Taboola.com, Ltd. (TBLA): Price and Financial Metrics

TBLA Price/Volume Stats

| Current price | $3.95 | 52-week high | $5.00 |

| Prev. close | $3.98 | 52-week low | $2.16 |

| Day low | $3.94 | Volume | 745,732 |

| Day high | $4.01 | Avg. volume | 1,404,375 |

| 50-day MA | $4.41 | Dividend yield | N/A |

| 200-day MA | $3.94 | Market Cap | 1.17B |

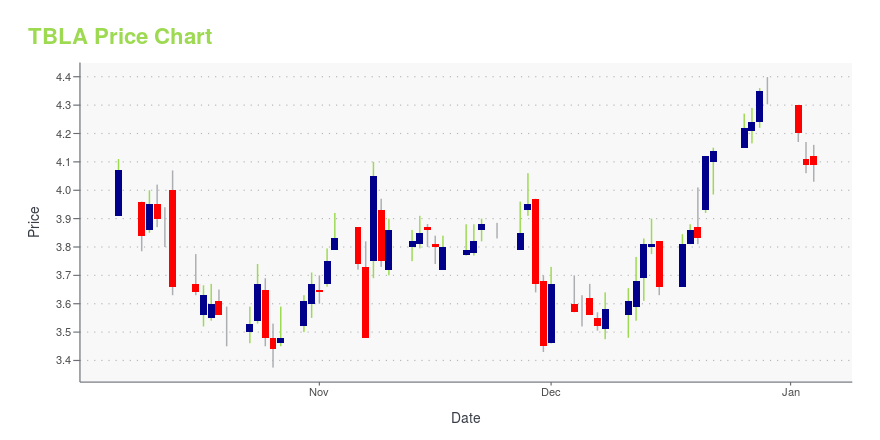

TBLA Stock Price Chart Interactive Chart >

Taboola.com, Ltd. (TBLA) Company Bio

Taboola.com, Ltd. operates a content discovery and native advertising platform for people, advertisers, and digital properties. It offers Taboola, a platform that helps people to find relevant content online, matching them with news stories, articles, blogs, videos, apps, products, and other content they want to explore; helps advertisers promote their brand to their audience; and provides new engagement and monetization opportunities to publishers, mobile carriers, and other digital properties. The company was founded in 2007 and is based in Ramat Gan, Israel.

Latest TBLA News From Around the Web

Below are the latest news stories about TABOOLACOM LTD that investors may wish to consider to help them evaluate TBLA as an investment opportunity.

7 Penny Stocks With Massive Upside (That Are NOT Biopharma)The world of penny stocks worth buying extends beyond the biopharma sector even though that industry receives massive attention. |

Taboola Announces New, Five-Year Deal with NBCUniversal News Group, Including NBC News, CNBC, MSNBC and TODAYNBCU News Group to Continue Optimizing Taboola’s Custom Recommendations Across Several Top U.S. Sites Including NBCNews.com, CNBC.com, MSNBC.com and Today.comNEW YORK, Nov. 28, 2023 (GLOBE NEWSWIRE) -- Taboola (Nasdaq: TBLA), a global leader in powering recommendations for the open web, today announced a new five-year deal with NBCUniversal News Group, the #1 news organization in the U.S. that reaches seven in 10 American adults each month. Under the new agreement, NBCU News Group will continue |

Taboola Beats High End of Guidance in Q3 On All Metrics, Raises Adj. EBITDA and Non-GAAP Net Income Guidance for 2023Exceeded high end of guidance on all metrics - Q3 2023 Revenues of $360.2M, Gross Profit of $100.7M, ex-TAC Gross Profit of $128.4M, Net loss of $23.1M, Non-GAAP Net Income of $6.7M and Adjusted EBITDA of $22.8M. Net cash provided by operating activities of $32.5M and Free Cash Flow in Q3 2023 of $22.8M. eCommerce double-digit growth in Q3, on track to reach nearly 20% of ex-TAC in 2023. Taboola News, distributing content to Android OEMs continues strong momentum in Q3; on track to grow from $50 |

Taboola Enhances Generative AI Capabilities to Allow For Automatic Editing of Existing Images, Accelerating Ad Creation and Seasonal Creative; Taboola Generative AI Adoption Accelerates, 25% of Creative Assets Leverage the TechnologyNEW YORK, Nov. 06, 2023 (GLOBE NEWSWIRE) -- Taboola (Nasdaq: TBLA), a global leader in powering recommendations for the open web, today announced new advancements in its Generative AI technology for advertisers. With Taboola Generative AI AdMaker, advertisers can instantly adjust existing creative assets, such as replacing backgrounds or generating image variations, significantly speeding the time it takes to launch their campaigns. One key use case for Taboola’s Generative AI AdMaker significan |

7 of the Best Cheap Stocks to Buy Under $5 in October 2023Generally speaking, you get what you pay for, which should be a warning for speculating on low-priced securities, even if they’re labeled the best cheap stocks under $5. |

TBLA Price Returns

| 1-mo | -9.40% |

| 3-mo | -4.59% |

| 6-mo | 11.27% |

| 1-year | 65.27% |

| 3-year | N/A |

| 5-year | N/A |

| YTD | -8.78% |

| 2023 | 40.58% |

| 2022 | -60.41% |

| 2021 | N/A |

| 2020 | N/A |

| 2019 | N/A |

Loading social stream, please wait...