Worthington Industries, Inc. (WOR): Price and Financial Metrics

WOR Price/Volume Stats

| Current price | $58.84 | 52-week high | $69.96 |

| Prev. close | $59.60 | 52-week low | $33.96 |

| Day low | $58.10 | Volume | 194,400 |

| Day high | $59.71 | Avg. volume | 298,859 |

| 50-day MA | $61.34 | Dividend yield | 1.12% |

| 200-day MA | $50.12 | Market Cap | 2.95B |

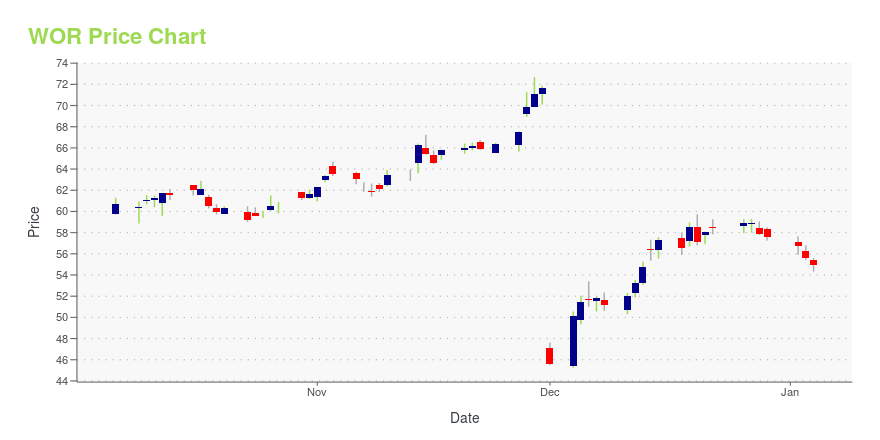

WOR Stock Price Chart Interactive Chart >

Worthington Industries, Inc. (WOR) Company Bio

Worthington Industries focuses on value-added steel processing and manufactured metal products in the United States, Europe, Mexico, Canada, and internationally. It operates through three segments: Steel Processing, Pressure Cylinders, and Engineered Cabs. The company was founded in 1955 and is based in Columbus, Ohio.

Latest WOR News From Around the Web

Below are the latest news stories about WORTHINGTON ENTERPRISES INC that investors may wish to consider to help them evaluate WOR as an investment opportunity.

Worthington Industries, Inc. (NYSE:WOR) Q2 2024 Earnings Call TranscriptWorthington Industries, Inc. (NYSE:WOR) Q2 2024 Earnings Call Transcript December 20, 2023 Worthington Industries, Inc. isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter (see the details here). Operator: Good afternoon and welcome to the Worthington Enterprises Second Quarter Fiscal 2024 Earnings Conference Call. [Operator Instructions]. […] |

Worthington Steel Inc Reports Mixed Fiscal Q2 2024 Results Amidst Market ChallengesDespite a Net Loss, Worthington Steel Sees Improved Margins and Strategic Growth |

Q2 2024 Worthington Enterprises Inc Earnings CallQ2 2024 Worthington Enterprises Inc Earnings Call |

WOR Stock Earnings: Worthington Industries Beats EPS, Beats Revenue for Q2 2024WOR stock results show that Worthington Industries beat analyst estimates for earnings per share and beat on revenue for the second quarter of 2024. |

Are Options Traders Betting on a Big Move in Worthington Enterprises (WOR) Stock?Investors need to pay close attention to Worthington Enterprises (WOR) stock based on the movements in the options market lately. |

WOR Price Returns

| 1-mo | -2.79% |

| 3-mo | 4.41% |

| 6-mo | 58.07% |

| 1-year | 66.34% |

| 3-year | 50.59% |

| 5-year | 168.21% |

| YTD | 2.50% |

| 2023 | 91.63% |

| 2022 | -6.90% |

| 2021 | 8.43% |

| 2020 | 25.21% |

| 2019 | 24.08% |

WOR Dividends

| Ex-Dividend Date | Type | Payout Amount | Change | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Loading, please wait... | |||||||||

Continue Researching WOR

Want to see what other sources are saying about Worthington Industries Inc's financials and stock price? Try the links below:Worthington Industries Inc (WOR) Stock Price | Nasdaq

Worthington Industries Inc (WOR) Stock Quote, History and News - Yahoo Finance

Worthington Industries Inc (WOR) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...