Woodside Energy Group Ltd (WDS): Price and Financial Metrics

WDS Price/Volume Stats

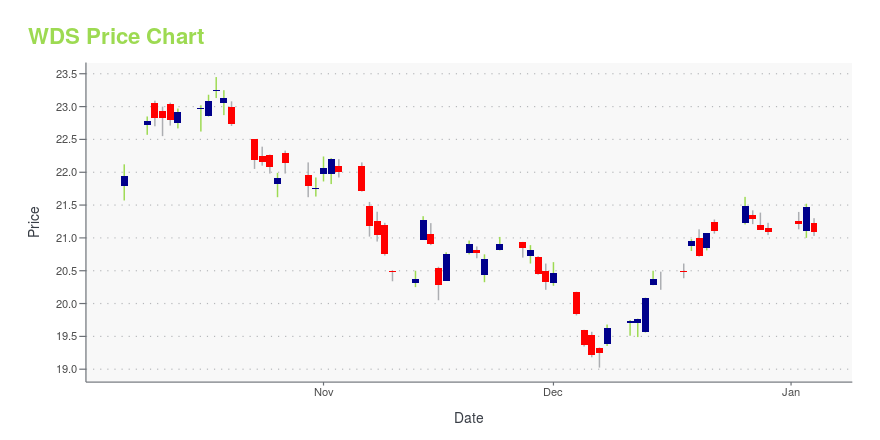

| Current price | $18.24 | 52-week high | $25.84 |

| Prev. close | $18.46 | 52-week low | $18.19 |

| Day low | $18.23 | Volume | 1,092,100 |

| Day high | $18.48 | Avg. volume | 945,433 |

| 50-day MA | $19.60 | Dividend yield | 6.18% |

| 200-day MA | $21.72 | Market Cap | 17.95B |

WDS Stock Price Chart Interactive Chart >

Woodside Energy Group Ltd (WDS) Company Bio

Woodside Energy Group Ltd engages in the exploration, evaluation, development, production, marketing, and sale of hydrocarbons in Oceania, Asia, Canada, Africa, and internationally. The company produces liquefied natural gas, pipeline natural gas, condensate, liquefied petroleum gas, and crude oil. It holds interests in the Greater Browse, Greater Sunrise, Greater Pluto, Greater Exmouth, North West Shelf, Wheatstone, Julimar-Brunello, Canada, Senegal, Greater Scarborough, and Myanmar projects. The company was formerly known as Woodside Petroleum Ltd and changed its name to Woodside Energy Group Ltd in May 2022. Woodside Energy Group Ltd was founded in 1954 and is headquartered in Perth, Australia.

Latest WDS News From Around the Web

Below are the latest news stories about WOODSIDE ENERGY GROUP LTD that investors may wish to consider to help them evaluate WDS as an investment opportunity.

Here's Why Woodside Energy Group (ASX:WDS) Has Caught The Eye Of InvestorsFor beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to... |

12 High Growth Energy Stocks to BuyIn this article, we will take a look at the 12 high growth energy stocks to buy. To skip our analysis of the recent market trends and activity, you can go directly to see the 5 High Growth Energy Stocks to Buy. Geopolitical tensions, once again, are having an impact on global oil prices. Yemen’s […] |

Deal-Hungry Woodside CEO Draws Criticism in Rush for Growth(Bloomberg) -- At one of Perth’s most affluent beach-side suburbs, police were already in wait on an early morning in August as climate campaigners arrived near the home of Woodside Energy Group Ltd.’s Chief Executive Officer Meg O’Neill.Most Read from BloombergRange Rovers Become Thief-Magnets, Causing Prices to TumbleOwner of the Philippines’ Largest Malls Says China Feud May Hurt BusinessesCiti Shuts Muni Business That Once Was Envy of RivalsUS Approves New Kind of Nuclear Reactor for First T |

Woodside, Santos proposed $52 billion tie-up unlikely to be sealed until at least Feb -sourceAustralia's Woodside Energy and rival Santos are unlikely to announce any agreement on a proposed A$80 billion ($52 billion) tie-up to create a global oil and gas giant until at least February, said a person with direct knowledge of the talks. Woodside and Santos last week confirmed speculation they were in preliminary discussions to create a joint entity that would have assets stretching from Australia to Alaska, the Gulf of Mexico, Papua New Guinea, Senegal and Trinidad and Tobago. Santos is being advised on the deal by Citigroup and Goldman Sachs, while Morgan Stanley is advising Woodside, sources confirmed. |

Explainer-What would a Woodside and Santos merger look like?Australian energy companies Woodside and Santos announced on Dec. 7 they are in preliminary talks to merge, a tie-up that would come amid a wave of consolidation in the global energy sector. If Woodside swallows up Santos, it would be the largest corporate deal in Australia for several years. The combined entity would become the biggest liquefied natural gas (LNG) producer in Australia, which is the world's No. 2 supplier of the superchilled fuel. |

WDS Price Returns

| 1-mo | -7.36% |

| 3-mo | -9.13% |

| 6-mo | -15.16% |

| 1-year | -12.42% |

| 3-year | 30.15% |

| 5-year | -3.15% |

| YTD | -10.94% |

| 2023 | -4.58% |

| 2022 | 67.74% |

| 2021 | -6.76% |

| 2020 | -24.21% |

| 2019 | 14.35% |

WDS Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Loading social stream, please wait...