Vaxart Inc. (VXRT): Price and Financial Metrics

VXRT Price/Volume Stats

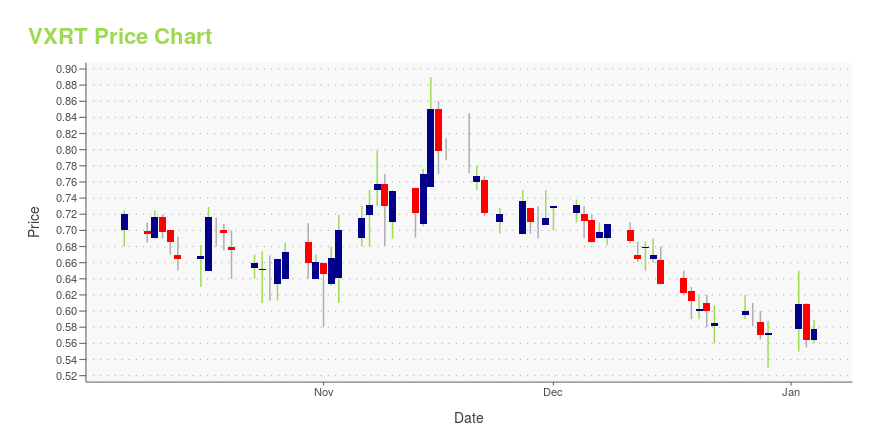

| Current price | $0.76 | 52-week high | $1.59 |

| Prev. close | $0.84 | 52-week low | $0.53 |

| Day low | $0.75 | Volume | 1,913,700 |

| Day high | $0.86 | Avg. volume | 1,987,745 |

| 50-day MA | $1.16 | Dividend yield | N/A |

| 200-day MA | $0.85 | Market Cap | 131.37M |

VXRT Stock Price Chart Interactive Chart >

Vaxart Inc. (VXRT) Company Bio

Vaxart, Inc. operates as a clinical-stage biotechnology company, which engages in the development of oral recombinant vaccines. Its products include Influenza, Norovirus and Respiratory Syncytial Virus. The company was founded in 2004 and is headquartered in South San Francisco, CA.

Latest VXRT News From Around the Web

Below are the latest news stories about VAXART INC that investors may wish to consider to help them evaluate VXRT as an investment opportunity.

Here's Why Vaxart (NASDAQ:VXRT) Must Use Its Cash WiselyJust because a business does not make any money, does not mean that the stock will go down. For example, biotech and... |

Vaxart, Inc. (NASDAQ:VXRT) Q3 2023 Earnings Call TranscriptVaxart, Inc. (NASDAQ:VXRT) Q3 2023 Earnings Call Transcript November 2, 2023 Vaxart, Inc. beats earnings expectations. Reported EPS is $-0.11, expectations were $-0.18. Operator: Greetings, and welcome to the Vaxart Business Update and Third Quarter 2023 Financial Results Conference Call. A question-and-answer session will follow management’s opening remarks. Individual investors may submit written questions to […] |

Vaxart Inc (VXRT) Reports Q3 2023 Financial Results and Business UpdatesCompany highlights progress in norovirus and COVID-19 vaccine developments and financial performance |

Vaxart Provides Business Update and Reports Third Quarter 2023 Financial ResultsNorovirus challenge study topline results indicate the potential of Vaxart’s oral pill vaccine candidate to reduce rates of norovirus infection, norovirus acute gastroenteritis and viral shedding Clinical proof of concept for the Company’s oral pill vaccine platform now established in two human challenge studies for norovirus and influenza Conference call today at 4:30 p.m. ET SOUTH SAN FRANCISCO, Calif., Nov. 02, 2023 (GLOBE NEWSWIRE) -- Vaxart, Inc. (Nasdaq: VXRT) today announced its business |

Vaxart Doses First Subject in Phase 1 Trial of Its Norovirus Vaccine Candidate in Lactating MothersTrial evaluating the ability of oral vaccine tablets to induce breast milk antibodies and transfer of antibodies to young infants SOUTH SAN FRANCISCO, Calif., Nov. 02, 2023 (GLOBE NEWSWIRE) -- Vaxart, Inc. (Nasdaq: VXRT) today announced it has dosed the first subject in its Phase 1 clinical trial evaluating Vaxart’s oral pill bivalent norovirus vaccine candidate focused on lactating mothers. “Initiating this study is an important step toward Vaxart’s goal of developing a vaccine that may reduce |

VXRT Price Returns

| 1-mo | -38.21% |

| 3-mo | 2.37% |

| 6-mo | 15.15% |

| 1-year | 7.31% |

| 3-year | -86.36% |

| 5-year | -0.26% |

| YTD | 32.68% |

| 2023 | -40.39% |

| 2022 | -84.67% |

| 2021 | 9.81% |

| 2020 | 1,529.10% |

| 2019 | -81.36% |

Continue Researching VXRT

Here are a few links from around the web to help you further your research on Vaxart Inc's stock as an investment opportunity:Vaxart Inc (VXRT) Stock Price | Nasdaq

Vaxart Inc (VXRT) Stock Quote, History and News - Yahoo Finance

Vaxart Inc (VXRT) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...