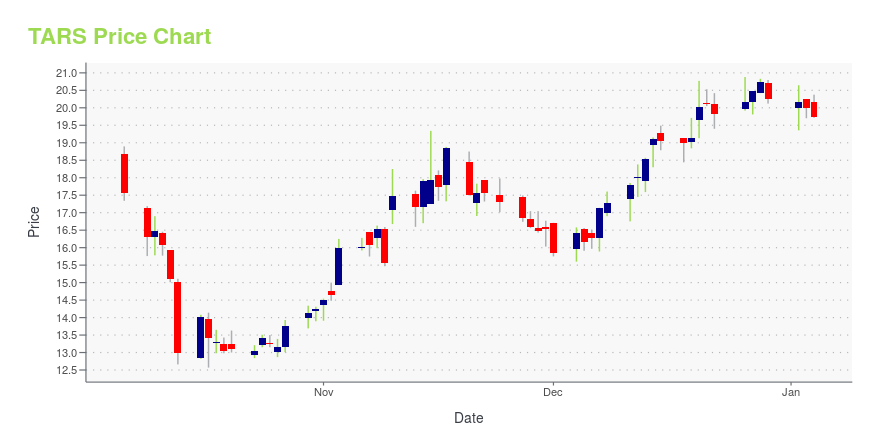

TARS Stock Price Chart Interactive Chart >

Tarsus Pharmaceuticals Inc. (TARS) Company Bio

Tarsus is a clinical-stage biopharmaceutical company headquartered in Irvine, California. Tarsus was founded in 2017 to bring innovative therapies to a range of diseases in need of better solutions, starting with Demodex blepharitis and eye care.

Latest TARS News From Around the Web

Below are the latest news stories about TARSUS PHARMACEUTICALS INC that investors may wish to consider to help them evaluate TARS as an investment opportunity.

Tarsus Pharmaceuticals Stock Scores Relative Strength Rating UpgradeA Relative Strength Rating upgrade for Tarsus Pharmaceuticals shows improving technical performance. |

Tarsus Announces Positive Topline Results from the Ersa Phase 2a Clinical Trial Evaluating TP-03 for the Treatment of Meibomian Gland Disease in Patients with Demodex MitesTP-03 demonstrated statistically significant and clinically meaningful improvements across two objective measures of MGD, regardless of BID or TID dosing, and was well toleratedIRVINE, Calif., Dec. 11, 2023 (GLOBE NEWSWIRE) -- Tarsus Pharmaceuticals, Inc. (NASDAQ: TARS), whose mission is to focus on unmet needs and apply proven science and new technology to revolutionize treatment for patients, today announced topline results from the Ersa Phase 2a clinical trial evaluating TP-03 (lotilaner opht |

Insider Sell Alert: Tarsus Pharmaceuticals Inc's Dianne Whitfield Offloads 8,355 SharesIn the realm of stock market movements, insider trading can provide valuable insights into a company's health and future prospects. |

Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS) Q3 2023 Earnings Call TranscriptTarsus Pharmaceuticals, Inc. (NASDAQ:TARS) Q3 2023 Earnings Call Transcript November 10, 2023 Operator: Good afternoon and welcome to the Tarsus Pharmaceuticals Third Quarter 2023 Financial Results Conference Call. As a reminder, this call is being recorded. At this time, I would like to turn the call over to David Nakasone, Head of Investor Relations to […] |

Analysts Are Betting On Tarsus Pharmaceuticals, Inc. (NASDAQ:TARS) With A Big Upgrade This WeekTarsus Pharmaceuticals, Inc. ( NASDAQ:TARS ) shareholders will have a reason to smile today, with the analysts making... |

TARS Price Returns

| 1-mo | 10.64% |

| 3-mo | 49.19% |

| 6-mo | 167.74% |

| 1-year | 178.18% |

| 3-year | 22.13% |

| 5-year | N/A |

| YTD | 72.54% |

| 2023 | 38.13% |

| 2022 | -34.84% |

| 2021 | -45.56% |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...