Translate Bio, Inc. (TBIO): Price and Financial Metrics

TBIO Price/Volume Stats

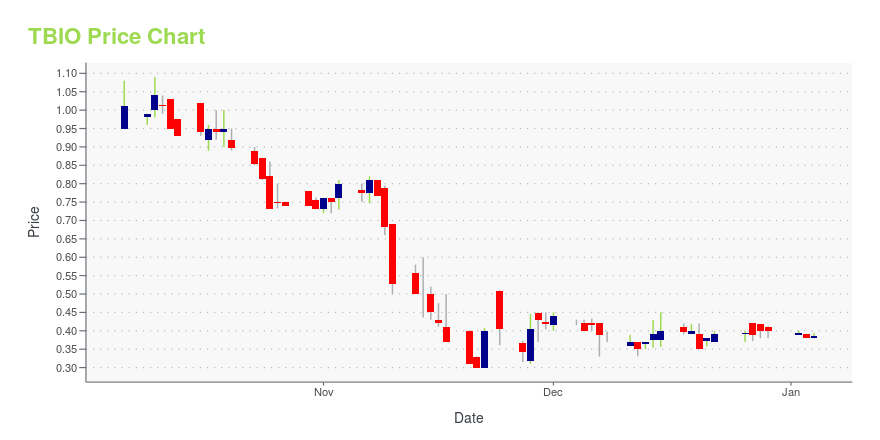

| Current price | $0.31 | 52-week high | $3.01 |

| Prev. close | $0.33 | 52-week low | $0.30 |

| Day low | $0.30 | Volume | 162,700 |

| Day high | $0.35 | Avg. volume | 643,854 |

| 50-day MA | $0.45 | Dividend yield | N/A |

| 200-day MA | $0.76 | Market Cap | 9.30M |

TBIO Stock Price Chart Interactive Chart >

Translate Bio, Inc. (TBIO) Company Bio

Translate Bio, Inc., a messenger RNA therapeutics company, engages in developing medicines to treat diseases caused by protein or gene dysfunction. It is developing MRT5005 that is in Phase I/II clinical trial for the treatment of cystic fibrosis; and MRT5201 for the treatment of ornithine transcarbamylase deficiency. It has strategic alliances with Sanofi Pasteur. The company was formerly known as RaNA Therapeutics, Inc. and changed its name to Translate Bio, Inc. in June 2017. Translate Bio, Inc. was founded in 2011 and is based in Lexington, Massachusetts.

Latest TBIO News From Around the Web

Below are the latest news stories about TELESIS BIO INC that investors may wish to consider to help them evaluate TBIO as an investment opportunity.

Today’s Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on MondayIt's time to start the week with a breakdown of the biggest pre-market stock movers that are worth watching on Monday morning! |

Telesis Bio Reports Third Quarter 2023 Financial ResultsSAN DIEGO, Nov. 13, 2023 (GLOBE NEWSWIRE) -- Telesis Bio Inc. (NASDAQ: TBIO), a leader in automated multi-omic and synthetic biology solutions, today reported financial results for the third quarter of 2023. “This quarter, we continued to drive adoption of our instruments and kits, make progress against important collaborations, advance our mRNA strategy, and strengthen both our Board of Directors and Management Team,” said Todd R. Nelson, PhD, CEO, and founder of Telesis Bio. Highlights Strengt |

Telesis Bio to Report Third Quarter Financial Results on Monday, November 13, 2023SAN DIEGO, Nov. 07, 2023 (GLOBE NEWSWIRE) -- Telesis Bio (Nasdaq: TBIO), a leader in automated multi-omic and synthetic biology solutions, today announced that it will release its third quarter 2023 financial results on Monday, November 13, 2023, after the market closes. The press release can be accessed via the Investor section of Telesis Bio’s website at https://ir.telesisbio.com/. About Telesis BioTelesis Bio is empowering scientists with the ability to create novel, synthetic biology-enabled |

Telesis Bio Announces Commercial Release of Cell-free Amplification Kit for Generation of Transfection-scale DNANew Kit offers BioXp automation workflow from candidate sequence to amplified DNA in daysSAN DIEGO, Nov. 03, 2023 (GLOBE NEWSWIRE) -- Telesis Bio Inc. (NASDAQ: TBIO), a leader in automated multi-omic and synthetic biology solutions, today announced the commercial release of its BioXp® De novo Cloning and Amplification kit on the BioXp 3250 and BioXp 9600 systems. This cell-free DNA amplification kit provides an efficient automated solution for building and amplifying DNA constructs to transfecti |

Telesis Bio Announces Commercial Release of BioXp® NGS Library Prep Kit for WGSNew Kit expands suite of NGS Library Prep solutions on the BioXp® System Enabling Speed and Efficiency for Whole genome sequencing (WGS) applications with the Automated Molecular Biology WorkstationSAN DIEGO, Sept. 28, 2023 (GLOBE NEWSWIRE) -- Telesis Bio Inc. (NASDAQ: TBIO), a leader in automated multi-omic and synthetic biology solutions, today announced the commercial release of its BioXp® NGS Library Prep kit for Whole Genome Sequencing on the BioXp 3250 and BioXp 9600 systems. This NGS libr |

TBIO Price Returns

| 1-mo | -33.43% |

| 3-mo | -2.30% |

| 6-mo | -63.71% |

| 1-year | -87.89% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -22.31% |

| 2023 | -66.75% |

| 2022 | -88.89% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Continue Researching TBIO

Want to do more research on Translate Bio Inc's stock and its price? Try the links below:Translate Bio Inc (TBIO) Stock Price | Nasdaq

Translate Bio Inc (TBIO) Stock Quote, History and News - Yahoo Finance

Translate Bio Inc (TBIO) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...