Transportadora de Gas del Sur S.A. ADR (TGS): Price and Financial Metrics

TGS Price/Volume Stats

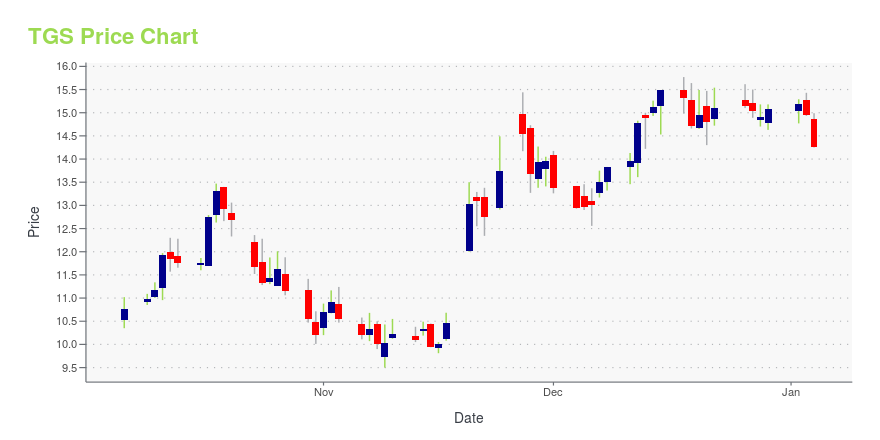

| Current price | $16.06 | 52-week high | $19.95 |

| Prev. close | $16.57 | 52-week low | $9.50 |

| Day low | $16.04 | Volume | 108,565 |

| Day high | $16.76 | Avg. volume | 254,997 |

| 50-day MA | $14.61 | Dividend yield | N/A |

| 200-day MA | $13.17 | Market Cap | 2.42B |

TGS Stock Price Chart Interactive Chart >

Transportadora de Gas del Sur S.A. ADR (TGS) Company Bio

Transportadora de Gas del Sur S.A. provides natural gas transportation services in Argentina. The company operates through four segments: Natural Gas Transportation, Production and Commercialization of Liquids, Other Services, and Telecommunications. The company was founded in 1992 and is based in Buenos Aires, Argentina.

Latest TGS News From Around the Web

Below are the latest news stories about GAS TRANSPORTER OF THE SOUTH INC that investors may wish to consider to help them evaluate TGS as an investment opportunity.

Bet on These 3 Low-Beta Energy Stocks to Combat VolatilityLow-beta energy stocks like Murphy USA (MUSA), Weatherford (WFRD) and Transportadora (TGS) are likely to provide a hedge against the notorious volatility of the energy sector. |

Hurry! 3 Argentine Stocks to Buy Before the New President Takes OfficeThese deeply-discounted Argentine stocks could see a massive surge under president-elect Milei's promised pro-business reforms. |

Copart and Best Buy have been highlighted as Zacks Bull and Bear of the DayCopart and Best Buy have been highlighted as Zacks Bull and Bear of the Day. |

Combat Volatility With These 3 Low-Beta Energy StocksLow-beta energy stocks like TotalEnergies (TTE), Weatherford (WFRD) and Transportadora (TGS) are likely to provide a hedge against the notorious volatility of the energy sector. |

20 Biggest Midstream Companies Heading into 2024In this article, we will take a look at the 20 biggest midstream companies heading into 2024. If you want to skip our detailed analysis, you can go directly to 5 Biggest Midstream Companies Heading into 2024. According to a report by Research and Markets, the oil and gas midstream market was valued at $27.5 billion […] |

TGS Price Returns

| 1-mo | 8.51% |

| 3-mo | 5.45% |

| 6-mo | 44.04% |

| 1-year | 49.12% |

| 3-year | 262.53% |

| 5-year | 62.28% |

| YTD | 6.43% |

| 2023 | 27.88% |

| 2022 | 165.77% |

| 2021 | -14.62% |

| 2020 | -27.48% |

| 2019 | -47.53% |

Continue Researching TGS

Want to see what other sources are saying about Gas Transporter Of The South Inc's financials and stock price? Try the links below:Gas Transporter Of The South Inc (TGS) Stock Price | Nasdaq

Gas Transporter Of The South Inc (TGS) Stock Quote, History and News - Yahoo Finance

Gas Transporter Of The South Inc (TGS) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...