Vishay Intertechnology, Inc. (VSH): Price and Financial Metrics

VSH Price/Volume Stats

| Current price | $22.28 | 52-week high | $30.10 |

| Prev. close | $21.58 | 52-week low | $20.57 |

| Day low | $21.71 | Volume | 1,711,300 |

| Day high | $22.28 | Avg. volume | 1,282,662 |

| 50-day MA | $22.05 | Dividend yield | 1.91% |

| 200-day MA | $23.82 | Market Cap | 3.06B |

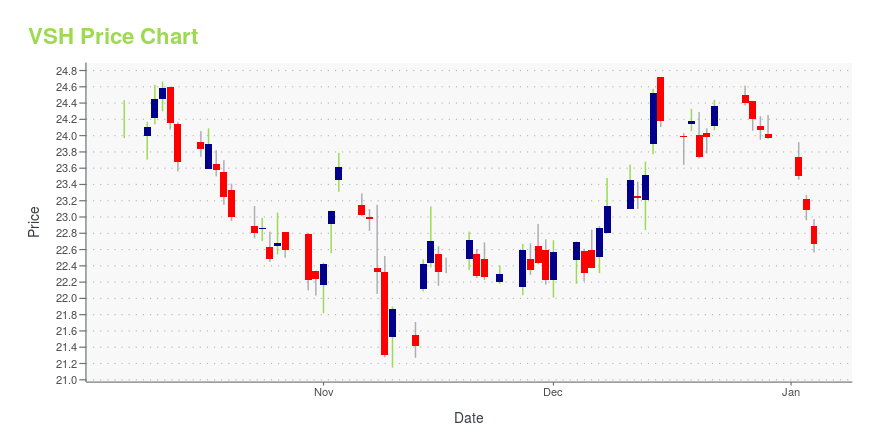

VSH Stock Price Chart Interactive Chart >

Vishay Intertechnology, Inc. (VSH) Company Bio

Vishay Intertechnology, Inc. engages in the manufacture and distribution of discrete semiconductors and passive components. It operates through the following segments: MOSFET (metal oxide semiconductor field-effect transistor), Diodes, Optoelectronic Components, Resistors, Inductors, and Capacitors. The MOSFET segment offers semiconductors which function as solid state switches to control power. The Diodes segment produces semiconductors which route, regulate, and block radio frequency, analog, and power signals, protect systems from surges or electrostatic discharge damage, and provide electromagnetic interference filtering. The Optoelectronic Components segment includes components that emit light, detect light, or do both. The Resistors and Inductors segment deals with components that impede electric current. The Capacitors segment provides components which store energy and discharge it when needed. The company was founded by Felix Zandman in 1962 and is headquartered in Malvern, PA.

Latest VSH News From Around the Web

Below are the latest news stories about VISHAY INTERTECHNOLOGY INC that investors may wish to consider to help them evaluate VSH as an investment opportunity.

Vishay Intertechnology's (NYSE:VSH) investors will be pleased with their respectable 50% return over the last five yearsWhen you buy and hold a stock for the long term, you definitely want it to provide a positive return. Better yet, you'd... |

Director Abraham Ludomirski Sells 75,049 Shares of Vishay Intertechnology Inc (VSH)On December 18, 2023, Abraham Ludomirski, a director at Vishay Intertechnology Inc, executed a sale of 75,049 shares of the company's stock, as reported in a SEC Filing. |

Vishay Intertechnology Inc's Dividend AnalysisVishay Intertechnology Inc (NYSE:VSH) recently announced a dividend of $0.1 per share, payable on 2023-12-27, with the ex-dividend date set for 2023-12-12. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Vishay Intertechnology Inc's dividend performance and assess its sustainability. |

Why Is Vishay (VSH) Up 7.3% Since Last Earnings Report?Vishay (VSH) reported earnings 30 days ago. What's next for the stock? We take a look at earnings estimates for some clues. |

Vishay (VSH) Boosts Its Opto Offerings With New OptocouplersVishay (VSH) introduces five new optocouplers for industrial applications in a bid to boost its optoelectronics portfolio. |

VSH Price Returns

| 1-mo | 0.59% |

| 3-mo | 1.11% |

| 6-mo | -0.57% |

| 1-year | 8.48% |

| 3-year | -9.52% |

| 5-year | 26.06% |

| YTD | -6.65% |

| 2023 | 12.96% |

| 2022 | 0.67% |

| 2021 | 7.46% |

| 2020 | -0.52% |

| 2019 | 20.66% |

VSH Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching VSH

Here are a few links from around the web to help you further your research on Vishay Intertechnology Inc's stock as an investment opportunity:Vishay Intertechnology Inc (VSH) Stock Price | Nasdaq

Vishay Intertechnology Inc (VSH) Stock Quote, History and News - Yahoo Finance

Vishay Intertechnology Inc (VSH) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...