CrowdStrike Holdings Inc. Cl A (CRWD): Price and Financial Metrics

CRWD Price/Volume Stats

| Current price | $293.69 | 52-week high | $365.00 |

| Prev. close | $299.15 | 52-week low | $115.67 |

| Day low | $291.71 | Volume | 2,287,016 |

| Day high | $304.80 | Avg. volume | 3,646,337 |

| 50-day MA | $318.63 | Dividend yield | N/A |

| 200-day MA | $228.52 | Market Cap | 71.03B |

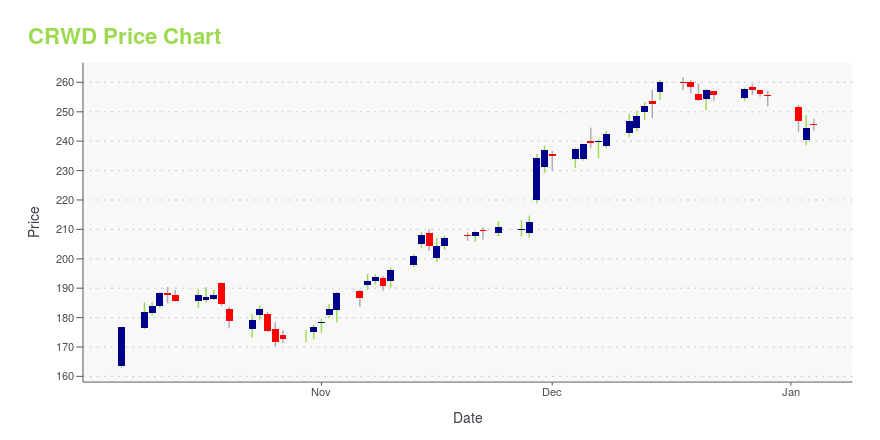

CRWD Stock Price Chart Interactive Chart >

CrowdStrike Holdings Inc. Cl A (CRWD) Company Bio

CrowdStrike Holdings, Inc. is an American cybersecurity technology company based in Austin, Texas. It provides cloud workload and endpoint security, threat intelligence, and cyberattack response services. The company has been involved in investigations of several high-profile cyberattacks, including the 2014 Sony Pictures hack, the 2015–16 cyber attacks on the Democratic National Committee (DNC), and the 2016 email leak involving the DNC. (Source:Wikipedia)

Latest CRWD News From Around the Web

Below are the latest news stories about CROWDSTRIKE HOLDINGS INC that investors may wish to consider to help them evaluate CRWD as an investment opportunity.

3 Stocks That Are Better Bets Than Cryptos In 2024Cryptocurrency made a major comeback in 2023. The strong year-to-date rally in the most popular cryptocurrencies testifies to the crypto boom. However, given the volatility of this market, here is a look at stocks that may be better and safer bets. |

The 3 Hottest Telehealth Stocks to Watch in 2024Uncover the hottest telehealth stocks for 2024, on the back of a market projected to reach a whopping $504.2 billion by 2030. |

7 Stocks that Multiple AI Bots Predict Will Soar in the Near FutureAI chatbots including ChatGPT and Bard believe these stocks are headed higher in the future, perhaps the near future. |

2024 Market Predictions: 2 Trends Destined to Crash, One Set to SoarTrends come and go on Wall Street, so two of this years hottest growth opportunities may fall flat next year. |

7 Undervalued Stocks for Long-Term StabilityLooking at the fundamentals and earnings projections can help investors identify the best undervalued long-term stocks to buy today. |

CRWD Price Returns

| 1-mo | -8.52% |

| 3-mo | 3.74% |

| 6-mo | 64.29% |

| 1-year | 115.35% |

| 3-year | 36.47% |

| 5-year | N/A |

| YTD | 15.03% |

| 2023 | 142.49% |

| 2022 | -48.58% |

| 2021 | -3.34% |

| 2020 | 324.74% |

| 2019 | N/A |

Loading social stream, please wait...