Verona Pharma plc - American Depositary Share (VRNA): Price and Financial Metrics

VRNA Price/Volume Stats

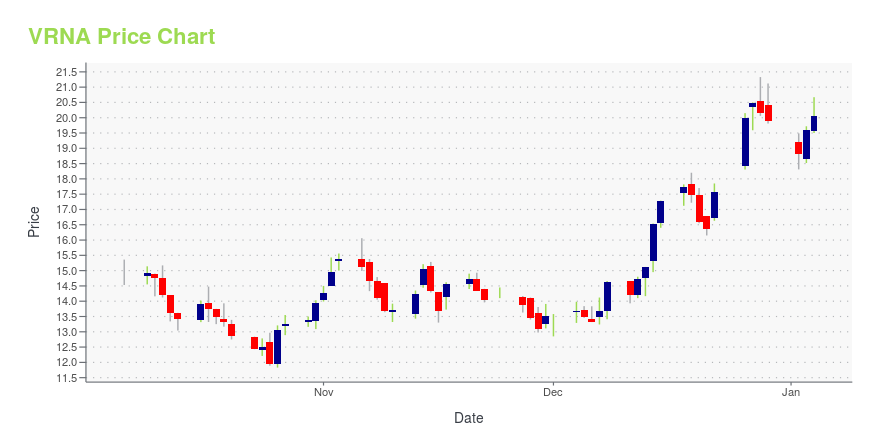

| Current price | $15.72 | 52-week high | $23.81 |

| Prev. close | $16.10 | 52-week low | $11.83 |

| Day low | $15.43 | Volume | 718,500 |

| Day high | $16.20 | Avg. volume | 501,113 |

| 50-day MA | $16.50 | Dividend yield | N/A |

| 200-day MA | $17.01 | Market Cap | 1.24B |

VRNA Stock Price Chart Interactive Chart >

Verona Pharma plc - American Depositary Share (VRNA) Company Bio

Verona Pharma plc, a clinical stage biopharmaceutical company, researches, discovers, and develops therapeutic drugs to treat respiratory diseases primarily in the United Kingdom and North America. The company’s lead product is RPL554, an inhaled dual phosphodiesterase 3 and 4 inhibitor, which is in Phase II clinical trial for the treatment of chronic obstructive pulmonary disease, cystic fibrosis, and asthma. Verona Pharma plc is based in London, the United Kingdom.

Latest VRNA News From Around the Web

Below are the latest news stories about VERONA PHARMA PLC that investors may wish to consider to help them evaluate VRNA as an investment opportunity.

Fluor Corporation and Align Technology have been highlighted as Zacks Bull and Bear of the DayFluor Corporation and Align Technology are part of the Zacks Bull and Bear of the Day article. |

3 Beaten-Down Biotech Stocks to Buy for a Turnaround in 2024Here we present three biotech stocks, SRPT, DNLI and VRNA, which took a beating in 2023 but have upside potential for 2024. |

Wall Street Analysts Believe Verona Pharma PLC American Depositary Share (VRNA) Could Rally 135.87%: Here's is How to TradeThe consensus price target hints at a 135.9% upside potential for Verona Pharma PLC American Depositary Share (VRNA). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term. |

Verona Pharma’s President and CEO David Zaccardelli Wins Executive of the Year SCRIP AwardLONDON and RALEIGH, N.C., Nov. 17, 2023 (GLOBE NEWSWIRE) -- Verona Pharma plc (Nasdaq: VRNA) (“Verona Pharma” or the “Company”), announces its President and CEO, David Zaccardelli, has won ‘Executive of the Year 2023’ at the SCRIP Awards in recognition of his exemplary leadership. David Zaccardelli, Pharm. D., President and CEO of Verona Pharma said: “I am honored to receive this prestigious award and would like to thank the dedicated and talented team at Verona Pharma for their efforts to bring |

11 Best Undervalued UK Stocks To Buy NowIn this piece, we will take a look at the 11 best undervalued U.K. stocks to buy now. If you want to skip our overview of the British economy, then take a look at 5 Best Undervalued UK Stocks To Buy Now. The U.K. is one of the biggest economies in the world and a […] |

VRNA Price Returns

| 1-mo | -1.44% |

| 3-mo | -8.44% |

| 6-mo | 26.47% |

| 1-year | -32.59% |

| 3-year | 100.25% |

| 5-year | 149.52% |

| YTD | -20.93% |

| 2023 | -23.92% |

| 2022 | 288.84% |

| 2021 | -4.00% |

| 2020 | 21.74% |

| 2019 | N/A |

Loading social stream, please wait...