AMC Entertainment Holdings, Inc. (AMC): Price and Financial Metrics

AMC Price/Volume Stats

| Current price | $2.92 | 52-week high | $62.30 |

| Prev. close | $2.98 | 52-week low | $2.38 |

| Day low | $2.76 | Volume | 13,924,778 |

| Day high | $3.00 | Avg. volume | 15,307,493 |

| 50-day MA | $3.98 | Dividend yield | N/A |

| 200-day MA | $13.23 | Market Cap | 768.77M |

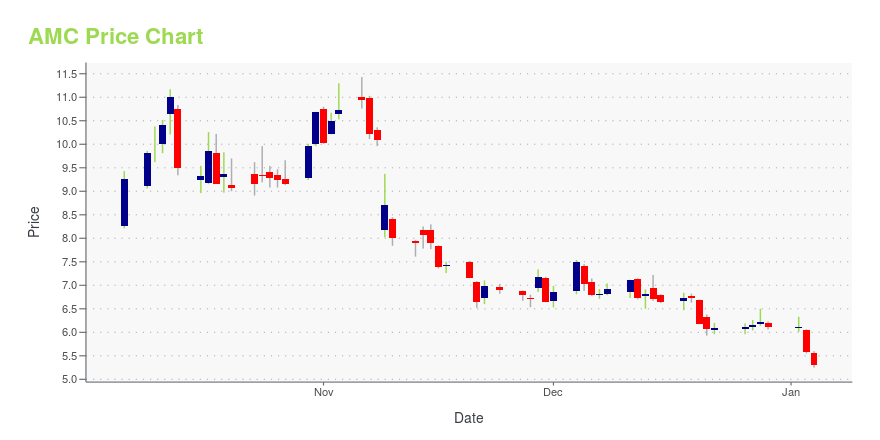

AMC Stock Price Chart Interactive Chart >

AMC Entertainment Holdings, Inc. (AMC) Company Bio

AMC Entertainment Holdings owns, operates, or holds interest in 348 movie theatres with a total of 4,960 screens primarily in North America. The company was founded in 1920 and is based in Leawood, Kansas.

Latest AMC News From Around the Web

Below are the latest news stories about AMC ENTERTAINMENT HOLDINGS INC that investors may wish to consider to help them evaluate AMC as an investment opportunity.

Is AMC Stock, 98% Below Its All-Time Peak, A Buy Or Sell Now? Here's What Fundamentals, Chart Action, Fund Ownership Metrics SayThe company posted a third-quarter net loss of 9 cents per share amid a healthy 45% rise in sales to $1.41 billion. |

3 Miserable Meme Stocks to Sell While You Still CanFor multiple fundamental reasons, these three meme stocks to sell are a heavy lift for retail traders and investors. |

Trim the Fat: 3 Stocks to Exit Before 2023 Wraps UpNavigate economic shifts and maximize profits, identifying three stocks to sell before 2024, in line with a changing U.S. economic market. |

AMC Plans to Issue 3.3 Million More Shares of AMC StockAMC has announced an AMC stock for debt exchange. |

12 Best Stocks To Buy on Robinhood for BeginnersIn this article, we discuss the 12 best stocks to buy on Robinhood for beginners. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Stocks To Buy on Robinhood for Beginners. For a very long time, the United States stock market was the ultimate status symbol, with access […] |

AMC Price Returns

| 1-mo | -31.62% |

| 3-mo | -35.25% |

| 6-mo | -67.84% |

| 1-year | -94.27% |

| 3-year | -96.98% |

| 5-year | -98.06% |

| YTD | -52.29% |

| 2023 | -84.96% |

| 2022 | -85.04% |

| 2021 | 1,183.02% |

| 2020 | -70.54% |

| 2019 | -36.60% |

Continue Researching AMC

Here are a few links from around the web to help you further your research on Amc Entertainment Holdings Inc's stock as an investment opportunity:Amc Entertainment Holdings Inc (AMC) Stock Price | Nasdaq

Amc Entertainment Holdings Inc (AMC) Stock Quote, History and News - Yahoo Finance

Amc Entertainment Holdings Inc (AMC) Stock Price and Basic Information | MarketWatch

Loading social stream, please wait...